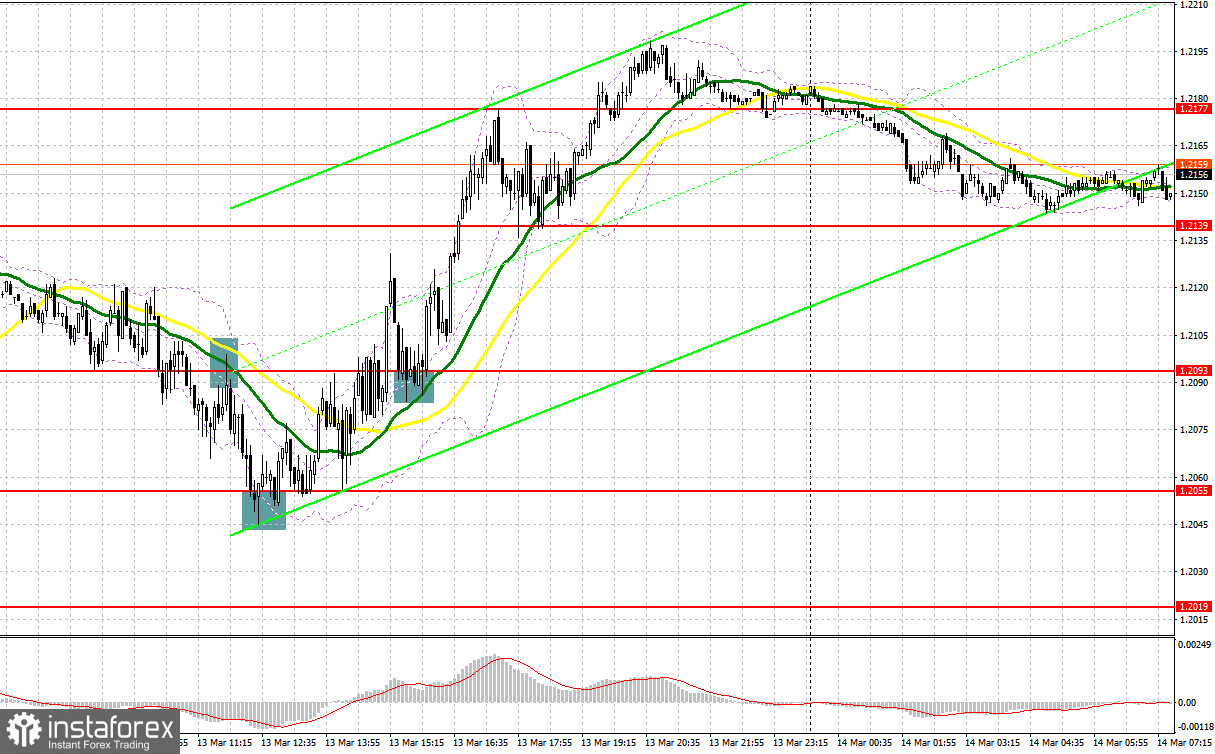

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to figure out what happened. Earlier, I asked you to pay attention to the level of 1.2093 to decide when to enter the market. A false breakout in the first part of the day gave a buy signal. The pair climbed by only 30 pips and then, the pressure returned. A breakout and an upward test of 1.2093 led to a sell signal. As a result, the pair lost about 40 pips. In the second part of the day, bulls managed to protect 1.2055, thus preventing traders from opening buy orders with the target at 1.2093. A settlement above this level gave one more buy signal with the target at 1.2177.

Conditions for opening long positions on GBP/USD:

