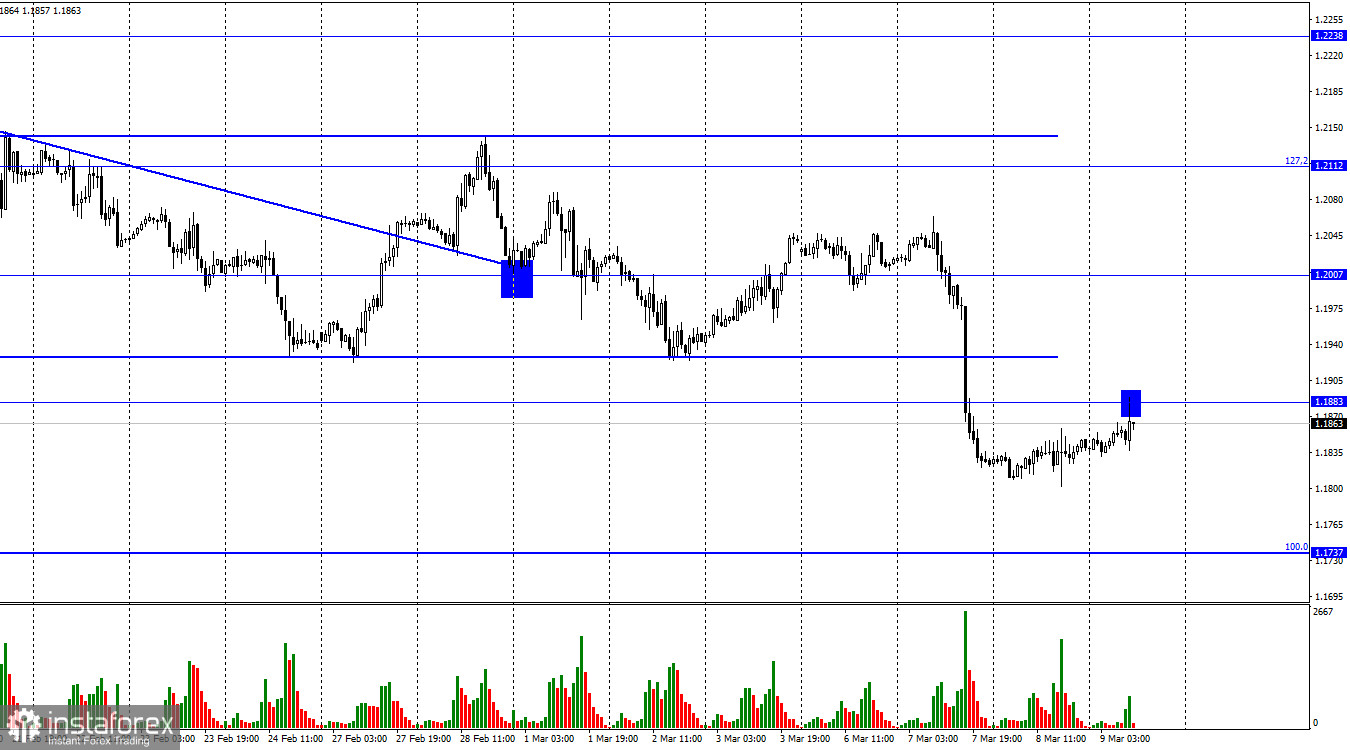

Hi, everyone! On the hourly chart, the GBP/USD pair performed an upward reversal on Wednesday and returned to 1.1883. If the price rolls back from this level, it is likely to resume a downward movement to 1.1737, the Fibo correction level of 100.0%. If the pair rises above 1.1883, it will increase the probability of a rise to 1.2007. The pair broke out of the sideways corridor. It means that the pound sterling is likely to sink lower.

There were no crucial economic reports in the UK yesterday. Jerome Powell made his second speech to Congress took place. He tried to soften his rhetoric on monetary policy. The US dollar dropped slightly following his speech. However, its decline could be trigged by profit-taking. The ADP report was also published. It is a monthly economic data release that tracks levels of nonfarm private employment in the US. It is usually revealed before Nonfarm Payrolls. Despite the fact that the reading turned out to be higher than expected, the US dollar did not grow. It means that not all reports are important and not all of them cause market volatility.

Currently, traders are shifting their attention to the release of NFP data. This report will provide hints about the Fed's future steps on monetary policy and determine the trajectory of the greenback. The US dollar is growing but there are no drivers today. Therefore, I do not expect robust growth. Moreover, the pair needs to consolidate above 1.1883 in order to climb higher.

