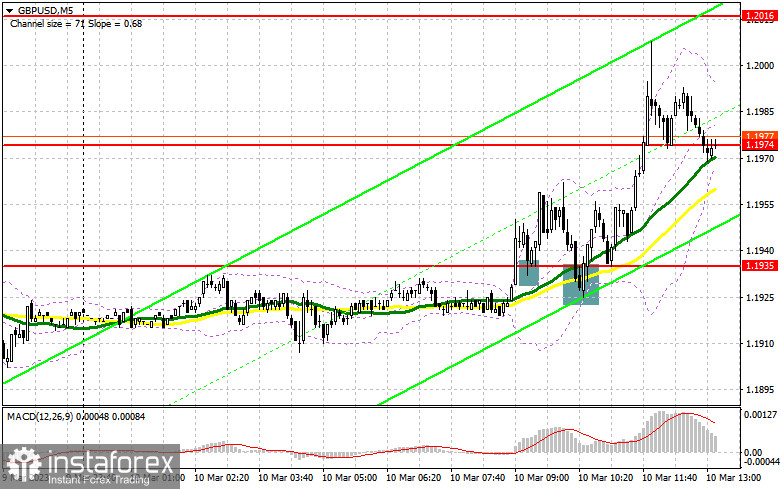

I focused on the 1.1935 level in my morning forecast and suggested making considerations about entering the market from there. Let's take a look at the 5-minute chart and see what happened. A breakout and top-down test of this area signaled a buy signal for the pound, resulting in a 60-point rise for the pair. The technical picture was entirely revised in the afternoon.

You require the following to open long positions on the GBP/USD:

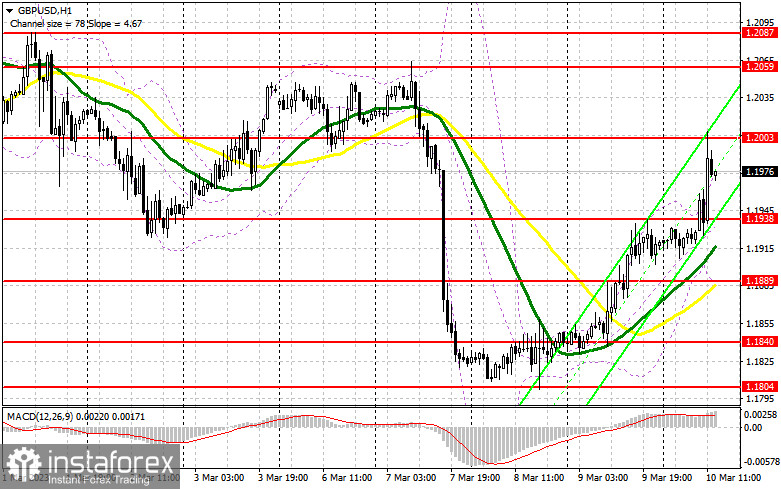

Traders bought the pound despite the somewhat different data on the UK's industrial production and GDP. The most likely reason for this is a lowering of expectations for the Bank of England to raise interest rates further, as it is evident that doing so will swiftly lead to a recession, which was avoided at the end of last year. But, as reports on the US labor market are expected, the second half of the day could change everything. The pressure on the pound will immediately return in the event of another strong employment growth, and purchasers will need to protect the new support of 1.1938 sets at the end of the first half of the day. The collapse and development of a false collapse at this level following good US data will result in an excellent entry point for purchase and an effort to move the pound up to 1.2003 - a new resistance level. Only in the event of weak data, which would cause GBP/USD to rise to a new maximum of 1.2059, would there be consolidation and a top-down test of this range. An exit from this area above will also create growth opportunities around 1.2100, where I fix profits. A test of this area will likewise show that the buyers' market has returned. The pressure on the pair will undoubtedly grow if the bulls are unable to complete the tasks assigned to them and miss 1.1938, which is fairly plausible given that the data might come out in any way. In this instance, I recommend that you not rush into purchases and instead open long positions only in the area of 1.1889, where the moving averages pass, and only on a false collapse. On the rise from the 1.1840 minimum, I will purchase GBP/USD right away to correct 30-35 points over the day.

