Last week ended with crazy moves that few expected; the new week began with similar moves that few expected either. As I mentioned in my previous articles, the unexpected news about the bankruptcy of two U.S. banks led to a slight panic in the markets, despite the claims of the US government that all depositors would be given their money back in full. Some analysts immediately concluded that the collapse of the two banks, which were closely tied to cryptocurrencies and tech stocks, was a result of the Federal Reserve's actions over the past year. The rate rose to 4.75%, a severe blow to almost all risky assets. One only has to remember how the cryptocurrency and stock markets have fallen over the past year and a half.

However, what we need to understand is, what does the U.S. dollar have to do with it, which fell sharply on Friday and Monday? Of course, it is obvious what the dollar has to do with it, since the dollar is the currency of the largest economy in the world, which has suffered certain losses over the past few days. Just a week earlier, almost no one believed in a recession in the U.S., the probability of a 50 basis point rate hike in March rose to almost 50%, and the dollar had a great new outlook that was completely consistent with the wave pattern of both instruments. As of Monday, virtually no one believes in a 50 bps hike on March 22, there is talk of a recession, there is talk of the need to cut interest rates a bit, and demand for the U.S. currency has plummeted and threatens to fall even further.

That's how, literally in 1-2 days, one of which was during the weekend, the market has changed, if not everything, then a lot. I consider that the current condition may be called a "light shock", so the market can move past it. If it does, then both instruments can go back to falling this week. But now the market will be much more careful with long positions on the U.S. dollar, and at this time I would not bet much on it strengthening even further. The wave pattern is getting confusing and the news background is getting ambiguous. This means that we may expect movements in different directions in the near future, further complicating the wave layout.

I also want to point out that the Silicon Valley Bank crash is the biggest one since 2008. So it is not surprising that many analysts immediately started talking about the beginning of a new economic crisis similar to that of 2008. Whereas a couple of months ago the market was filled with optimism about the imminent end of the monetary tightening program and was waiting for the cryptocurrency and stock markets to recover, now no one knows what to expect. Bankruptcy may not be the only one, the cryptocurrency market has been "raging" for a year and a half, and the Fed has no choice but to keep raising rates. The situation is complicated and tense. Its development can be absolutely unpredictable.

