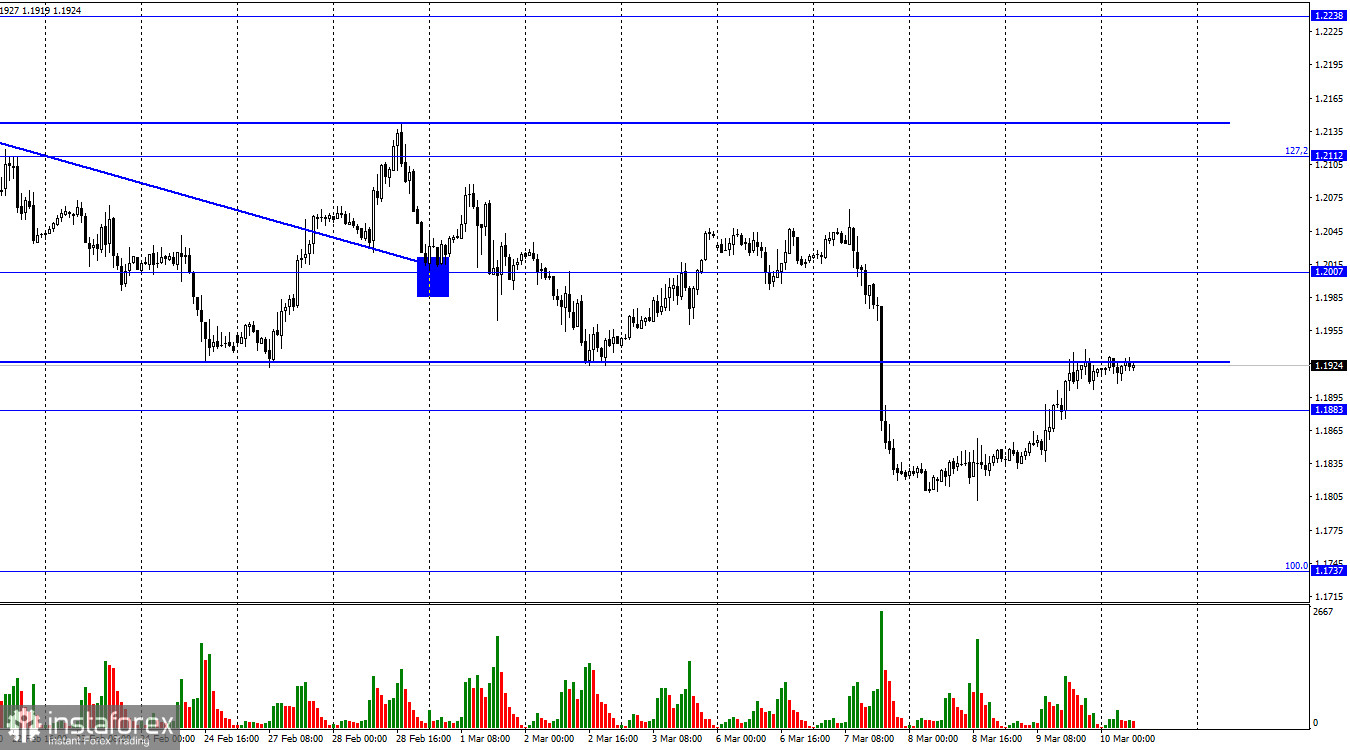

Hello dear, traders! According to the 1-hour time frame, GBP/USD extended gains on Thursday. The price reached the lower limit of the sideways corridor. In fact, it left the same corridor a few days ago. The pair may bounce from this line. In such a case, a bearish reversal may occur, targeting the 100.0% retracement level of 1.1737. Growth will extend if the price closes above the line, with targets at 1.2007 and 1.2112. Today, the US will see the release of important data, which will definitely leave an impact on GBP/USD quotes.

UK GDP grew by 0.3% m/m in January from -0.5% in the previous month, beating market expectations of 0-0.1%. At the same time, the British economy was flat in the three months to January. Industrial production fell 0.3% m/m in January. In my view, when two of the three indicators come weak, statistics cannot be considered upbeat. Although the bulls welcomed GDP results, it was not enough for them to open new positions. GBP/USD has been bullish over the past two days even without any macro reports. Therefore, traders should focus solely on US macro data today.

When it comes to the UK's economic activity in January, it is impossible to draw a definite conclusion. The economy is not shrinking every month, but a recession is inevitable in 2023. Anyway, it either has not started yet or has just begun. Anyway, this is enough for the BoE to raise rates again as inflation is still above 10%.