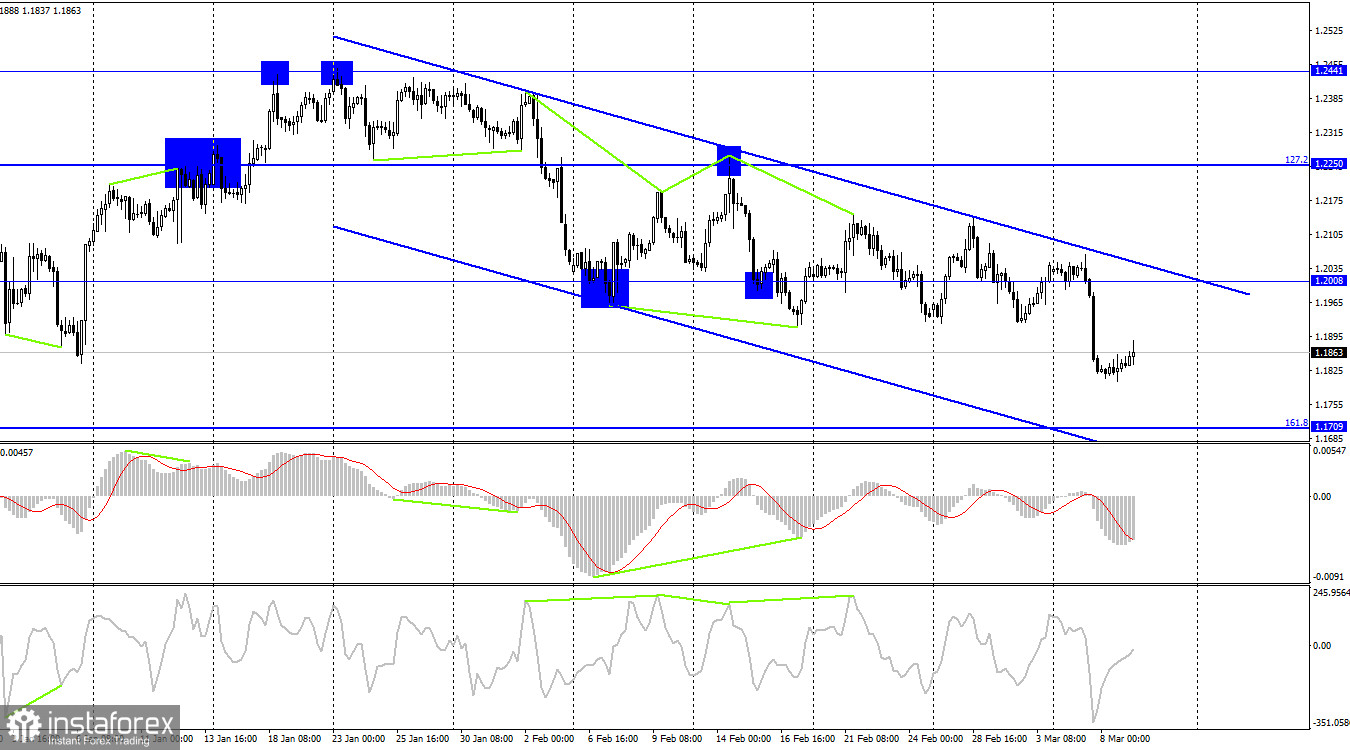

On the 4-hour chart, the pair dropped to 1.1709, the Fibonacci correction level of 161.8%. The downtrend corridor signals a bearish bias. If the pair rises above it, it may reach 1.2250, the Fibo level of 127.2%. A drop below the level of 1.1709 will increase the probability of a further fall to 1.1496.