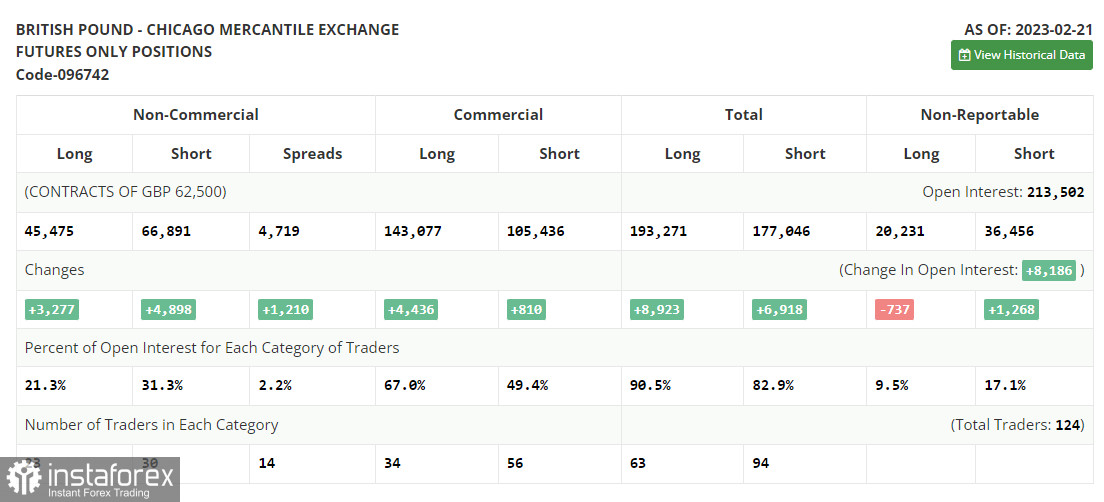

First of all, let us focus on the situation in the futures market. According to the COT report from February 21, the number of both long and short positions increased. Notably, the data is of zero importance at the moment since it was relevant a month ago. The CFTC has just started recovering after a cyber attack. That is why it is better to wait for fresh statistics. This week, all eyes will be turned to the UK labor market reports and average earnings growth. This will help the BoE to decide on the key interest rate hike amid stable inflation. Household earnings growth may keep inflation at the current high level. Meanwhile, the US is going to disclose its inflation figures, which may prove that Jerome Powell will switch to a looser policy. A risk of the US banking sector collapse, which occurred after the BSV bankruptcy, may force the Fed to alter its view on how long it should raise the benchmark rate until the economy becomes damaged. The recent COT report unveiled that the number of short non-commercial positions increased by 3,277 to 45,475, while the number of long non-commercial positions jumped by 4,898 to 66,891. Against the backdrop, the negative value of the non-commercial net position advance to -21,416 against -19,795 a week earlier. The weekly closing price decreased to 1.2112 from 1.2181.

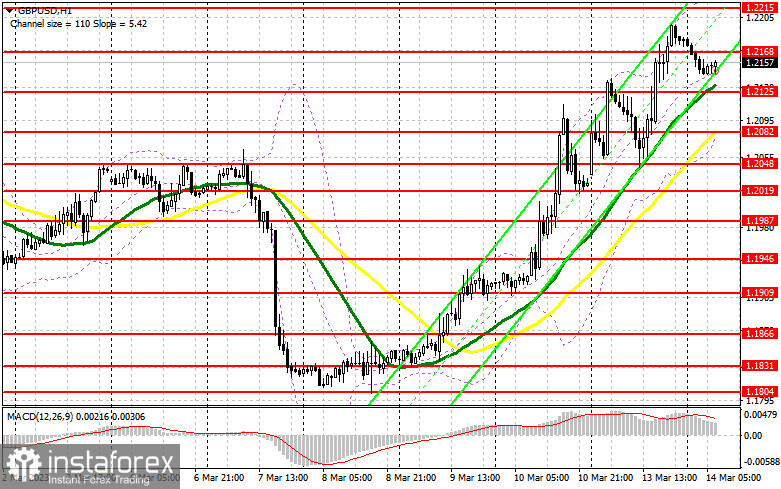

The pound sterling continues reaching new monthly highs. However, weak data on the UK labor market may stop the rally. Today, the UK will disclose data on unemployment claims, unemployment rate, and average earnings. Negative figures will lead to a decline in the pair in the first part of the day. That is why traders should focus on the nearest support level of 1.2125. Only a false breakout of this level will give a buy signal, thus confirming buyers' presence in the market. In this case, the pound sterling will have a chance to return to 1.2168, an intermediate resistance level formed yesterday. A breakout and a downward test of this level will give a buy signal with the target at 1.2215. Without this level, it will be difficult to form a new uptrend. If the price consolidates above this level, the currency will grow further. A breakout of 1.2215 and a downward test will allow the pound to climb to 1.2265, where it is better to lock in profits. The farthest target is located at 1.2321. The pair may touch it only after the publication of the US inflation report. In the pound/dollar pair declines and buyers fail to protect 1.2125, sellers will gain control. In the event of this, it is better to avoid buying the asset until the price touches 1.2082, where there are bullish MAs. There, traders may go long only after a false breakout. It is also possible to open buy orders just after a bounce off 1.2048, expecting a rise of 30-35 pips.

Conditions for opening short positions on GBP/USD:

In the first part of the day, bulls are likely to make an attempt to climb above the resistance level of 1.2168. That is why sellers should do their best to protect it. Only a false breakout of this level amid weak data on the UK labor market will give a sell signal with the target at the nearest support level of 1.2125. A breakout and an upward test of this area will give a sell signal with the target at the low of 1.2082. The next target is located at 1.2048, where it is better to lock in profits. If the pound/dollar pair increases and bears fail to protect 1.2168, the bullish trend will continue. Thus, buyers will have a chance to regain control over the market, thus allowing the pound/dollar pair to jump to the high of 1.2215. A false breakout of this level will give a short signal. Traders may also open sell orders at 1.2265, expecting a jump of 30-35 pips.

Signals of indicators:

Moving Averages

Trading is performed above the 30- and 50-day moving averages, which points to the bullish sentiment in the market.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the resistance level will be found at the upper limit of the indicator located at 1.2215. In case of a decline, the lower limit of the indicator located at 1.2082 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română