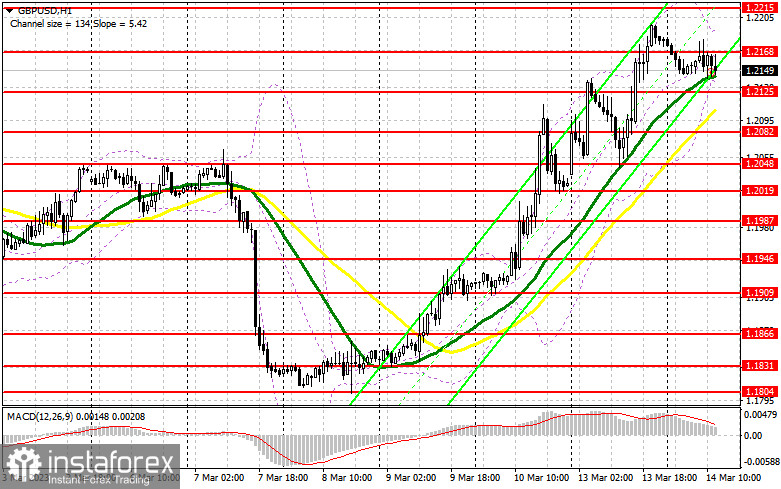

In my morning forecast, I focused on the level of 1.2168 and suggested deciding to enter the market based on it. Let's take a look at the 5-minute chart and see what happened. Growth and a false breakout in the first half of the day signaled a sell signal, but after falling by 25 points, the pound's pressure decreased. The technical situation has not changed for the second half of the day.

You require the following to open long positions on the GBP/USD:

The softening of the UK labor market provides the Bank of England with a bit more flexibility with interest rates, limiting the British pound's upward potential today. The market reaction to the US inflation statistics for February of this year will be widely monitored. Its decrease will assist the buyers of the pound in overcoming the resistance of 1.2168, which they were unable to do in the morning. The pressure on the pair will increase again if the US consumer price index rises. The only way to obtain a buy signal is if there is a false breakout at the moving average's level of 1.2125. This will allow a return to 1.2168, the intermediate resistance set by yesterday's results. A top-down test and a breakout will provide a buy signal, allowing you to proceed to 1.2215. Without this level, it will be difficult for GBP/USD buyers to count on starting a new rally. Only after the exit above can we talk about ongoing growth, and the breakdown of 1.2215 paired with the reversal test from top to bottom will open the way to 1.2265, where I will fix the profit. The 1.22321 area will be the target that is the furthest away, and it won't be changed until evidence showing a sharp reduction in inflationary pressure in the US is available. If GBP/USD declines and there are no buyers at 1.2125, the pound might be in the sellers' hands once more. If this occurs, I advise delaying long positions until 1.2082 in the afternoon. They will only buy there if there is a false breakout. To correct 30-35 points within a day, it is possible to open long positions on the GBP/USD immediately for a rebound from 1.2048.

If you want to trade the short positions on GBP/USD, you will need:

The pressure on the pair will remain while trading is performed below 1.2168, and we can anticipate a more extensive implementation of the morning sell signal. Only the development of a false breakout at this level, by analogy with what I have discussed previously, produces a sell signal based on the pair's decline to the nearest support of 1.2125 in the event of another breakthrough to 1.2168 during the American session. A breakthrough and reverse test from the bottom of this range will provide an entry point for sale with an update of 1.2082, which will be a fairly good downward correction after the pair's gain yesterday. The area of 1.2048 will be a further target, where I will fix profits. The bullish trend will continue due to the possibility of GBP/USD growth and the lack of bears at 1.2168 in the afternoon. Buyers will take back control of the market, which will cause a surge in the GBP/USD rate to as high as 1.2215. The only entry opportunity into short positions based on the decline of the pound is a false breakout at this level. If there isn't any activity there, I suggest selling GBP/USD at 1.2265 in the hopes that the pair would rise back up by 30-35 points over the day.

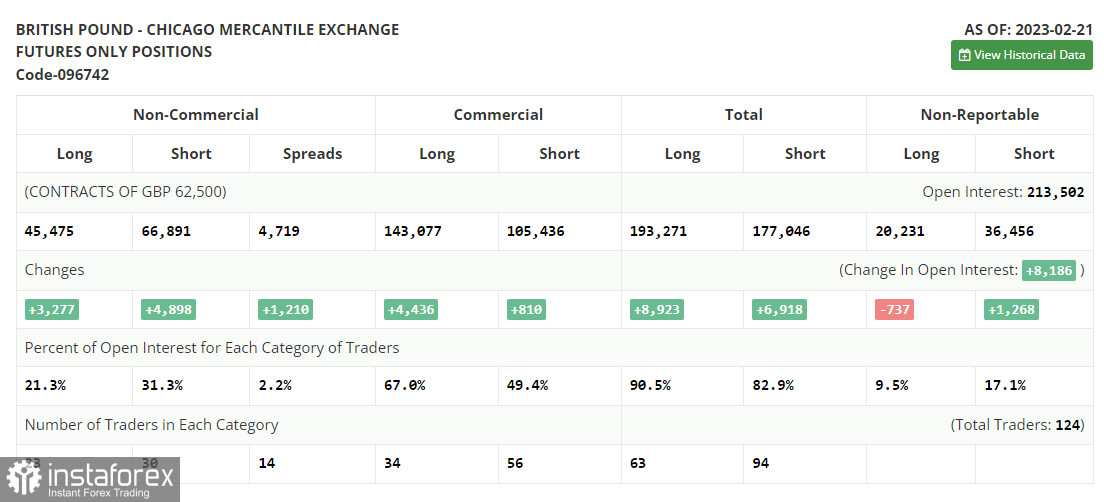

Both long and short positions rose in the COT report (Commitment of Traders) for February 21. The information from a month ago is not very pertinent at this time, thus it should be understood that these data are of little interest at this time. This is because statistics are only now starting to catch up following the cyberattack on the CFTC. I'll hold off till new reports are released and rely on more recent data. Important events this week are predicted to yield statistics on the UK labor market and the growth of average earnings, which will help the Bank of England in determining future interest rates against the backdrop of stable inflation. The increase in household income could maintain the high rate of inflation. We are also awaiting statistics on US inflation, which might ultimately increase traders' confidence that the Fed and Jerome Powell won't resume their course of strict policy, as was suggested last week. The prospect of the US banking industry collapsing, which emerged during the BSV bankruptcy, would undoubtedly alter Fed policymakers' assessments of how much more they need to raise the rate to "finish off" the economy. According to the most recent COT data, long non-commercial positions increased by 4,898 to 66,891 while short non-commercial positions increased by 3,277 to 45,475. As a result, the non-commercial net position's negative value increased to -21,416 from -19,795 a week earlier. The weekly ending price fell from 1.2181 to 1.2112 this week.

Signals from indicators

Moving Averages

Trade is taking place above the 30 and 50-day moving averages, which suggests that the pair will continue to increase.

Note that the author's consideration of the period and costs of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit in the area of 1.2135 will serve as support in the event of a downturn.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română