On Tuesday, the Reserve Bank of Australia expectedly raised its interest rate by 0.25% and spoke in favor of further tightening of monetary policy. However, despite this decision, the Australian dollar collapsed on Tuesday and, despite the attempts, remains at the moment near the lows reached that day.

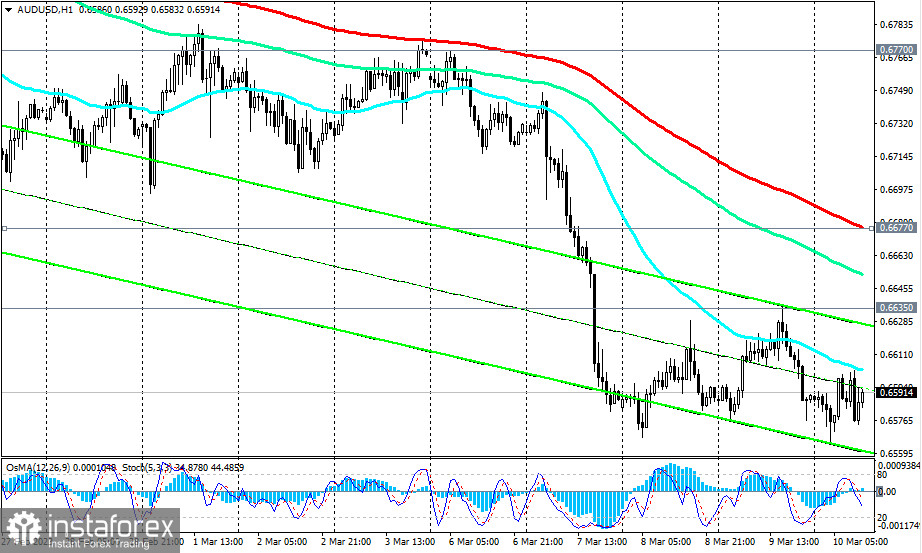

As of writing, AUD/USD is trading near 0.6590, in the zone of a stable long-term and medium-term bear markets, at last Tuesday's closing price.

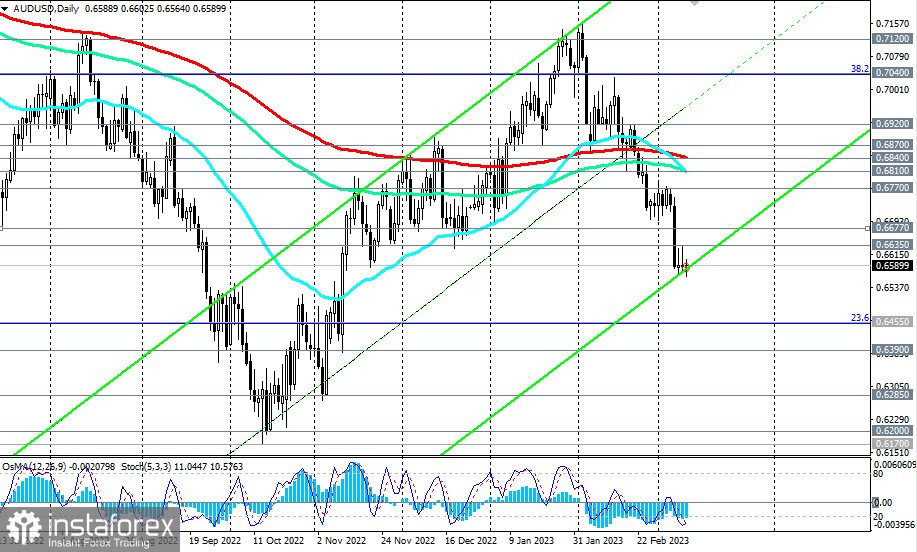

Last month was a very bad month for the Australian dollar and the AUD/USD pair, which lost all of its gains of the previous two months in February and fell to 0.6729. It turns out that this month also starts for AUD/USD with a significant decline. Nevertheless, economists believe that further strong weakening of the AUD should not be expected: the cycle of rising interest rates in Australia is unlikely to end soon.

If they are right, the first signal to resume long positions will be a breakdown of the nearest resistance levels 0.6635, 0.6677 (200 EMA on the 1-hour chart).

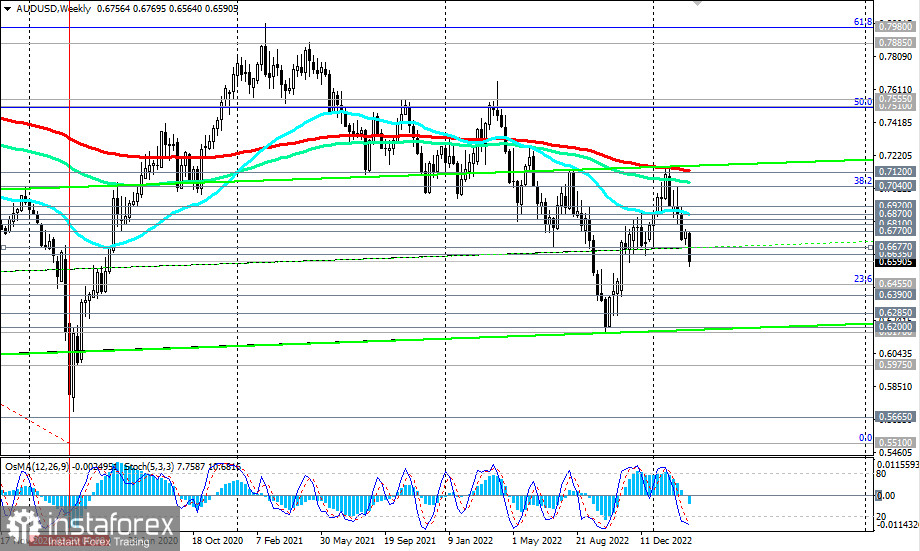

A breakdown of the key resistance level 0.6840 (200 EMA on the daily chart) will bring AUD/USD into the medium-term bull market zone, and a breakdown of the key resistance level 0.7120 (200 EMA on the weekly chart) will bring it into the long-term zone.

In the main scenario, the price will break through today's low at 0.6564, while AUD/USD will head towards last year's lows and 0.6285, 0.6200.

Technical indicators OsMA and Stochastic on the daily and weekly charts are also on the sellers' side.

Support levels: 0.6564, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6600, 0.6635, 0.6677, 0.6770, 0.6810, 0.6840, 0.6870, 0.6900, 0.6920

Trading scenarios

Sell Stop 0.6555. Stop-Loss 0.6645. Take-Profit 0.6564, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Buy Stop 0.6645. Stop-Loss 0.6555. Take-Profit 0.6677, 0.6770, 0.6810, 0.6840, 0.6870, 0.6900, 0.6920, 0.7000, 0.7040, 0.7075, 0.7100, 0.7140

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română