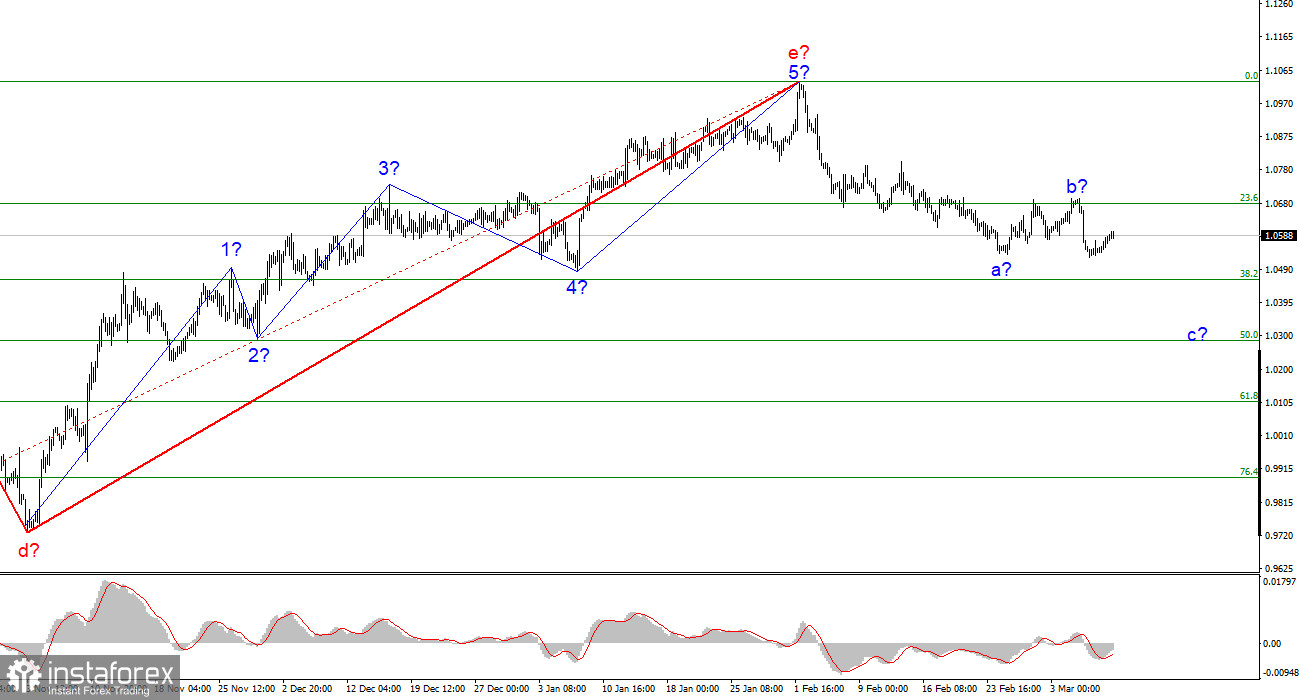

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. It's also encouraging that the movements are almost entirely in line with the wave analysis. The upward part of the trend, which has taken on the pattern a-b-c-d-e, is already finished. I continue to anticipate the pair to decline since, if the wave markup for the current wave is accurate, we should build at least three waves down. Two of these three waves may be already finished. An update on the low wave a resulted from this week's fall in the pair's quotes. As a result, wave 3 or C is currently being developed. It should be noted that the entire current trend segment may turn out to be a pulse, just as the prior one was corrective, even if it was five-wave in nature. As a result, I anticipate that the pair will continue to decrease, with targets close to the predicted mark of 1.0283, or 50.0% Fibonacci. To determine if the market may continue developing a downward trend section after working off this level, it will be required to assess the scenario and the wave image.

We anticipate strong payrolls in the USA.

On Thursday, the euro/dollar pair increased by 40 basis points. Even if there was no background news yesterday, Jerome Powell's Tuesday statements continue to have an impact on the market. Let me remind you that Powell made it apparent that day that the Fed rate might rise more quickly or significantly than the market currently anticipates. He even permitted the rate to grow by 50 basis points in March, which immediately raised a demand for US currency. Nevertheless, the pair was unable to keep falling on Wednesday and Thursday. At this point, the question is whether the downward wave b has been completed, or whether it will adopt a more convincing three-wave form. If today's American reports fall short of expectations, the pair will keep increasing, and wave C development will start later.

