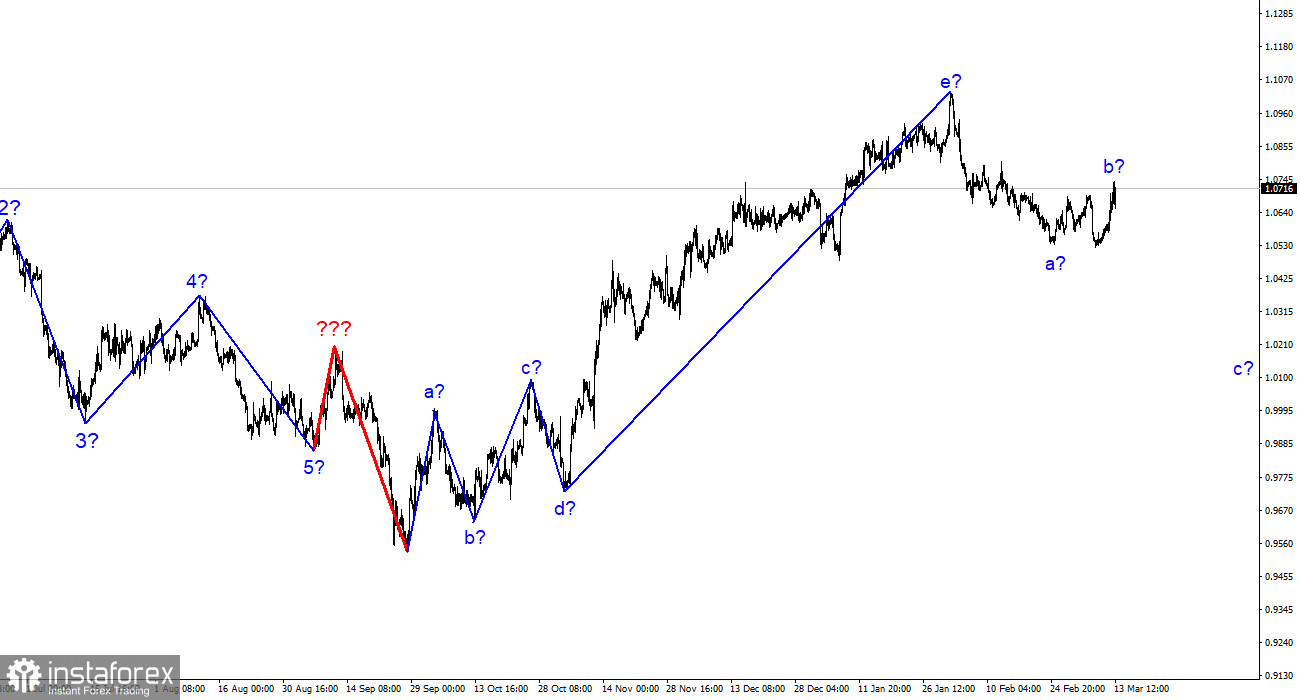

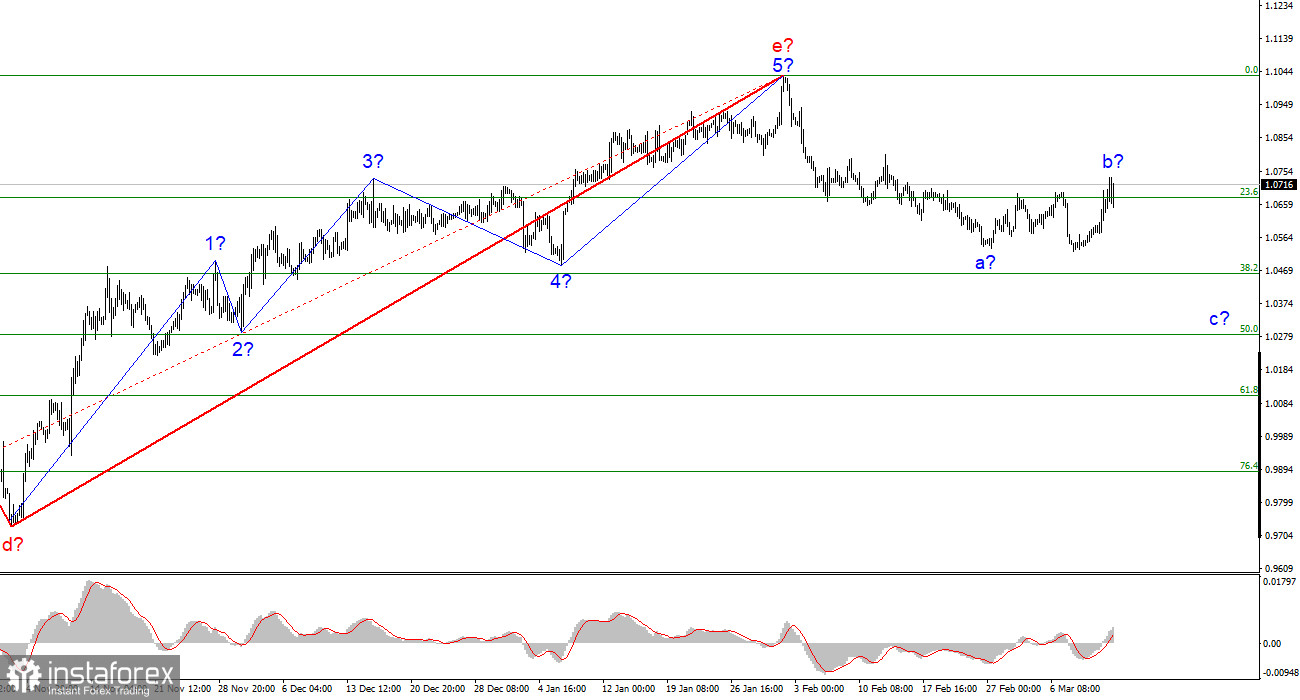

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. It's also encouraging that the movements are almost entirely in line with the wave analysis. The upward part of the trend, which has taken on the pattern a-b-c-d-e, is already finished. I continue to anticipate the pair to decline since, if the wave pattern for the current wave is accurate, we should build at least three waves down. Two of these three waves may already be finished. The proposed wave b, which is now nearing completion once more or has already been completed, has become more complicated as a result of the recent rise in quotes. But I must point out that the movement of last Friday seriously complicates the wave picture. Now that quotes are increasing, the current wave situation can still happen, but there is a risk that the pattern of the current wave will change, which we would prefer to prevent. For the time being, I continue to anticipate that the pair will continue to decrease, with targets close to the predicted mark of 1.0283, or 50.0% Fibonacci. To determine if the market may continue developing a downward trend section after working off this level, it will be required to assess the scenario and the wave picture.

We waited for strong payrolls to no avail.

On Friday, the euro/dollar pair increased by 60 basis points; today, it increased by an additional 70 basis points. Despite the lack of news today, market activity is extremely high. Yet, the events from the weekend and the end of last week led to some sort of panic in the foreign currency market. And it all began with Powell's speech before the US Congress, following which the majority of analysts predicted a hike in the