Early this week, it was already clear that significant fundamentals were from the U.S. Some analysts expected Federal Reserve Chairman Jerome Powell to be hawkish in his address to Congress, but few expected it to be so "tough". As I mentioned before, there was nothing unreasonable about Powell's words. The FOMC has all the tools and economic indicators it needs to not just keep raising interest rates, but to increase them further. The Fed does not want to see high inflation for two or three more years, so it is ready to take action, even if it leads to a recession. However, the U.S. has little to fear. The recession in the U.S. is likely to be mild and short-lived. Analysts now estimate a possible drop in the economy of no more than 1%. In a temporary sense, it may not last more than two quarters. As early as next year, the economy will start to show growth again. And let me remind you that the Fed rate is already at 4.75%. Hence, there is still no recession with the rate close to the peak.

Powell also made it clear that nothing is impossible for the Fed. The rate can rise for a long time, it can rise even faster than it did in February. When FOMC officials talk about any method of achieving the 2% inflation target, their words really should be taken seriously and literally. Thus, the market has now begun to realize that the rate may well rise to 6% or even more. No one can give a final value now, but the Fed can raise the rate as much as it needs to. And the European Central Bank or the Bank of England can hardly boast of such opportunities.

This week, Powell will deliver another speech in Congress, which may also increase the demand for the US currency, given that the Fed chair provides the market with new hawkish comments and answers to questions. The Nonfarm Payrolls report will be out on Friday and I think it is a good time to focus on that indicator. Last month, it was well above market expectations, but it can't be like that every month. I think it will be much lower in February, but I also think the forecast is quite low. Based on that, I think the real value will be almost in line with market expectations. I don't expect any dramatic changes from the unemployment rate either. It is not an indicator that changes every month. Personally, I am expecting a fairly neutral set of data on Friday. If my expectations come true, there will not be any strong moves, but at the same time, the market is bearish now and the demand for USD may rise further. But do it smoothly and leisurely. There is enough time till the meetings of the ECB, BoE and Fed, and there is enough time for each of the instruments to fall by 200-300 points and the corrective sets of waves can be considered completed.

