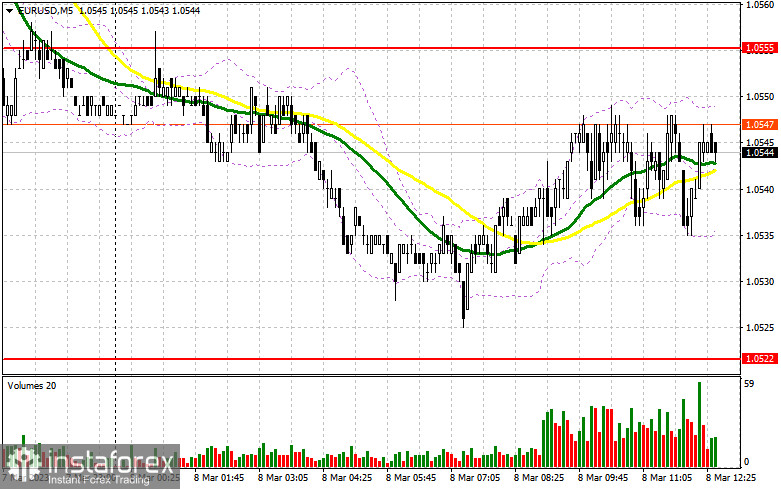

I focused on the 1.0555 level in my morning forecast and suggested making considerations about entering the market from there. Let's take a look at the 5-minute chart and see what happened. Even if there were a lot of statistics about the eurozone, the pair's volatility in the morning was just approximately 20 points. As a result, we did not meet the target levels. There were no indications to buy or sell. The technical picture and strategy were left unchanged for the afternoon.

If you want to trade long positions on EUR/USD, you will need:

After the release of information on changes in the number of employed from ADP and the balance of the foreign trade balance, we may be expected to see a significant increase in volatility. Several promising indications are expected, which should put pressure back on the euro and prompt purchases of US dollars going forward because of the danger of inflation staying at current levels. Jerome Powell, the chairman of the Fed Board of Governors, will not make any interesting remarks in his speech today before the House of Representatives because he will be repeating what he stated in the Senate yesterday. As a result, the best scenario for the bulls in the second half of the day will be to protect the nearest support of 1.0522. An indication to revert to a new resistance of 1.0555 will be provided by the emergence of a false breakout. With a move to 1.0588, which will be challenging for bulls, the breakout and top-down test form an extra entry point for developing long positions against the backdrop of euro zone data. The bears' stop orders will be hit by the collapse of 1.0588, providing a further signal with the potential to move to 1.0615, where I will fix the profit. A test of this level will signal the end of a bullish corrective following yesterday's sell-off. The pressure on the pair will return if EUR/USD weakens and there are no buyers around 1.0522 during the US session, which is more likely. A breach of this level will cause a drop to the next support area of 1.0487. Only the emergence of a false collapse there will suggest a purchase of the euro. For a rebound from the low of 1.0451 or even lower, around 1.0395, I will begin long positions right away with the target of a 30-35 point upward reversal during the day.

If you want to trade short positions on EUR/USD, you'll need:

Sellers are waiting for significant U.S. statistics and refraining from forcing events in the hopes that Powell will make some sort of reference to the new information when he speaks before the House of Representatives. Growth and the development of a false breakout in the immediate area of a new resistance level of 1.0555, which will trigger sales of the euro to bring it down to the area of 1.0522, an intermediate support level, continue to be the best-case scenario for opening new short positions. An additional signal to start short positions with an exit around 1.0487 has been formed by the collapse and reversal test of this range against the backdrop of extremely strong US figures, which will reinforce the market's bearish trend. Fixing below this range will result in a larger drop to the 1.0451 area, where I will take profit. I suggest you delay opening short positions until the level of 1.0588 if the EUR/USD moves higher throughout the European session and there are no bears at 1.0555. Moreover, you can only sell there following a failed consolidation. In anticipation of a rebound from the high of 1.0615, I will open short positions right away with a 30- to 35-point correction in mind.

Signals from indicators

Moving Averages

Trade is taking place below the 30 and 50-day moving averages, which suggests that the pair will continue to fall.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper bound, or approximately 1.0570, will serve as resistance in the event of an increase.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

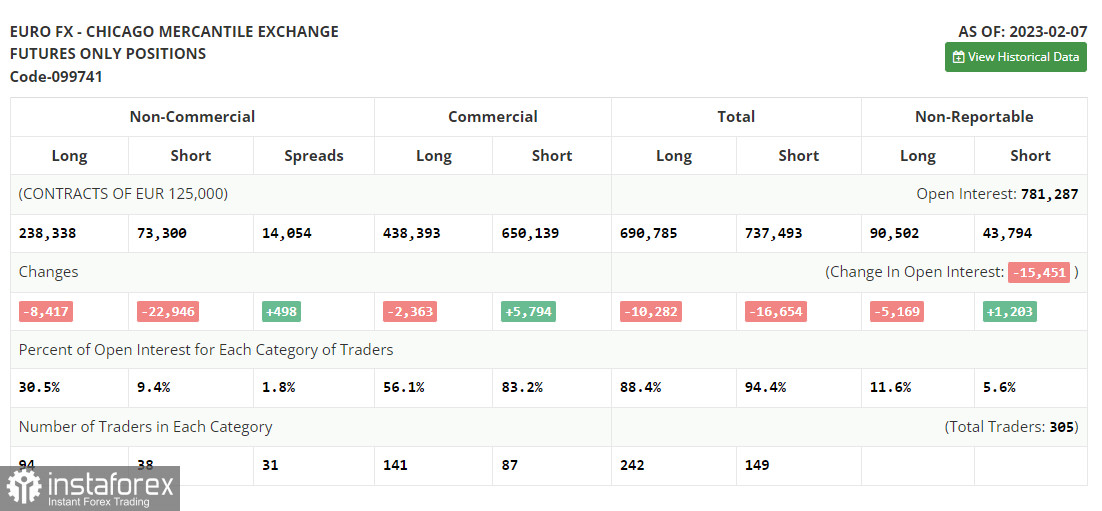

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română