U.S. President Joe Biden, instead of reassuring the markets, has frightened them even more. Statements that everything is under control and depositors have nothing to worry about, without any specifics mean nothing. But when reporters tried to ask follow-up questions, the U.S. president silently left the room. And there really are a lot of questions. After all, back on Sunday, Janet Yellen said there were no plans to bail out struggling banks at public expense. According to the U.S. Treasury Secretary, the Federal Reserve will provide the banking system with necessary liquidity. Moreover, allegedly, even customers with deposits in excess of what is covered by the deposit insurance system. How will all this work, and where will the money come from? After all, in this case we are not even talking about billions, but trillions of dollars. It turns out that the Fed will just have to print money. Moreover, if it is not going to be covered by the government, then how will this money get into the banking system? Will it be done by just handing it out to the financial institutions in need? But on what principle, and what is the order of their return? And what about the refinancing rate? After all, inflation is still incredibly high. And there is a gradual abandonment of the dollar in the world. Just look at the sanctions against Russia, forcing the largest energy supplier to switch to other currencies. This leads to a decrease in the dollar's share in international trade, and as a consequence, to a decrease in demand for the U.S. currency. In such a situation, the issue of money will have a more tangible effect on inflation. In other words, even at the thesis level, the plans that Yellen announced, if implemented, will inevitably lead to an increase in inflation, which the Fed is trying to curb.

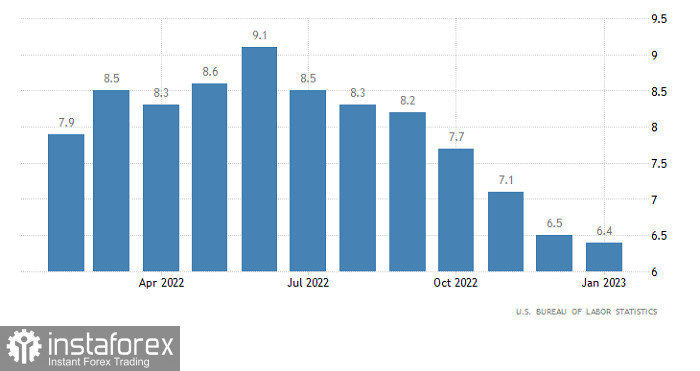

So it is not surprising that the dollar continued to lose ground. However, it is not as rapid as it was on Friday. Investors are somewhat comforted by the fact that the Biden administration recognizes the problem and is clearly trying to find some solution. And given Yellen's ideas voiced back on Sunday, the significance of the U.S. inflation report increases sharply. After all, inflation could slow from 6.4% to 6.1%. If these expectations hold true, the Fed will have more room to maneuver and the central bank may very well actually be able to provide emergency relief to the financial sector without catastrophic consequences. But in any case, we are talking about both slowing the rate hikes and their reduction soon, and about the next iteration of quantitative easing. All this will have a negative impact on the dollar and contribute to its further weakening.

Inflation (United States):

The GBPUSD is above 1.2150 for the first time since mid-February. This move indicates prevailing interest in the bullish sentiment, which is accompanied by an increase in the volume of long positions.

On the four-hour chart, the RSI is moving in the overbought area, indicating that long positions are overheating during the intraday period. On the daily chart, the RSI crossed the 50 middle line upwards, indicating a shift in trading interests.

On the four-hour chart, the Alligator's MAs are pointing upwards, this is a technical signal of an uptrend. On the daily chart, it shows a change in direction.

Outlook

Keeping the price above 1.2150 in the long term can indicate a gradual recovery in the pound's value relative to the decline in February.

As for the alternative scenario, traders will consider it as the pullback due to the local overbought status.

The complex indicator analysis revealed that in the intraday and short-term periods, technical indicators are pointing to bullish sentiment due to the breakdown of the resistance level of 1.2150.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română