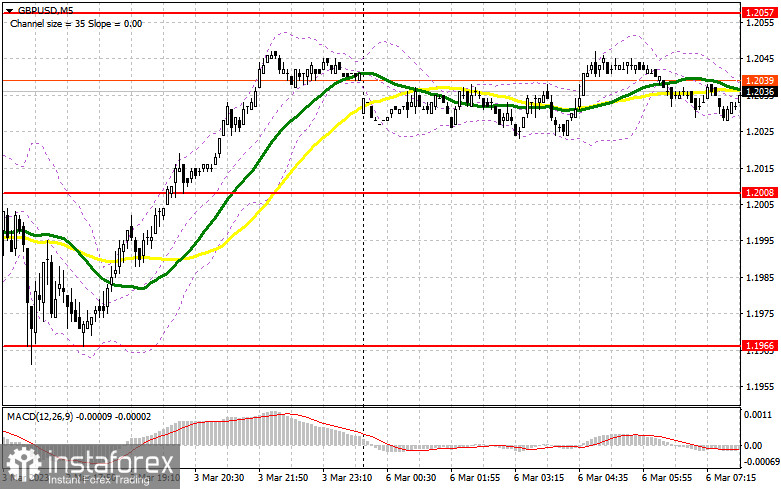

Yesterday, the pair did not form any entry signals. Let's discuss what happened on the 5-minute chart. Despite the targets set for the first and the second half of the day, we couldn't get any clear signals to enter the market. In the New York session, the support area of 1.2008 was very unclear so I couldn't find any entry point there either.

For long positions on GBP/USD:

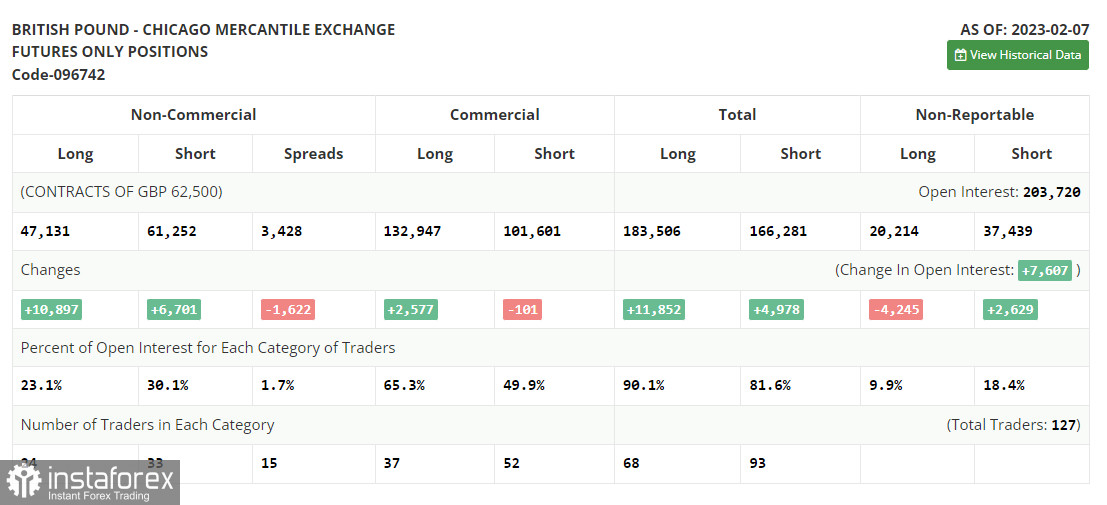

Before moving on to the technical setup, let's first talk about the futures market. The Commitments of Traders report for February 7 recorded a rise in both long and short positions. Apparently, traders approved of the BoE's further policy which is why we saw so many long positions added. Yet, some market participants decided to sell the pound while it is still strong as they expect the Fed to maintain its aggressive monetary approach. This week, no significant economic reports are expected in the UK which means that pressure on risk assets may finally ease. In theory, this may allow the pound to develop an upside correction against the US dollar. Markets will definitely take notice of the statement by Fed Chair Jerome Powell as it will give a hint about the regulator's agenda at the next meeting in late March. According to the latest COT report, short positions of the non-commercial group of traders went up by 6,701 to 61,252, while long positions rose by 10,897 to 47,131. This resulted in a decline in the negative value of the non-commercial net position. It dropped to -14,121 from -18,317 recorded a week ago. The weekly closing price fell to 1.2041 from 1.2333.