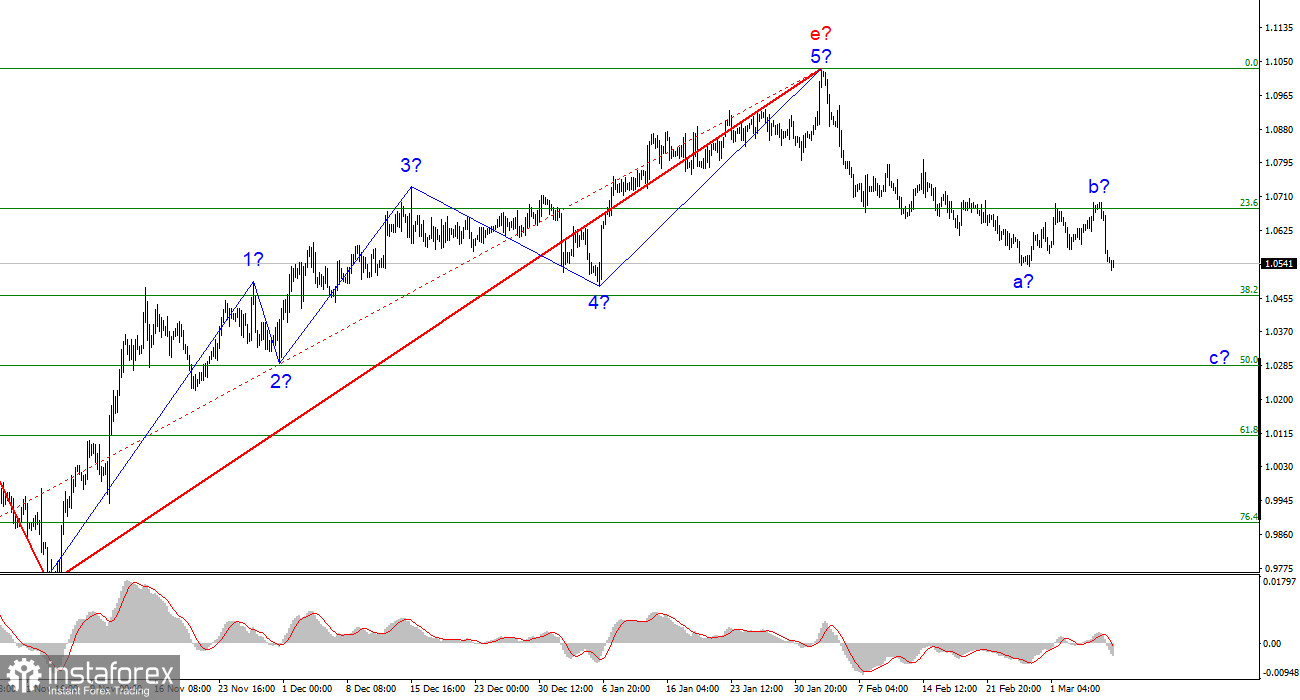

Based on the analysis, I conclude that the construction of the uptrend is complete. So now it is possible to consider short positions with targets located near the calculated mark of 1.0284, which corresponds to 50.0% of Fibonacci. At this time, a corrective wave 2 or b can be built, which should be taken into account. It may be better to open short positions now on the MACD's bearish signals.

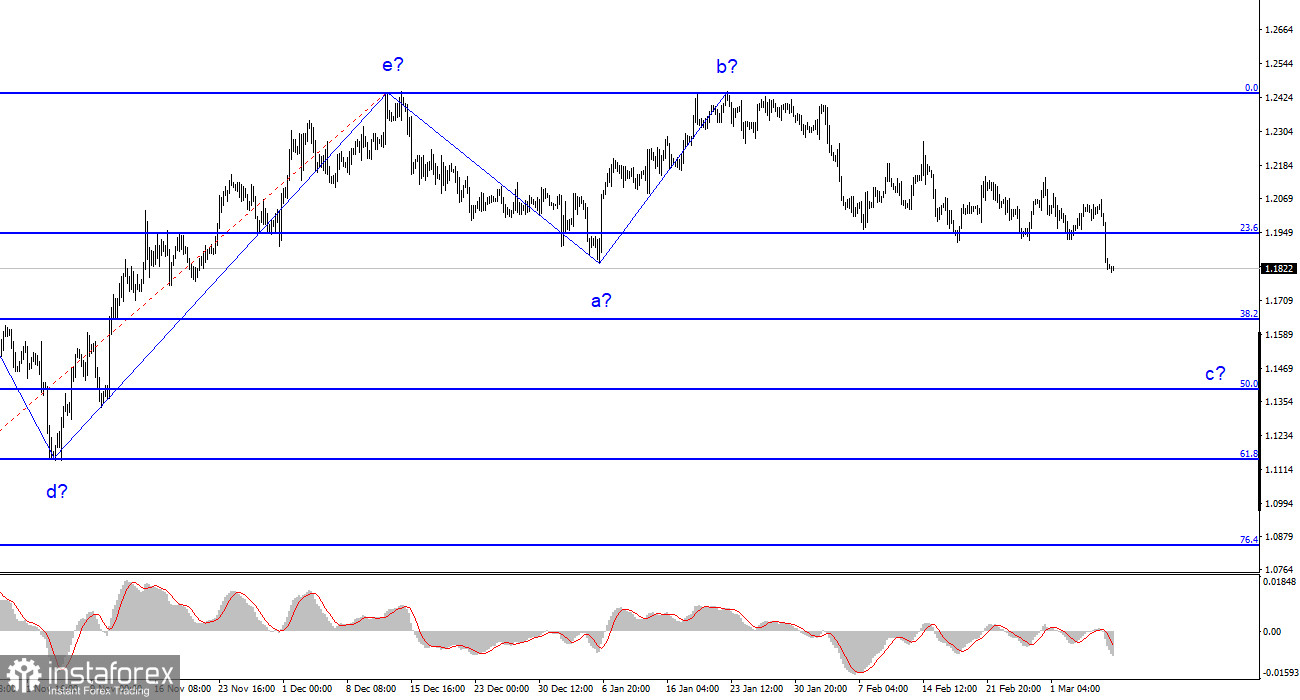

The wave pattern of GBP/USD implies that a downtrend is being built. At this time, it is possible to consider shorts with targets located near 1.1508, which is equal to the 50.0% Fibonacci. A Stop Loss order could be placed above the peaks of waves e and b. Wave c might take a less extended form, but for now I expect the pair to fall by at least another 200 pips (from the current marks).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română