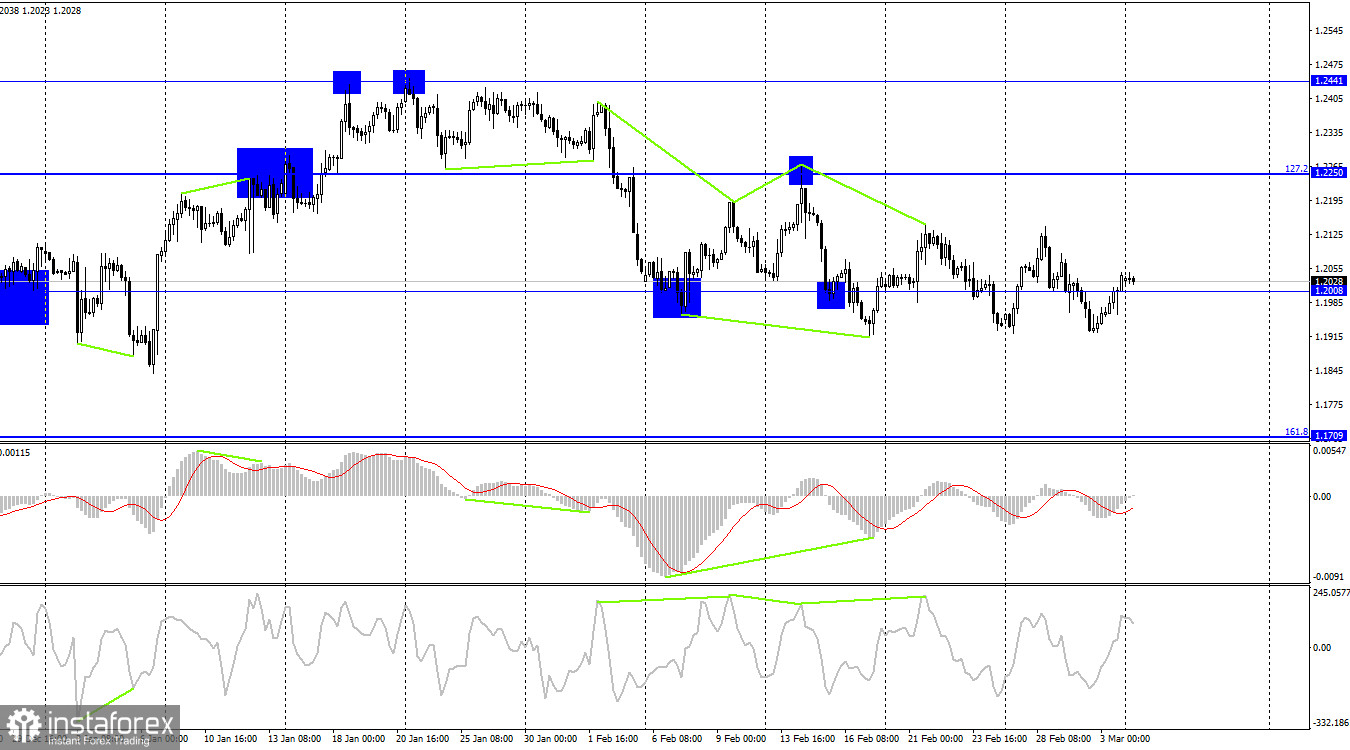

The GBP/USD pair continued to rise on Friday after recovering from the side channel's lower line, according to the hourly chart. The growth process may continue in the direction of the upper line of the corridor and the corrective level of 127.2% (1.2112). The pound's future will depend on whether it fixes above or below the channel.

The UK's services sector business activity index was published on Friday. It increased to 53.5, immediately surpassing the mark of 50.0. Right from the start of the day, the British pound was positively charged. Although it lost 0.1 points, the ISM business activity index in America attempted to lower its mood, which nevertheless turned out to be fairly positive. However, the strong growth of the US dollar has not occurred, and the upcoming week will have a wide range of events and reports, giving traders hope of breaking out of the horizontal corridor.

The most intriguing reports will be released in the UK on Friday. A report on the GDP and industrial production is one of them. The British economy is attracting more traders' attention since it is in a pre-recessionary stage, which is what the Bank of England needs to continue raising interest rates. Therefore, the interest rate has a significant impact on the value of the British pound. In America, two of Jerome Powell's speeches will be delivered simultaneously, and important reports on the labor market and unemployment will be made public. The reports won't be weak, and I think Powell's rhetoric will take on a new "hawkish" tone. The US dollar might take a big step forward this week to break out of its downward trend. There are, however, a variety of other options. The pair might stay in the side channel for a few more weeks if the reports from Friday are negative or neutral. Just the index of business activity in the UK services sector will be announced on Monday, which could affect traders' moods.

On the 4-hour chart, the pair displayed another reversal in favor of the pound, but lately, market reversals have become rather prevalent. The 1.2008 level is rarely noticed by traders. There are no new divergences in the making. No trend line or corridor exists. The scenario is rather intricate, so I encourage you to focus more on the hourly chart analysis, even though not everything is yet evident.

