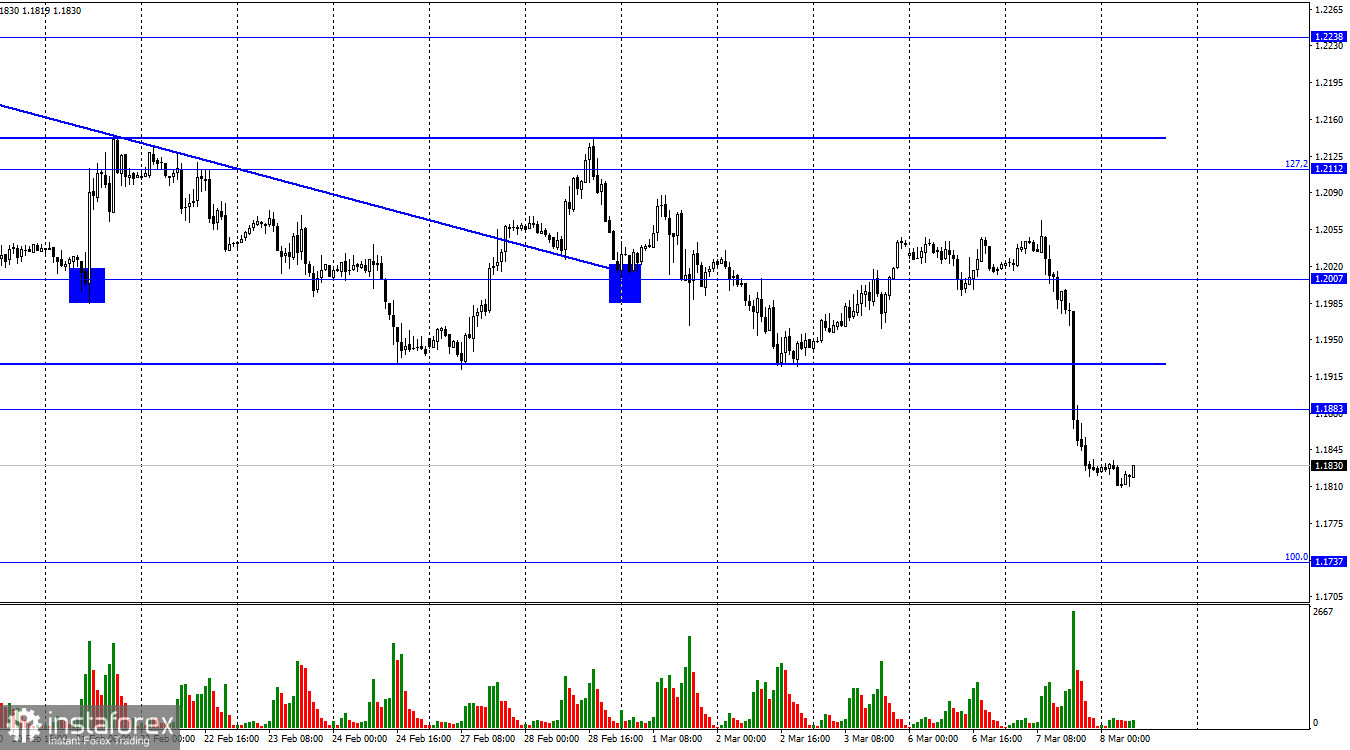

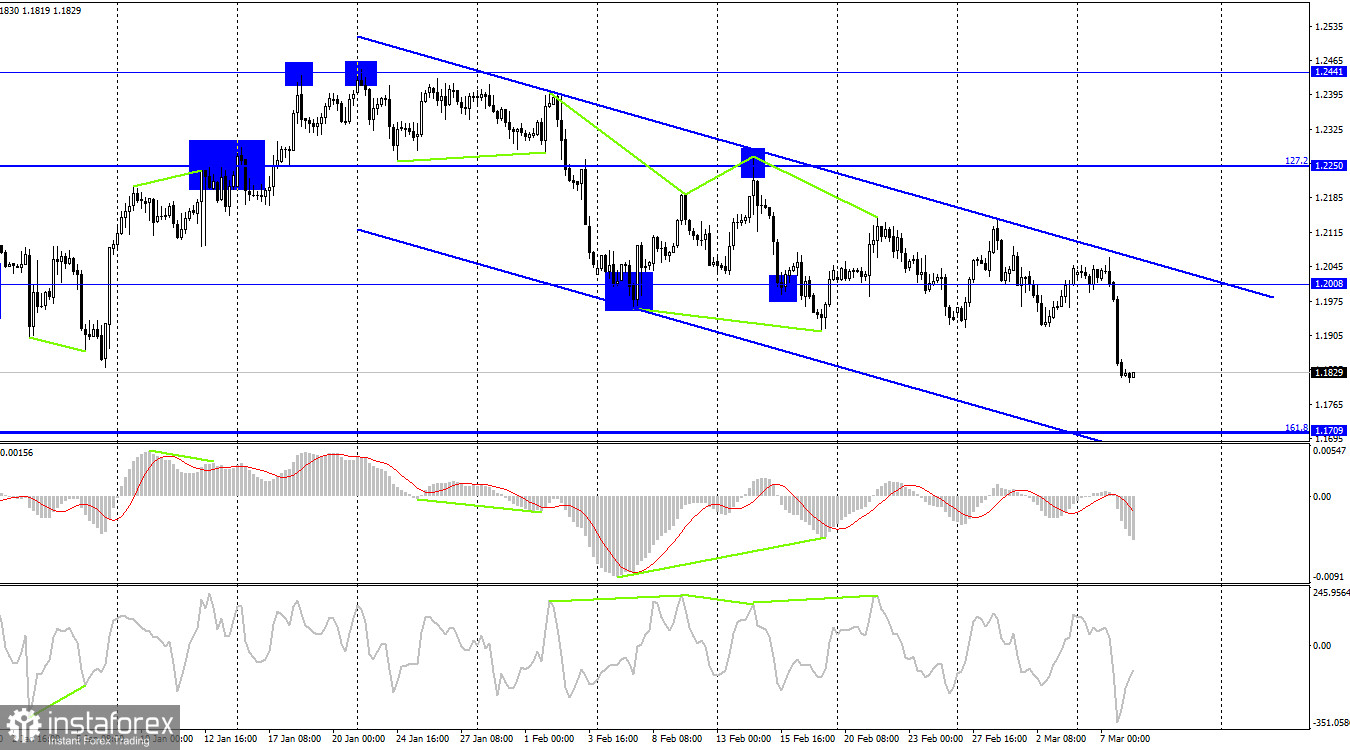

As a result, I think that today's response to the speech of the Fed President may also be quite powerful and unexpected. Powell's rhetoric is obvious, thus the current strengthening of the US dollar cannot be fully denied. On the 4-hour chart, the pair took a new turn in favor of the US dollar and started to decline once more, heading for the corrective level of 161.8% (1.1709). The downward trend corridor identifies the mood of traders as "bearish." The British pound will benefit from fixing the rate of the pair above it and some growth in the direction of the Fibo level of 127.2% (1.2250). The likelihood of a further decrease toward the next level of 1.1496 will grow if the price closes below the level of 1.1709.