Market participants have always been intrigued by the Nonfarm Payrolls report. This is one of those reports that almost always draws a response. It now has a double meaning and importance because the monetary policy's parameters depend on the situation of the labor market. The market anticipates that there will be 20–210,000 new jobs created in February. I believe that this projection is realistic and do not anticipate a significant decline in the number of payrolls. This suggests that the demand for US currency today won't drop significantly. Don't ignore the unemployment report, though. The dollar may weaken on Friday if unemployment increases and payrolls are not very compelling. Today, the wave pattern will nearly never be broken. Wave B will merely become more difficult if the upward movement continues. If the downward movement persists, wave b will be considered finished and wave c's development will begin. The wave markup and the news background are now both in favor of the dollar's growth.

Conclusions in general.

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A corrective wave 2 or b can still be developed at this point; however, it will now take a longer form. Opening sales now on the MACD "down" signals is advised.

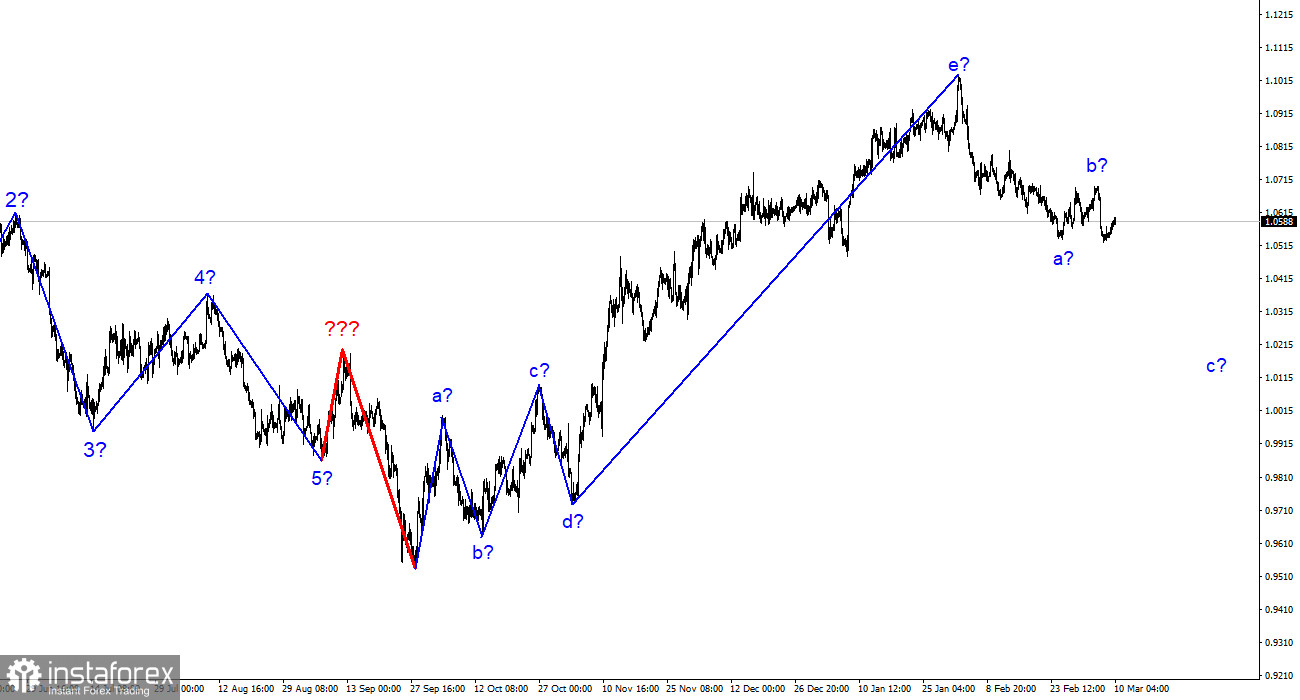

On the older wave scale, the upward trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. The downward trend's development has already started, and it might have any size or structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română