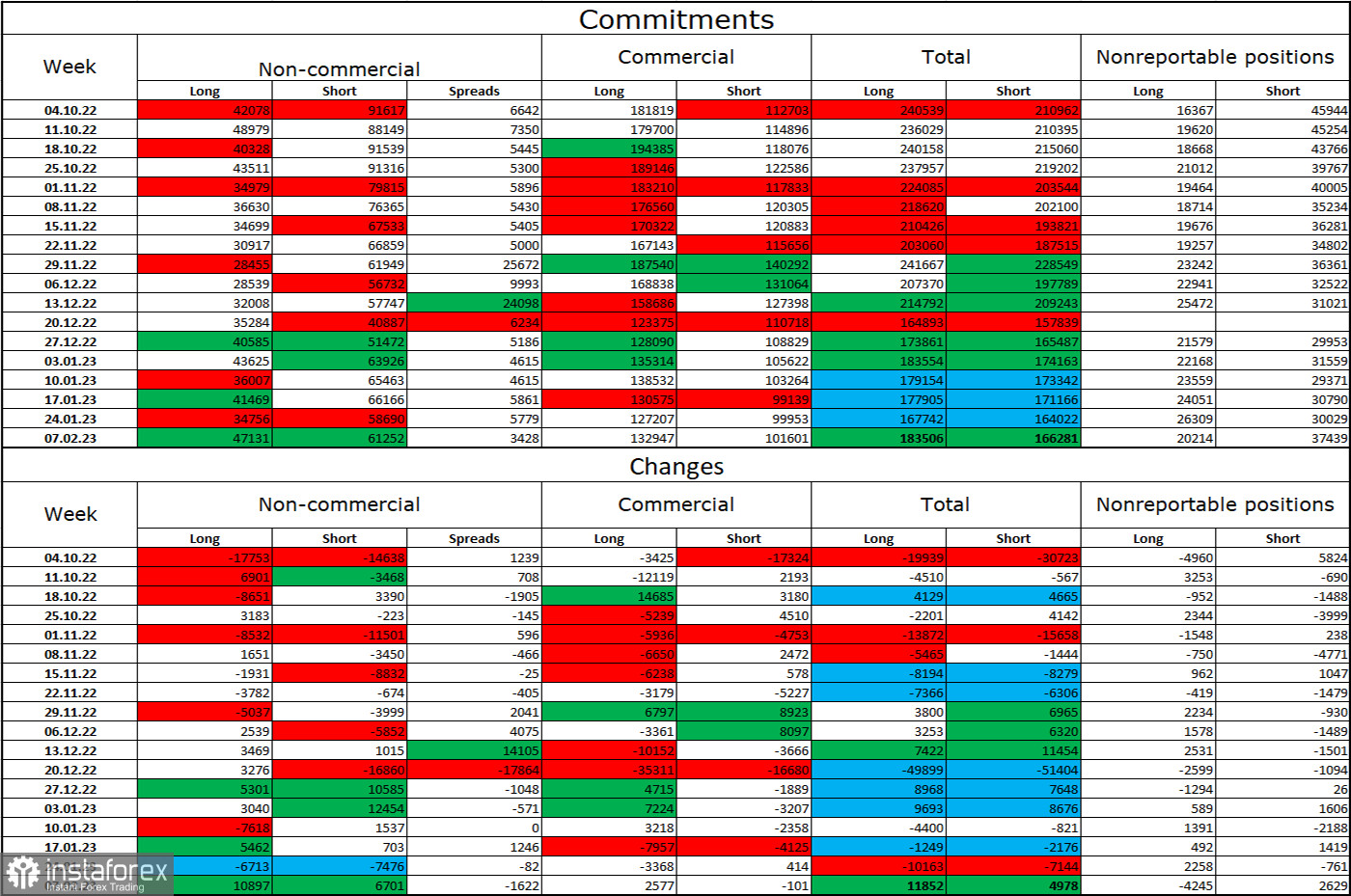

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "non-commercial" category was less "bearish" than it had been the previous week. But, since the CFTC has not released any new reports, we are currently discussing reports from a month ago. Speculators now hold 10,897 more long contracts than short contracts, a difference of 6,701 units. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound during the last several months, although the difference between the number of long and short positions held by speculators still exists. Consequently, the pound's prospects remain dismal, but the British pound is not eager to decline and is instead concentrating on the euro.

The three-month upward corridor on the 4-hour chart had an exit, and the dollar can now be supported at this time. On the hourly chart, though, you must still exit the side corridor to accomplish this.

The following is the UK and US news calendar:

US – index of business activity in the construction sector (09:30 UTC).

The calendars of economic events in the UK and the US only have one entry for Monday. The information background may not have much of an impact on traders' attitudes for the remainder of the day.

Forecast for GBP/USD and trading advice:

On the hourly chart, I suggest new sales of the pound when it closes below the level of 1.1920 (the lower line of the corridor), with targets of 1.1883 and 1.1737. As the price of the pair rose over the level of 1.1920 with a target of 1.2112, buyers might enter the market. Now, these deals can be kept.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română