Overview :

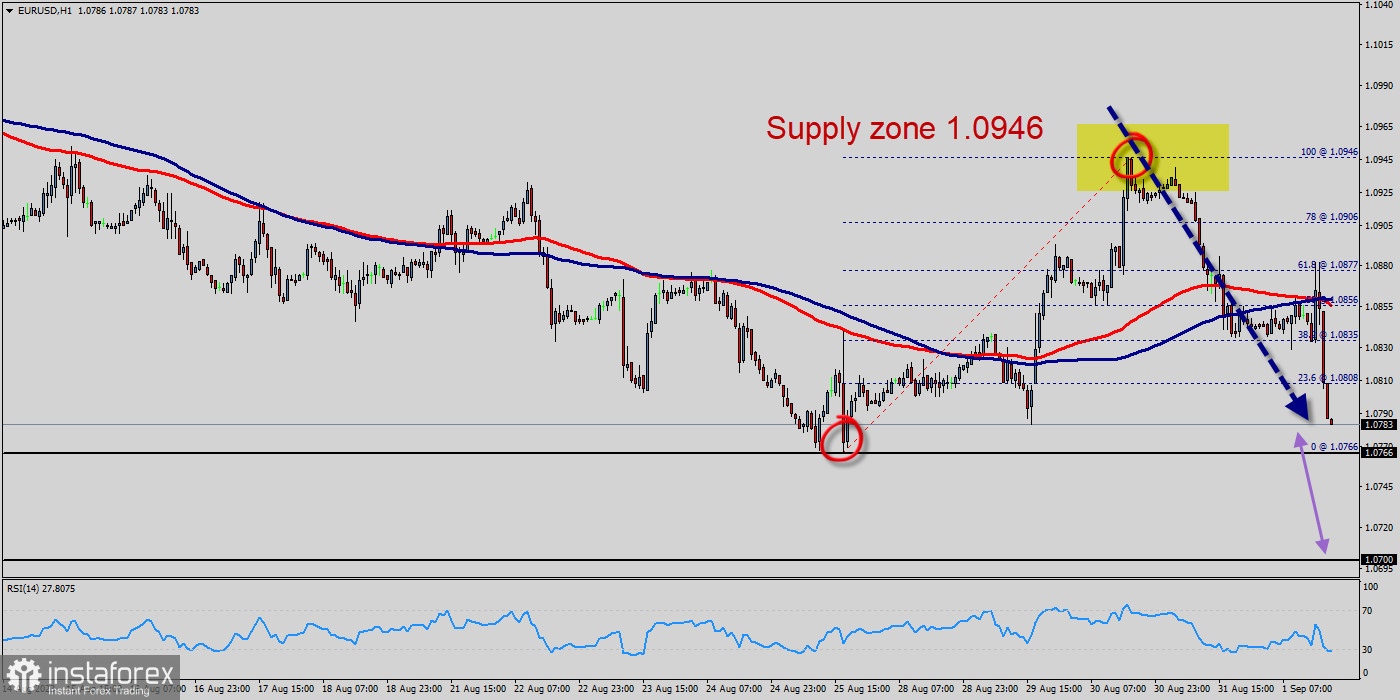

The EUR/USD pair hit the weekly pivot point and resistance 1, because of the series of relatively equal highs and equal lows. But, the pair has dropped down in order to bottom at the point of 1.0835. Hence, the major support was already set at the level of 1.0766.

Moreover, the double bottom is also coinciding with the major support this week. Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100.

Therefore, it will be advantageous to sell below the resistance (supply zone) level of 1.0810 with the first target at 1.0766. From this point, if the pair closes below the weekly pivot point of 1.0835, the EUR/USD pair may resume it movement to 1.0700 to test the weekly support 1.

Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss below the last bottom at 1.0877.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română