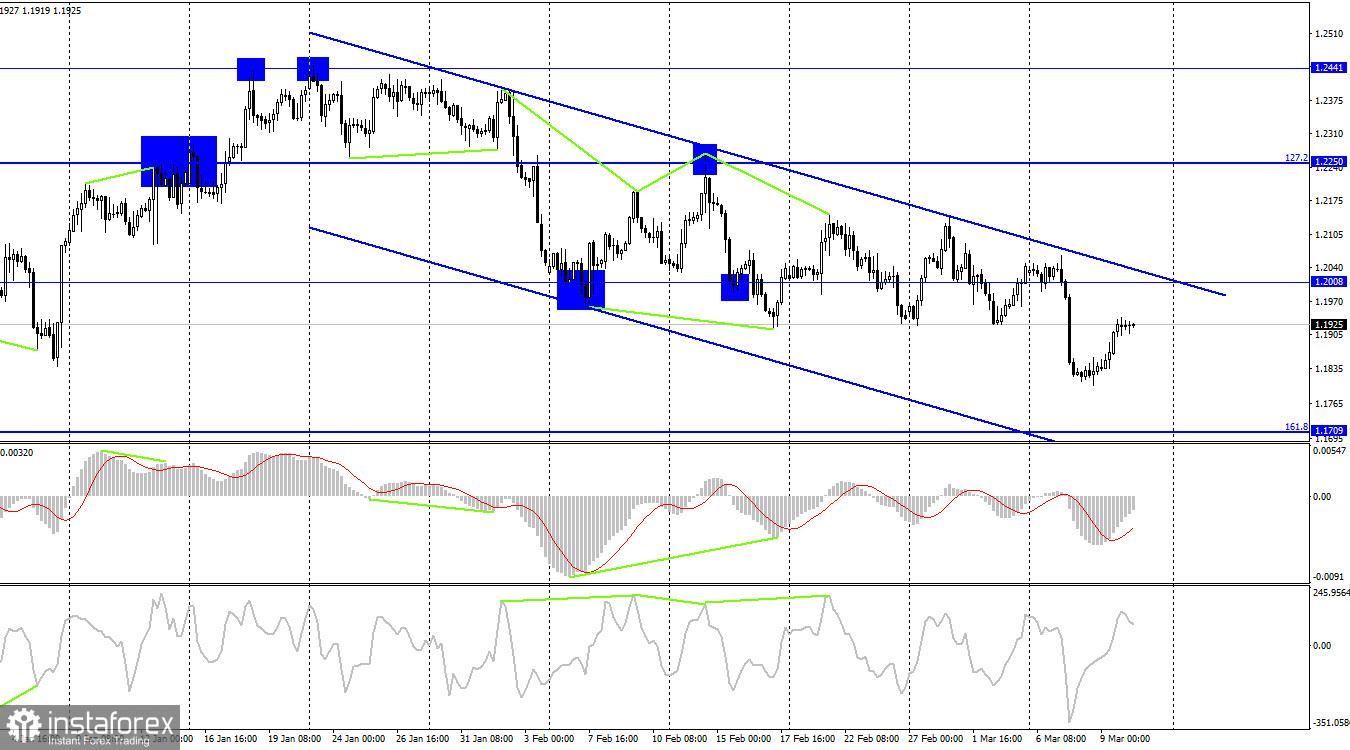

In the 4-hour time frame, the pair reversed and headed to 1.2008. It still trades within a descending trend corridor, indicating a bearish bias. A bearish reversal may soon occur. The quote may then go to the 161.8% retracement level of 1.1709. Neither of the technical indicators shows divergence today.