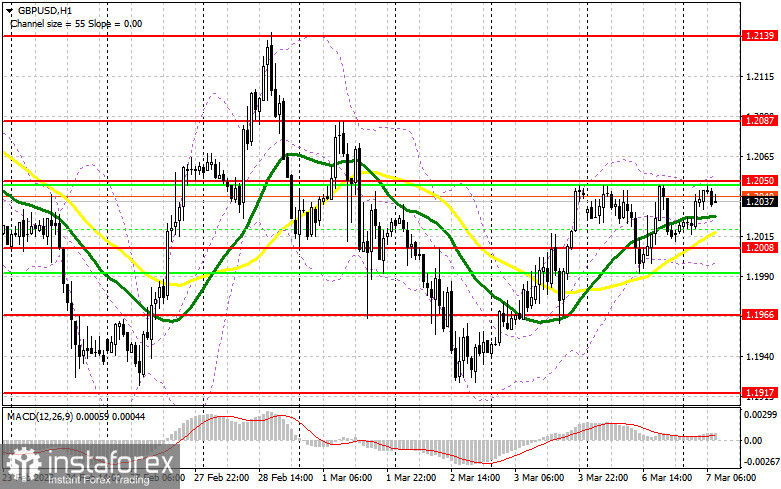

The pound is still trading in the range-bound market so we need to adjust to new levels every time. Today, the UK's Halifax House Price Index will be released. In addition, BoE's Deputy Governor Sam Woods will give a statement. Buyers will most likely appreciate the message but to assert their position, they will need to keep the price above the new support of 1.2008. This is where we can see the moving averages playing on the side of the bulls. A false breakout of this level will give us a buy signal and confirm the presence of the pound buyers this week. This will allow the pair to return to strong resistance at 1.2050 and then head for 1.2087. Without testing this level, GBP/USD bulls may not be able to develop an upside correction. Only a break above this range will signal the continuation of the upward movement. A breakout of 1.2087 and its downward retest will pave the way towards 1.2139 where I will be taking profit. The level of 1.2177 will act as the highest target. Its retest may be possible only after Powell's statement. If GBP/USD declines and buyers are idle at 1.2008, bears may regain control of the pound. In this case, I would recommend buying the pair only when the price reaches 1.1966 after a false breakout. You can open long positions on GBP/USD right after a rebound from 1.1917, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Bears showed their strength near the weekly high but there is little chance they will develop a downtrend. Everything will depend on what Fed Chair Jerome Powell will say. Bulls are likely to attempt a breakout of the resistance of 1.2050 in the first half of the day, so bears will need to protect it. A false breakout of this level following the speech by the BoE's official and the publication of some reports will generate a sell signal that may send the price lower to the nearest support of 1.2008. Its breakout and a downward retest will create a good entry point to sell the pair with the target at the low of 1.1966. The level of 1.1917 will act as the lowest target where I will be taking profit. If GBP/USD rises and bears are idle at 1.2050, bulls will have a chance to stop the downtrend. If so, GBP/USD may surge to the high of 1.2087. Its false breakout will serve as a good opportunity to sell the pair, considering a further downward movement. If nothing happens there as well, I would recommend going short on GBP/USD from 1.2139, keeping in mind a pullback of 30-35 pips within the day.

Indicator signals:

Moving Averages

Trading near the 30- and 50-day moving averages indicates market uncertainty.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair advances, the upper band of the indicator at 1.2050 will serve as resistance. In case of a decline, the lower band of the indicator at 1.2000 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română