If you want to trade short positions on GBP/USD, you will need:

Sellers surrendered, allowing them to recover the whole March 7 drop. Now would be a good moment to take your time and observe how the US labor market figures are received. When a false breakout forms at the level of 1.2003, which was formed in the morning, I will take action in case the pound has another upward movement in the afternoon. Only this will serve as a signal to buy or sell with the expectation of a decline toward the 1.1938 support level. A breakout and bottom-up test of this range will raise pressure on the pound, resulting in a new significant sell-off around the area of 1.1889. The area around 1.1840 will be my furthest target, where I'll make a profit. I suggest you not rush with sales given the possibility of GBP/USD growth and the absence of bears on 1.2003, which won't occur until we learn about the decline of the US labor market. In this scenario, the bears will pull back, and an entry point for short positions will only be formed by a false breakout at the next resistance level of 1.2059. If there isn't any activity there, I'll sell GBP/USD right away at its highest price of 1.2099, but only if I believe the pair will fall back by 30-35 points over the day.

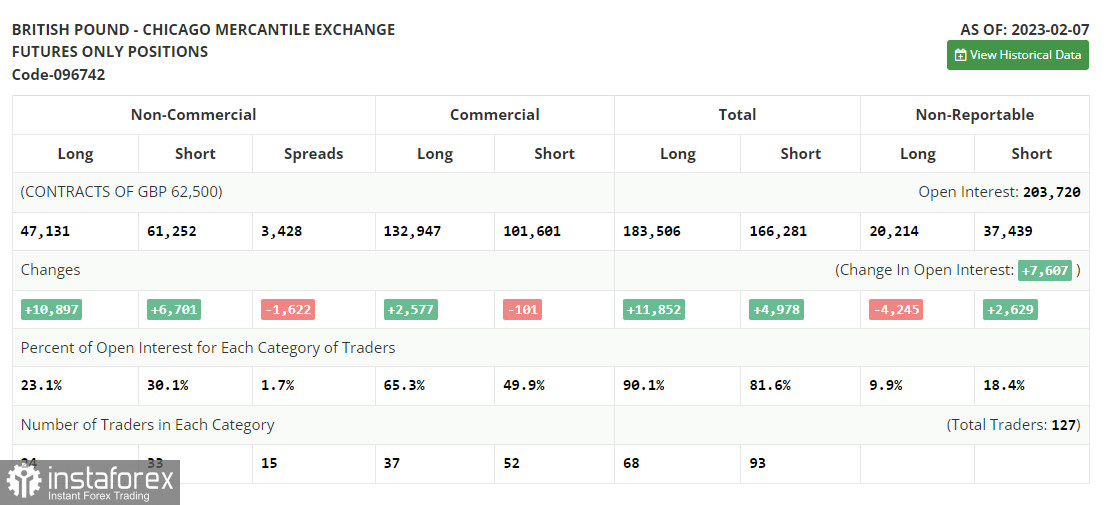

Long and short positions increased in the COT report (Commitment of Traders) for February 7. Given the rise in long positions, it is clear that traders were pleased with the Bank of England's plans. Others, on the other hand, decided to seize the opportunity and sell the more expensive pound in the hopes that the Fed would continue its aggressive monetary policy this year. Except for a few reports, there are no significant fundamental signs for the UK this week, so the pressure on risky assets may slightly lessen, which theoretically may result in an upward correction of the pound relative to the US dollar. As Jerome Powell, the chairman of the Federal Reserve, gets the markets ready for the committee meeting at the end of March this year, his remarks are important. According to the most recent COT data, short non-commercial positions increased by 6,701 to 61,252, while long non-commercial positions increased by 10,897 to 47,131. As a result, the non-commercial net position's negative value decreased to -14,121 from -18,317 the previous week. In comparison to 1.2333, the weekly ending price dropped to 1.2041.

Signals from indicators

Moving Averages

Trade is taking place above the 30 and 50-day moving averages, which suggests that the pair will continue to increase.

Note that the author's consideration of the period and costs of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română