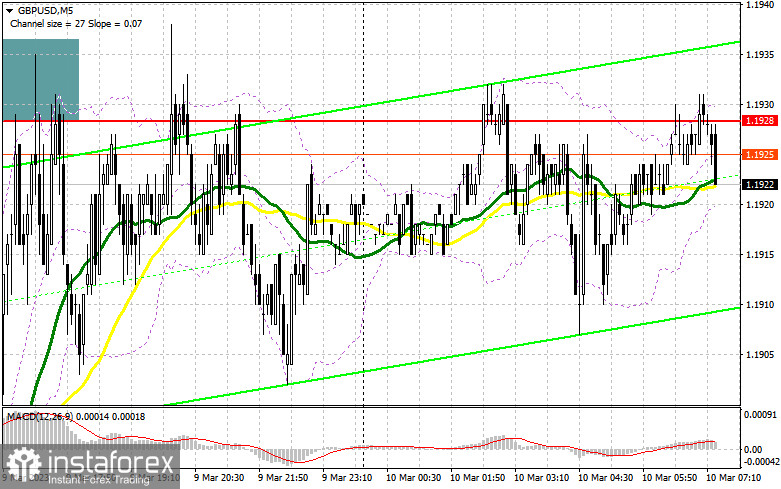

A few entry signals were made yesterday. Let's look at the M5 chart to get a picture of what happened. In the previous review, I focused on the 1.1837 level and considered entering the market there. Growth and a false breakout at 1.1837 generated a sell signal, but the price did not fall steeply. In the North American session, a false breakout at around 1.1928 produced another sell signal, and the quotes went down by 30 pips.

When to open long positions on GBP/USD:

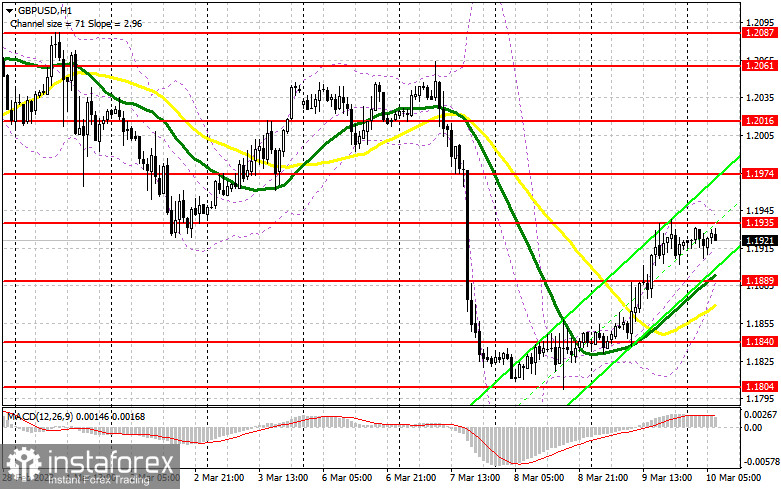

A bearish correction may soon end. Therefore, it is important to stay mindful when buying ahead of the US jobs market report. In addition, a series of macro reports in the UK is scheduled for release today, including GDP, industrial production, and manufacturing production. These statistics may also have an effect on market sentiment. In fact, the pound may come under pressure in the European session because these figures could disappoint. If the pair goes down, a false breakout through the nearest support at 1.1889 will make a buy signal, targeting yesterday's resistance at 1.1935. In fact, it is in line with the bullish moving averages. After consolidation and a downside test of this range on the back of upbeat data, GBP/USD may head toward the 1.1974 high. There, long positions could be considered after a false breakout with the target at 1.2016 where I am going to lock in profits. If the bulls lose grip on the 1.1889 level, the pressure on the pound will increase. In such a case, a trading plan will be to buy after a false breakout through support at 1.1840 or after a rebound from the 1.1804 low, allowing a correction of 30 to 35 pips intraday.

When to open short positions on GBP/USD:

The bears may return to the market in the European session after the release of disappointing macro reports in the UK, showing risks of a slowdown in economic growth already this spring. In the European session, a trading plan will be to sell after a false breakout through resistance at 1.1935, targeting 1.1889. In fact, the level is in line with the moving averages. The pair may come under pressure after a breakout and a reverse test of this level to the upside. This may generate a sell signal with the target at 1.1840 where I am going to lock in profits. If GBP/USD goes up and there are no bears at 1.1935, the bears may lose control of the market entirely. A false breakout through the 1.1974 resistance level will create a sell entry point. If there is no trading activity there as well, I am going to sell GBP/USD from the 1.2016 high, allowing a bearish correction of 30 to 35 pips intraday.

COT report:

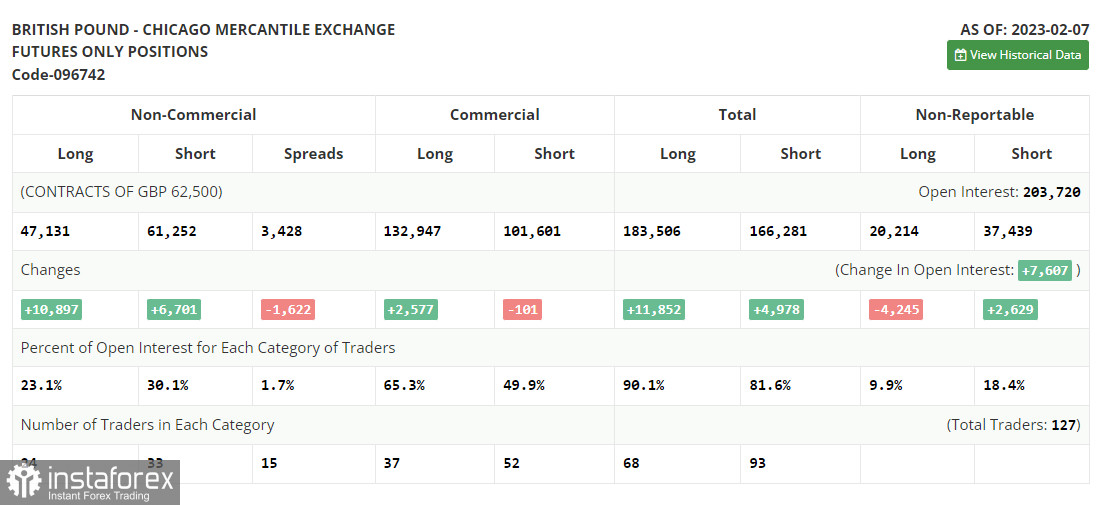

The COT report for February 7 logged a rise in both long and short positions. Apparently, traders welcome the BoE's further monetary policy plans which is why they opened new long positions. Yet, some market participants decided to sell a stronger pound, expecting the Fed to maintain its aggressive stance. This week, there will be just a few interesting reports in the economic calendar of the UK. It means that pressure on risk assets may finally ease, and a bullish correction may occur. Markets will definitely pay attention to Fed Chair Jerome Powell's remarks as they brace for the regulator's next meeting in late March. According to the latest COT report, short non-commercial positions grew by 6,701 to 61,252, while long positions increased by 10,897 to 47,131. The non-commercial net position came in at -14,121 versus -18,317 a week ago. The weekly closing price fell to 1.2041 from 1.2333.

Indicator signals:

Moving averages

Trading is carried out slightly above the 30-day and 50-day moving averages, indicating a bullish continuation.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Support stands at 1.1889, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română