Fed rate of 50 basis points in March. This news helped to strengthen the dollar, but on Wednesday the pair started to increase, which at first appeared to be a rollback. On Friday, demand for the dollar fell as a result of confusing US statistics, and on Saturday news broke that one of the country's largest banks had filed for bankruptcy. On Sunday - regarding the failure of a second bank connected to the first.

Hence, it is fairly simple to comprehend why the market is currently uneasy and why the US dollar is also falling. Let me remind you that Friday's Nonfarm Payrolls again exceeded market forecasts by a wide margin. Only the unexpected rise in unemployment to 3.6% for many harmed the news picture. Yet even though the dollar was supported by at least one out of every two reports, demand for it still actually fell. The market rapidly lost track of Powell's statements, stopped anticipating a significant hike in the FOMC rate, and ignored the wave analysis, which suggests a decrease. The pair is currently moving in both directions. It is quite difficult to predict where the tool will be in an hour or two given the existing circumstances. I think we should stay with the main wave scenario and prepare for a fall. You should enter sales on the MACD reversals that are "down" with any change in the course of events.

Conclusions in general

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A corrective wave 2 or b can still be developed at this point, in which case it will have a longer form. Opening sales now on the MACD "down" signals is advised.

On the older wave scale, the ascending trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it might have any size or structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română