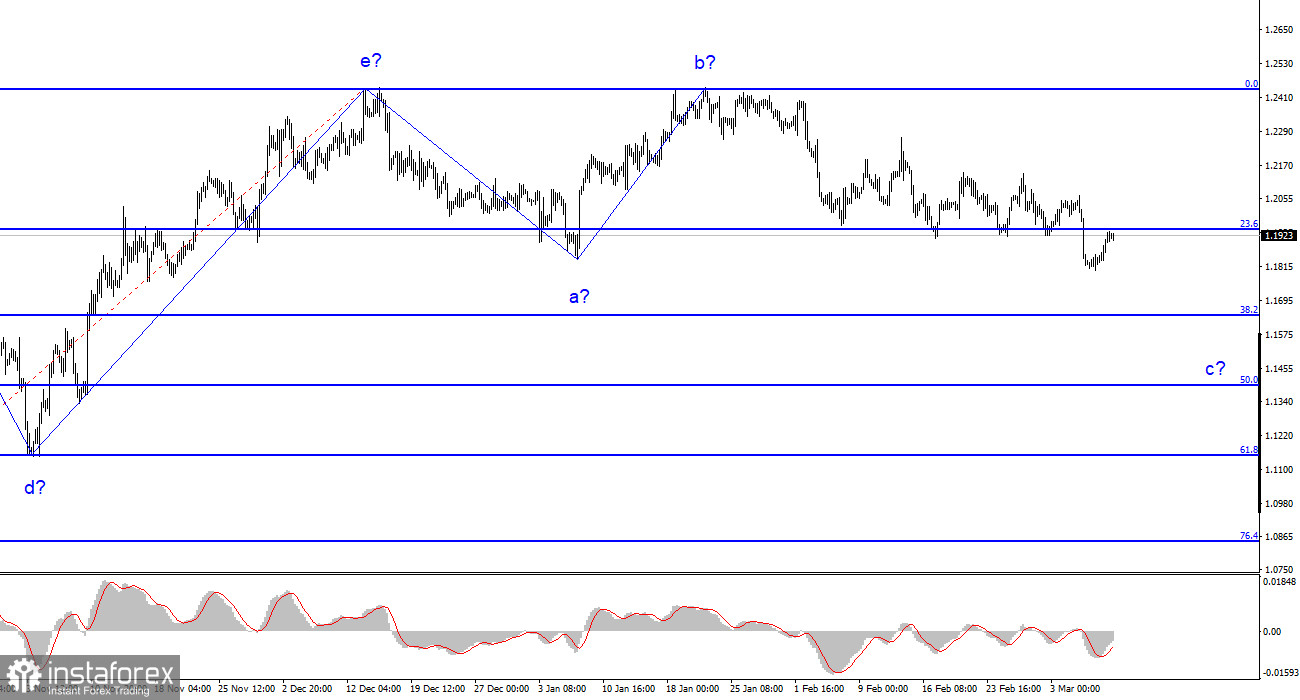

The wave analysis for the pound/dollar pair now appears to be challenging, but it does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I predict that the downward part of the trend has begun and will continue to develop, taking at least a three-wave form. Although Wave B appeared to be unnecessarily prolonged, it did not cancel. As a result, it is presumed that the development of a wave with targets below wave a's low is currently continuing from the downward sector of the trend. The low of wave a has already been broken, allowing for the development of this wave to be finished right now. On the other hand, I think it will be considerably deeper — at least 200 points lower than the current price. It's still too early to speculate about whether the entire downward part of the trend will even take a five-wave structure. I currently view the level of 1.1641 as the closest target, which according to Fibonacci equals 38.2%.

Although the pound/dollar exchange rate increased marginally on Thursday, development on the anticipated third wave is still ongoing. As a result, the pair's price decrease should likewise continue. There could be several factors causing a decline today, or there could be none at all. It is quite difficult to foresee what the British and American reports will reveal. Even though the US economy is strong and the British economy has not yet entered a recession, both GDP and payrolls might nevertheless surprise market participants today.

Although it is tough to expect positive results from the British economy right now, it is always feasible for growth to exceed expectations by 0.1-0.2%. And this will be sufficient for the British pound's demand to increase a little. Last month's nonfarm payrolls exceeded market estimates by a wide margin, but this is no guarantee that this pattern will be seen month after month. I only want to emphasize that, currently, a wide range of possibilities exist. Even while the pair's decline is the most reasonable and anticipated course of action, this does not guarantee that the pair will collapse. But I anticipate a decrease in the coming weeks because Jerome Powell made it obvious this week before the Senate that the Fed will tighten monetary policy more quickly and hike interest rates for a longer period than the market anticipates. Although the Bank of England is considering keeping a "hawkish" stance in the UK, there have been no such messages from them. None of the central banks are currently prepared to abandon the rate hike, and the more signals from the ECB and Bank of England that are released, the less likely it is that the euro and the pound will fall—which they should now, as the wave pattern predicts this will happen. But today, none of that is relevant. The market's mood will be determined by data on the US labor market today.

Conclusions in general.

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave c might be shorter, but for the time being, I anticipate a further 200-point drop (from current levels).

On the higher wave scale, the picture is comparable to the euro/dollar pair, but there are still significant variances. The upward correction part of the trend has now been finished. If this presumption is true, we must wait for the development of a downward section to continue for at least three waves with the possibility of a reduction in at least the area of Figure 15.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română