Technical outlook:

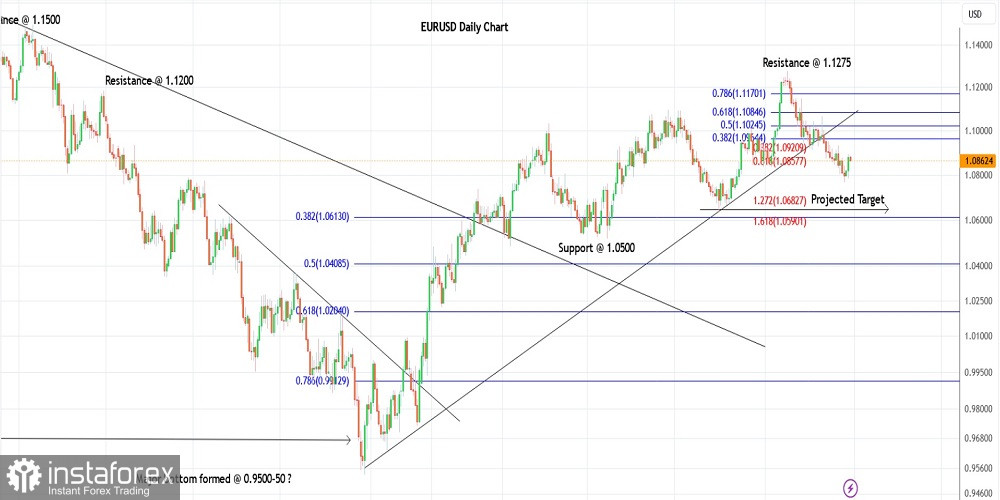

EUR/USD rallied through 1.0890 on Tuesday, indicating the potential for a further upside. If a meaningful retracement is underway, potential targets are 1.1000 and 1.1050 levels respectively. Please note that the Fibonacci 0.618 retracement is seen through the 1.1080 level which should provide enough resistance for prices to turn lower again.

EUR/USD could be within a larger-degree corrective phase after having carved a high at 1.1275 levels earlier. The first correction phase could be completed at 1.0765 or close to completion. The second correction phase is pointing towards the area between 1.1000 and 1.1080. Therefore, we can expect another round of sell-off towards 1.0500 going forward.

EUR/USD could produce an intraday pullback towards 1.0830 which is a potential support zone. Traders might want to exit short positions for a while and go long towards 1.1000 and up to 1.1080 levels. The near-term trend might remain bullish but the bears should be back in control from 1.1080 and drag the price through 1.0500.

Trading idea:

A potential short-term rally towards 1.1000 remains possible before turning lower.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română