What happened in the last three days is quite difficult to describe in words. On the one hand, we all got used to the fact that Bitcoin can "fly" by $5-10,000 a day. On the other hand, it has frankly not been like that for a long time. Nevertheless, for the last three business days, all markets are in a very excited state, and we can't speak about logical movements. For example, Bitcoin soared during this period of time (the cryptocurrency market works on weekends) by $4,000. It doesn't seem much, but the growth was extremely sharp and, in fact, occurred in the last two days. So, it's absolutely safe to say that it wasn't the unemployment and Nonfarm reports in the U.S. that triggered these moves. That means there is only one option left... The bankruptcy of two banks in the U.S. that were closely linked to the technology and cryptocurrency sector...

Immediately the question arises: if the market has received two more bankruptcies of companies somehow connected with cryptocurrencies, then why is Bitcoin rising and not falling? Of course, the U.S. government and the Federal Reserve promised to settle the situation and protect depositors' rights, so no one should get hurt, but this is rather negative news for the cryptocurrency market! Most likely, we are not dealing with the growth of Bitcoin, but with the fall of the U.S. dollar. Logically, if the U.S. dollar is getting cheaper, then Bitcoin and any other instruments valued in dollars are going up. But even that doesn't explain why the rise has been so strong. We think the explanation we used for the currency market is quite applicable here. The market is simply in shock from the sudden news.

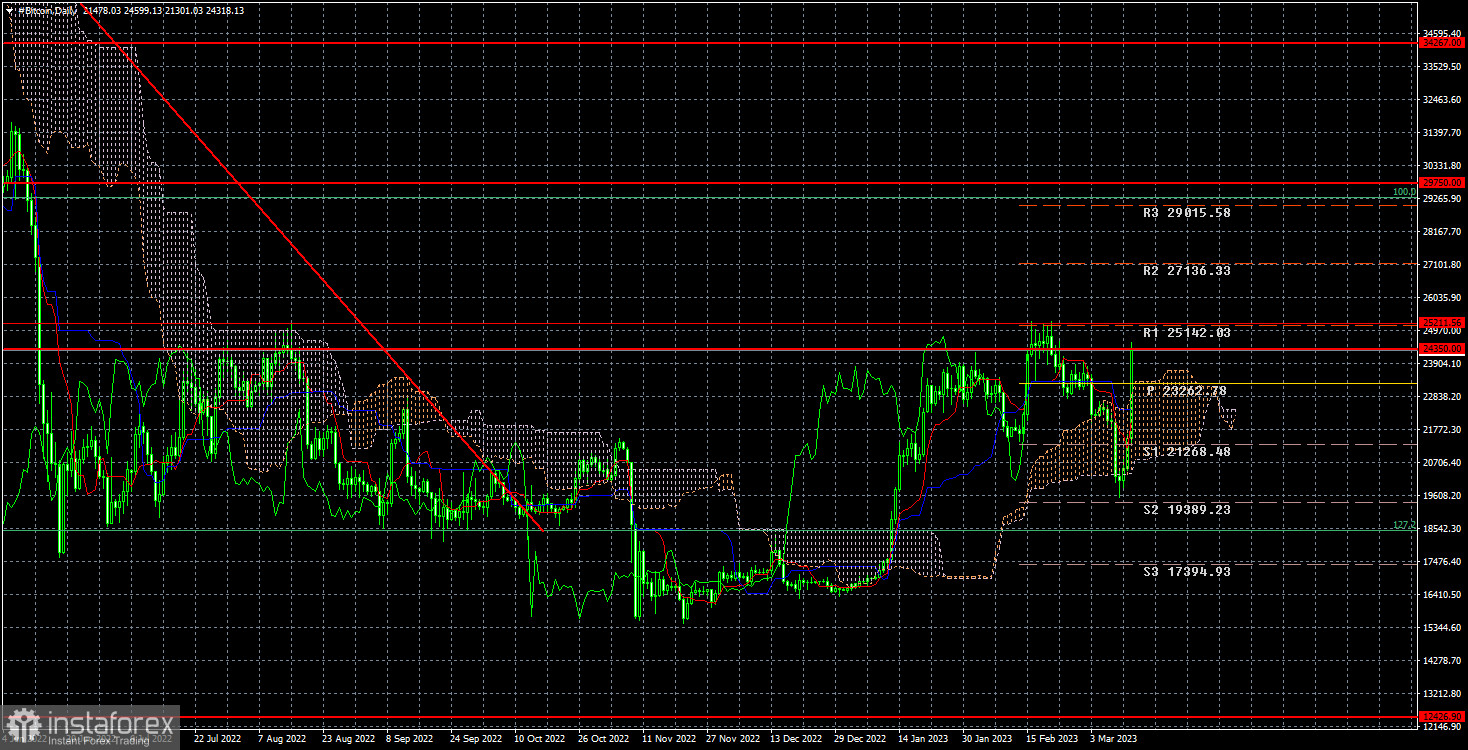

At the moment, the cryptocurrency returned to $24,350 and may well rebound from it again. The last support level for preserving the horizontal channel is $25,211. If Bitcoin surpasses these two levels, the chances of continuing the upward movement will increase dramatically. But be careful: as we said, the market is in an excited state right now, and in that state it can make decisions that defy logic. I believe we are going to see more than one more paradoxical and illogical move this week. Although, of course, anything can be explained post factum.

On the 24-hour chart, quotes failed to overcome the subsidiary level of $25,211, but have already returned to $24,350. If we don't see any resistance from these levels, then we can say that the bullish trend has officially started, and the first target will be $29,750. If we look at the current situation impartially, I still think that the fall to $15,500 is more probable. But now we need a new sell signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română