The AUD/USD pair rallied in the last hours and now is located at 0.6516 at the time of writing. The price turned to the upside as the Dollar Index crashed after poor US data reported yesterday. Technically, the price action signaled that the downside movement ended and that the buyers could take the lead again.

The rate dropped a little in the first part of the day as the Australian CPI reported only a 4.9% growth versus the 5.2% growth expected. In addition, the Construction Work Done and Building Approvals came in worse than expected as well.

Now, the AUD/USD pair resumed its leg higher as the US Prelim GDP, Prelim GDP Price Index, ADP Non-Farm Employment Change, and Goods Trade Balance disappointed. On the other hand, Pending Home Sales and Prelim Wholesale Inventories reported positive data. Tomorrow, the Chinese and the US figures should move the price.

AUD/USD Aims At 38.2%!

From a technical point of view, the AUD/USD pair is strongly bullish. After yesterday's rally, the rate retreated a little to test and retest the former highs trying to accumulate bullish energy before jumping higher.

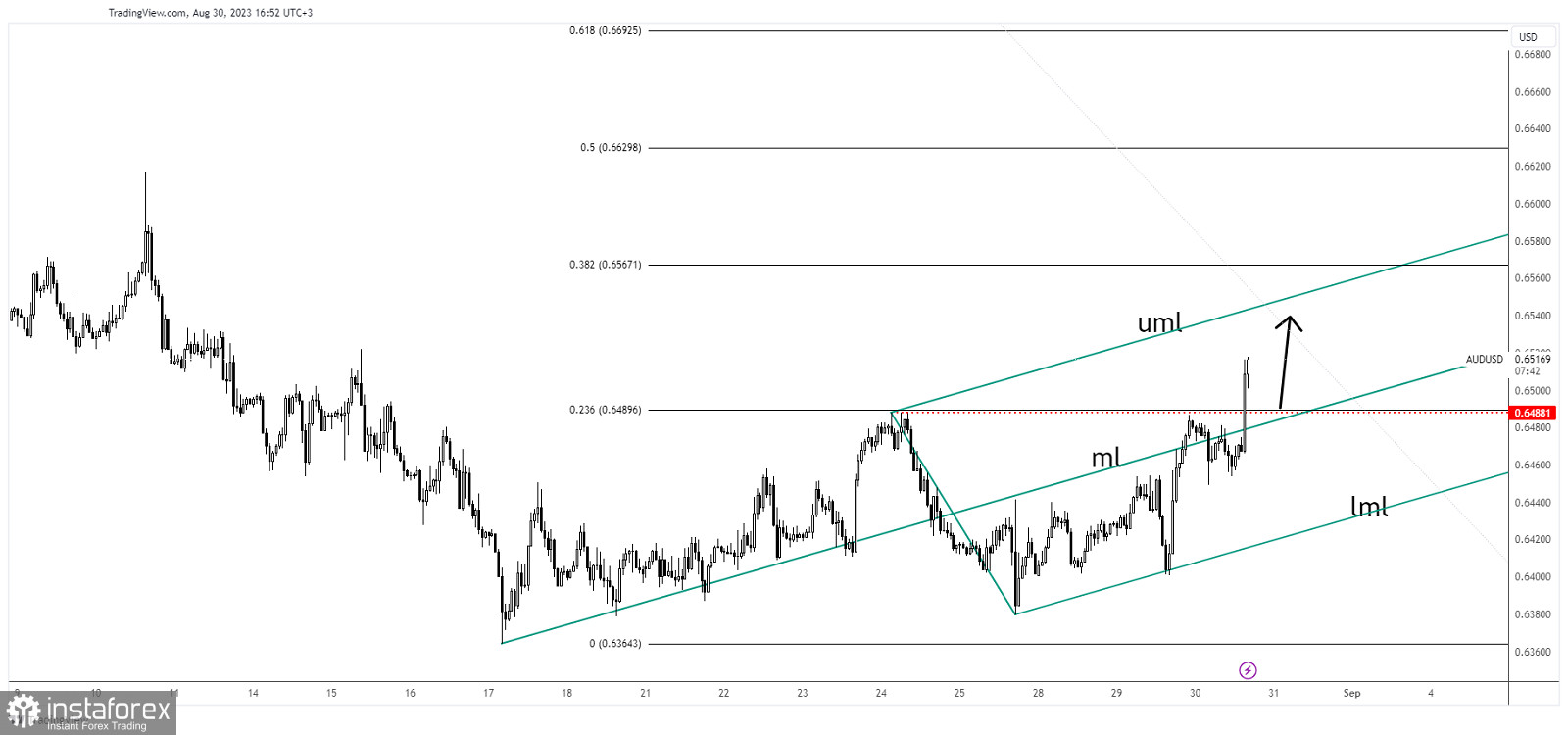

As you can see, the rate registered an aggressive breakout through the median line (ml), 0.6488 former high, and above the 23.6% (0.6489) retracement level signaling further growth.

AUD/USD Outlook!

Breaking and closing above 0.6488 was seen as a buying signal. Still, after its strong rally, we cannot exclude a minor retreat. Coming back to test and retest the 23.6% (0.6489) and the median line (ml) is seen as a new buying signal. The upper median line (uml) and the 38.2% (0.6567) represent upside targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română