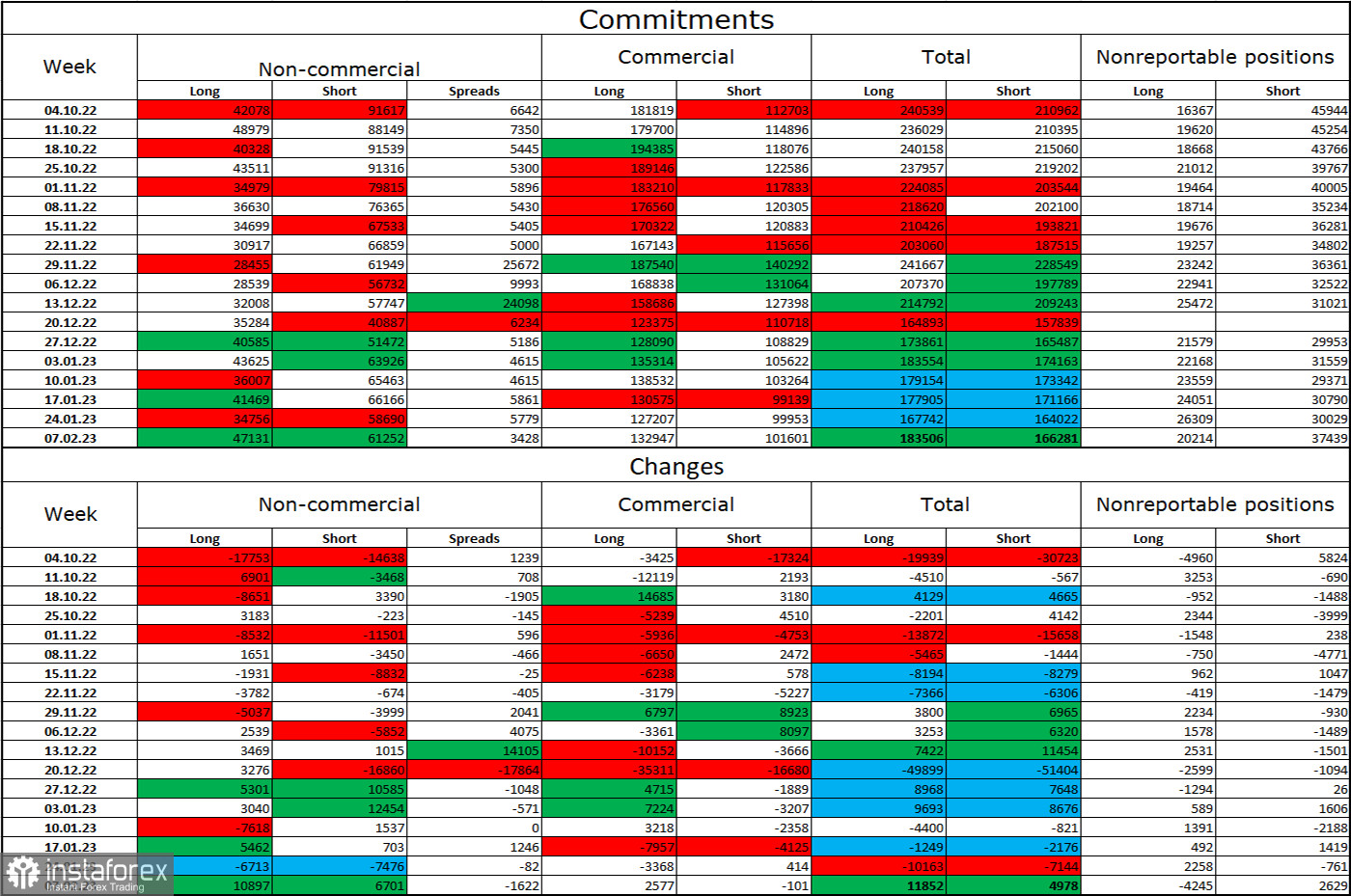

Commitments of Traders (COT):

The mood of the Non-commercial category of traders over the last week has become less bearish than a week earlier. However, those reports were released a month ago as the CFTC did not provide new reports. The number of long positions increased by 10,897, while the number of short ones grew by 6,701. The sentiment of big traders remains bearish. The number of short positions still exceeds the number of long ones. Over the past few months, the situation has changed markedly. The pound sterling has been rising gradually. However, as of early February, there was a difference between the number of long and short positions. Thus, the prospects for the pound sterling remain dismal. Yet, it is still climbing amid a steady upward movement of the euro. On the 4H chart, it broke out of the three-month upward corridor. It might facilitate a jump in the US dollar. Yet, the pair needs to escape from the sideways corridor on the 1H chart.

Economic calendar for US and UK:

US– Initial Jobless Claims, 13:30 UTC.

On Thursday, there will be no crucial economic reports in the UK and the US. The impact of fundamental factors on market sentiment will be low.

Outlook for GBP/USD and trading recommendations:

Traders are recommended to open short positions if the pair declines below 1.1920 (the lower border of the corridor) on the hourly chart with targets of 1.1883 and 1.1737. The pair has already sunk to the first key level. It could approach the second one before it grows above 1.1883. It is better to open long positions if the pair rises above 1.1883 with a target of 1.2007 on the 1H chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română