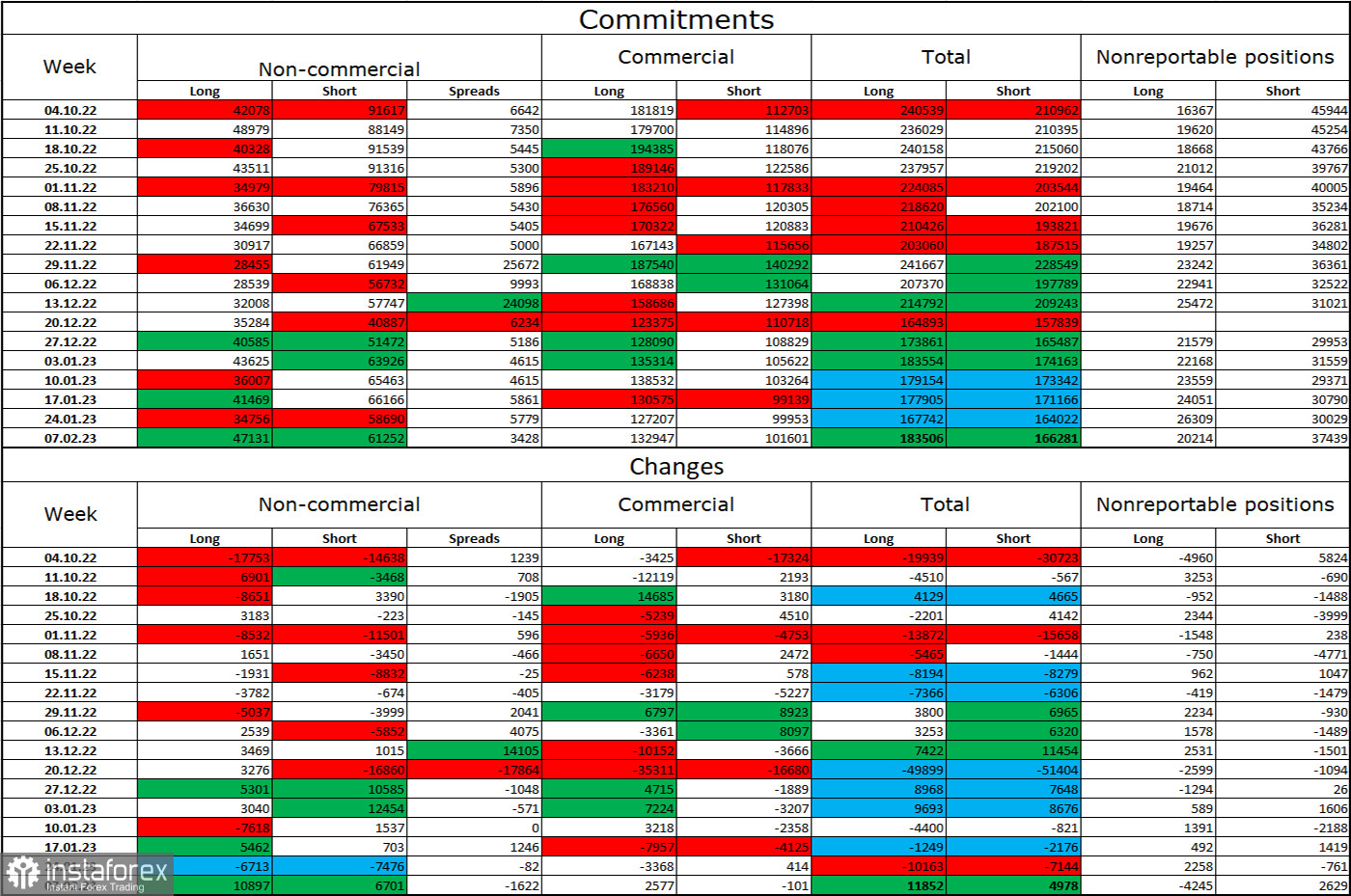

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "Non-commercial" category was less "bearish" than it had been the previous week. But, since the CFTC has not released any new reports, we are currently discussing reports from a month ago. Speculators now hold 10,897 more long contracts than short contracts, a difference of 6,701 units. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound during the last several months, although the gap between the number of long and short positions held by speculators still exists. And "now" refers to the beginning of February. Consequently, the prospects for the pound remain dismal, but the pound is in no hurry to fall, focusing on the euro currency. The three-month upward corridor on the 4-hour chart had an exit, and the dollar can now be supported at this time. On the hourly chart, though, you must still exit the side corridor to accomplish this.

The following is the UK and US news calendar:

US – change in the number of people employed in the non-agricultural sector from ADP (13:15 UTC).

US – speech by the head of the Fed, Mr. Powell (15:00 UTC).

In the UK, there are no noteworthy economic events scheduled for Wednesday, whereas Powell will give another address in the US. The information background may once again have a significant impact on traders' attitudes throughout the rest of the day.

Forecast for GBP/USD and trading advice:

On the hourly chart, I suggested new sales of the pound when it closed below the level of 1.1920 (the lower line of the corridor), with targets of 1.1883 and 1.1737. We may wait till the second objective is resolved since the first one has already been accomplished. On the hourly chart, the pair may be bought if it recovers from the level of 1.1737 with a target of 1.1883 in sight.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română