Following the crisis in the US banking sector, in which Silicon Valley Bank and two smaller banks filed for bankruptcy, markets stabilized somewhat, thanks to the ambivalence among investors about further developments.

On the one hand, the crisis may force the Fed to suspend further interest increases, but on the other hand, the calls from Bank of America and Goldman Sachs to continue to raise rates to fight inflation have somewhat tempered hopes that the Fed might not only hesitate to lower rates but even raise them by 0.25%. In that regard, consumer inflation data coming out today will play a more important role than before as it will be viewed not only through the lens of the fate of further interest rate hikes, but also through the banking crisis that threatens to spill over into other sectors of the US economy.

Forecasts have said the index should adjust down to 0.4% in February, lower than the previous month's 0.5%. On a year-on-year basis, the index is expected to fall from 6.4% to 6%. If the data turns out to be in line with expectations or even a bit lower, the Fed may take a pause in raising rates at its meeting on March. This will of course put pressure on dollar as Treasury yields will fall further, while equity markets will see gains. But if the figures are higher than expected, the Fed may have to continue raising rates by 0.50%. However, further spreading of the banking crisis could force the bank to take a pause while trying to buy the problem.

Forecasts for today:

GBP/USD

The pair is still trading within the range of 1.1930-1.2200. A decline in inflation could push the quote above the upper limit and towards 1.2400, while rising inflationary pressures are likely to put push the pair down to 1.1930.

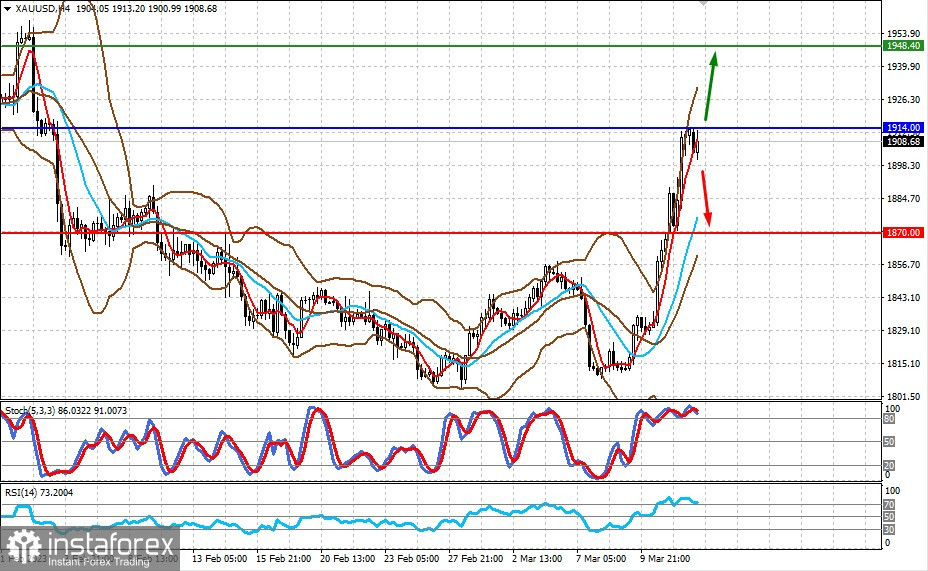

XAU/USD

Gold may come under pressure if inflation in the US shows an increase in February. It could fall to 1870.00 if that is the case, but if the data shows a decrease, prices could rise to 1948.40.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română