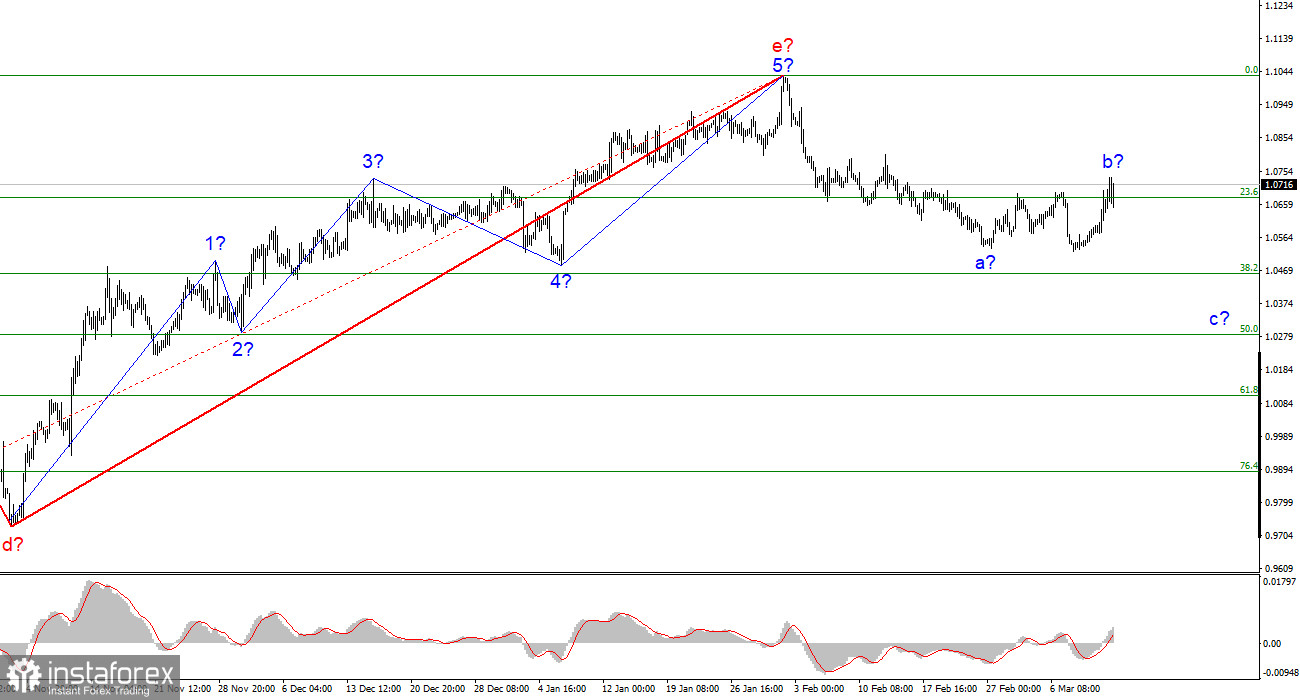

On the basis of the analysis, I conclude that the construction of the uptrend section is completed. So now it is possible to consider short positions with targets located near the calculated mark of 1.0284, which corresponds to 50.0% of Fibonacci. At this time, the correctional wave 2 or b may still be under construction, in which case it will take a more extended form. It is better to open shorts on the MACD's "bearish" signals.

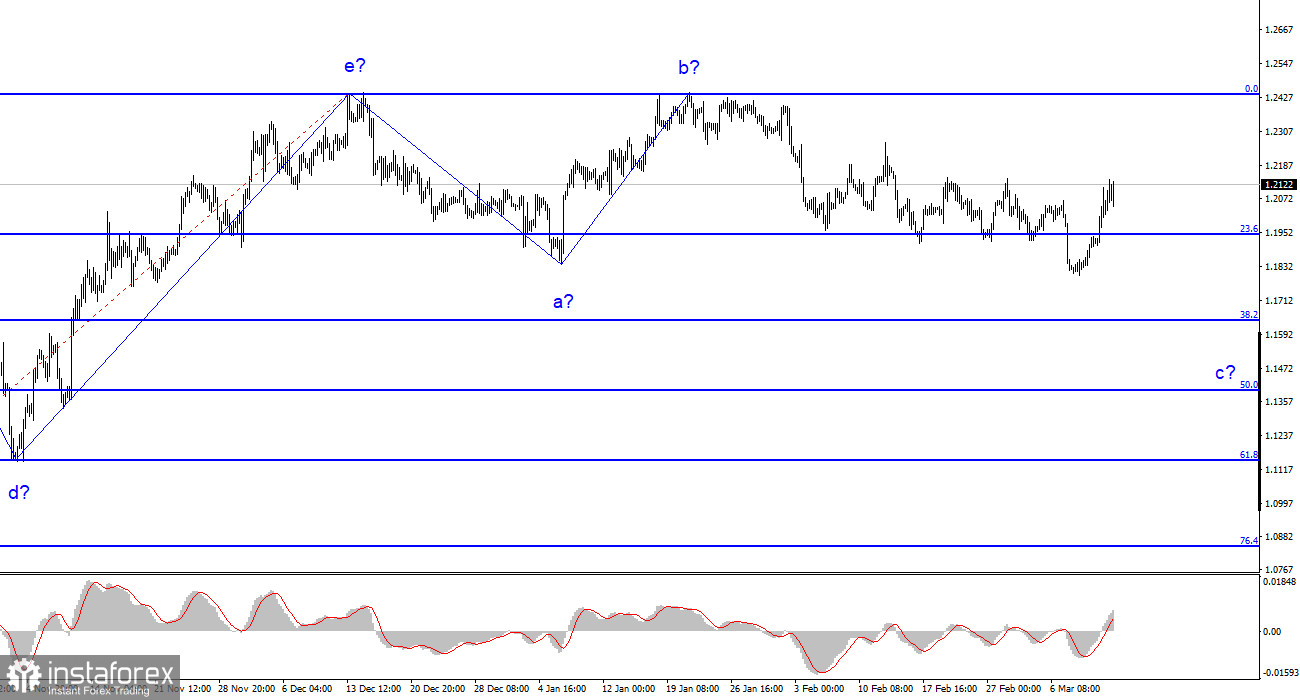

The wave pattern of GBP/USD suggests building a downtrend. At this time, you can consider shorts with targets near 1.1641, which is equal to 38.2% Fibonacci, according to the MACD indicator turning bearish. A Stop Loss order could be placed above the peaks of waves e and b. Wave c may take a less extended form, but for now I expect a decline of another 300-400 pips at least (from the current marks).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română