Euro fell to daily lows due to weak investor confidence data from Sentix and retail sales in January this year. Pound also headed to daily lows despite good PMI report for the construction sector.

Considering that there is nothing important scheduled to be released this afternoon apart from the data on US manufacturing orders, traders will not be in a hurry to enter the market before the events that await tomorrow. One of those is the speech of Fed Chairman Jerome Powell, which will give a hint on how officials plan to raise interest rates and to what levels. If the aggression persists, demand for dollar will return, leading to a further decline in both euro and pound.

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0646 (green line on the chart) and take profit at the price of 1.0671.

Euro can also be bought at 1.0625, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0646 and 1.0671.

For short positions:

Sell euro when the quote reaches 1.0625 (red line on the chart) and take profit at the price of 1.0598.

Euro can also be sold at 1.0646, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0625 and 1.0598.

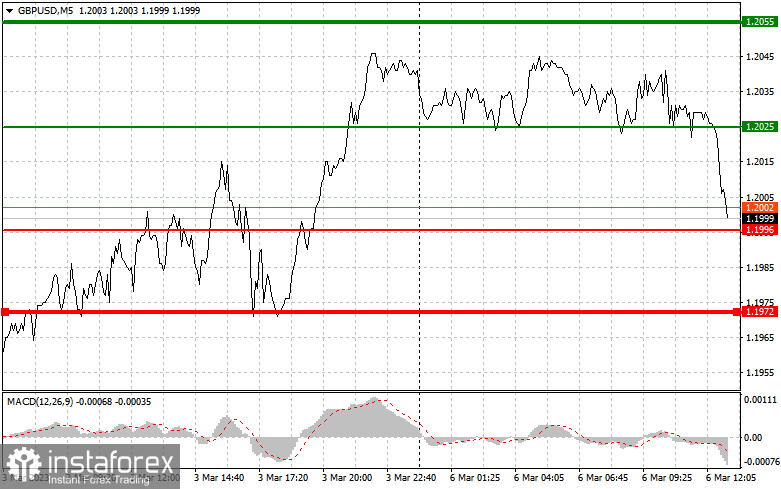

GBP/USD

For long positions:

Buy pound when the quote reaches 1.2025 (green line on the chart) and take profit at the price of 1.2055 (thicker green line on the chart).

Pound can also be bought at 1.1996, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2025 and 1.2055.

For short positions:

Sell pound when the quote reaches 1.1996 (red line on the chart) and take profit at the price of 1.1972.

Pound can also be sold at 1.2025, but the MACD line should be in the overbought area as only by that will the market reverse to 1.1996 and 1.1972.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română