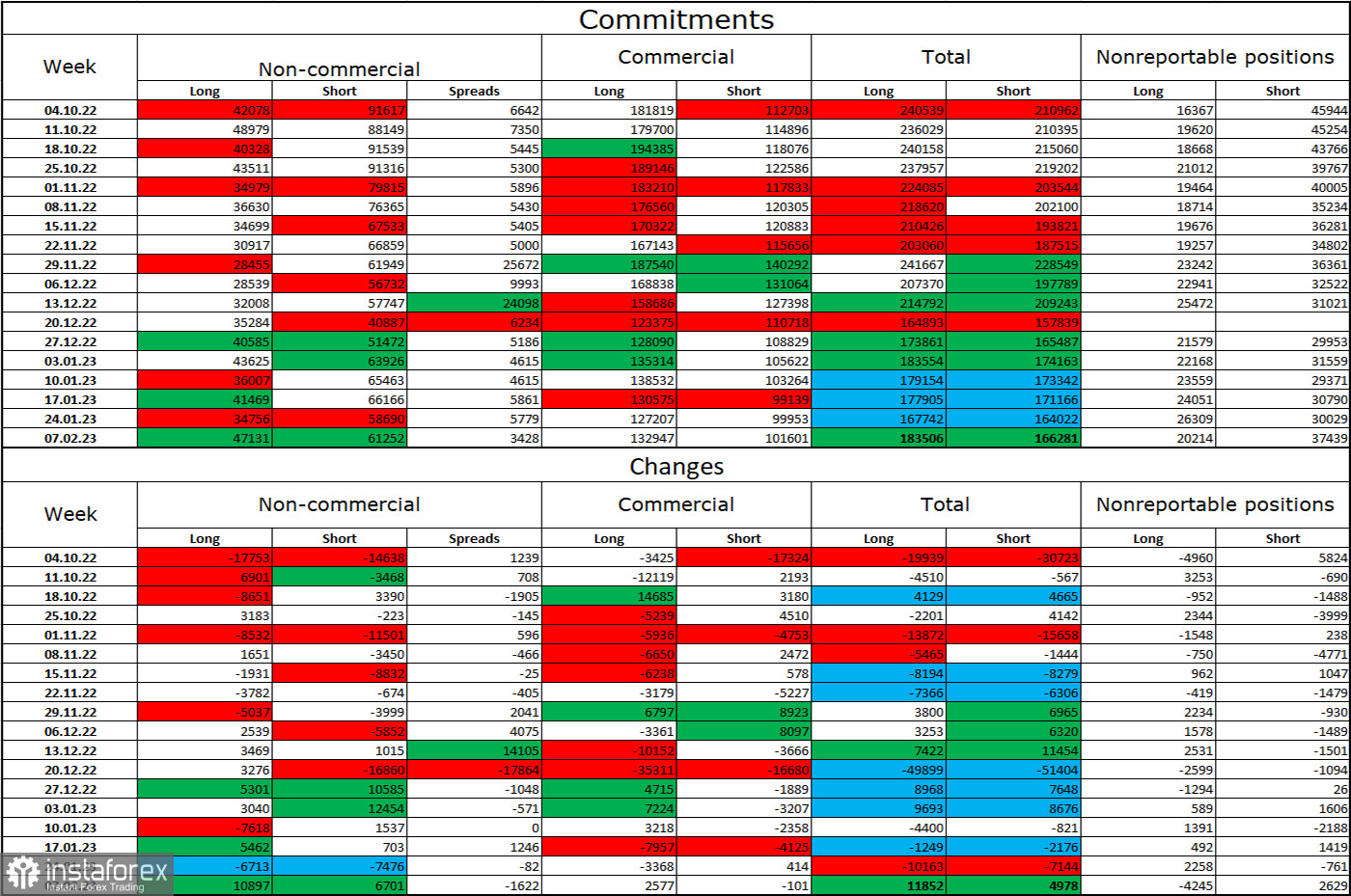

Commitments of Traders:

The bearish sentiment of non-commercial traders decreased last week. However, we are now talking about reports from a month ago. The CFTC has not provided fresh data yet. Speculators opened 10,897 new long positions and 6,701 short ones. Overall, sentiment is still bearish with a wide gap between shorts and longs. Although the pound sterling has limited growth potential now, it is in no rush to go down. In the 4-hour time frame, the pair has left the limits of the 3-month ascending corridor, which may provide support for the greenback. Anyway, the pair should leave the sideways trend on the 1-hour chart first.

Macroeconomic calendar:

UK – GDP (07-00 UTC); Industrial Production (07-00 UTC).

US – Average Hourly Earnings (13-30 UTC); Nonfarm Payrolls (13-30 UTC); Unemployment Rate (13-30 UTC).

Friday is a busy day both in the UK and the US due to the release of many important macro reports. Therefore, fundamental factors may have a strong influence on market sentiment.

Outlook for GBP/USD:

The trading plan will be to sell after a bounce from 1.2007 or the lower limit of the sideways channel in the 1-hour time frame, with targets at 1.1883 and 1.1737, as well as to buy after the close above 1.1883, targeting 1.2007.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română