The cryptocurrency market ended the previous week with a sharp bearish breakdown of the $23k level. Subsequently, the buyers managed to stop the fall near the $22k level, however there was no significant absorption of bearish volumes.

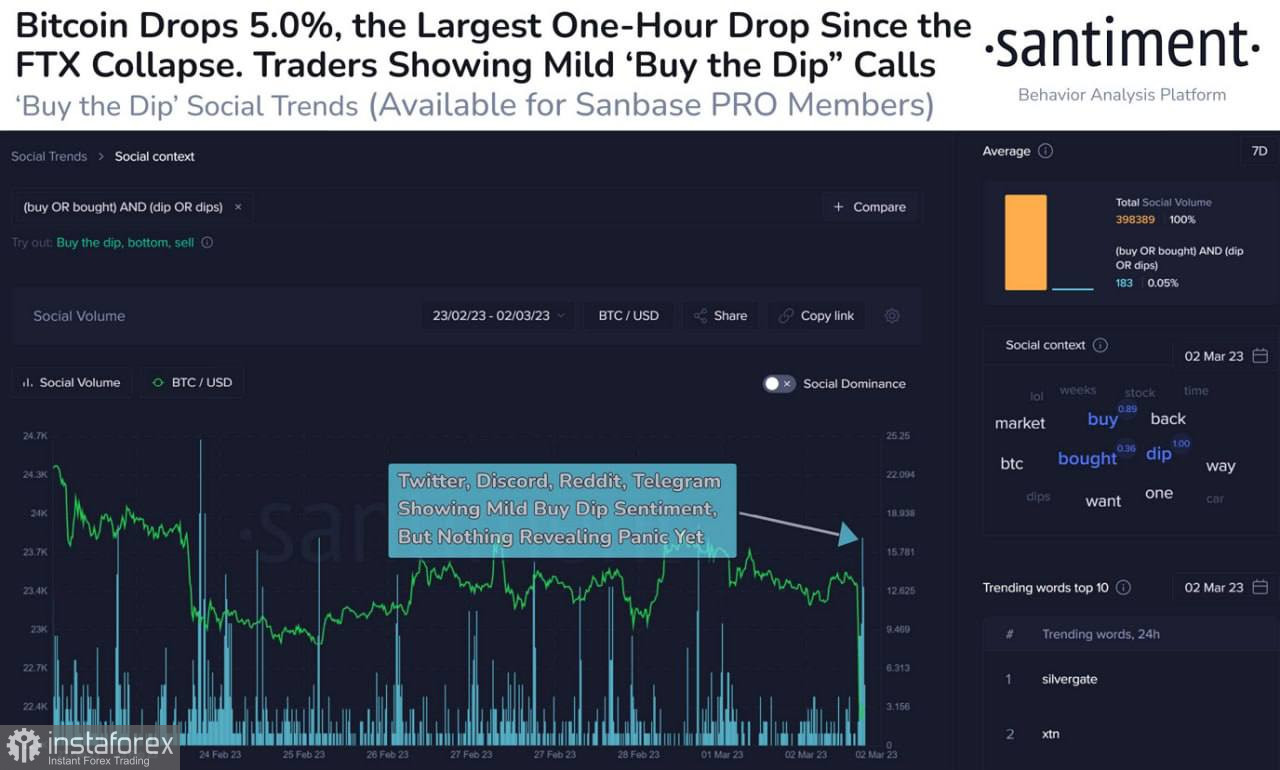

Santiment analysts note that during the fall of the crypto market on Friday, there was no panic among BTC investors. According to the social media sentiment, there were "buy the dip" signals on the crypto market, which also did not lead to a significant change in the situation.

The fall of the cryptocurrency market and Bitcoin is associated with the financial problems of the crypto bank Silvergate. According to the latest information, the company has decided to close its own crypto platform. The Silvergate situation heightened investor concerns, but was not a key component of the market crash.

Fundamental Factors

One of the key catalysts for the collapse of the crypto market was the Fed's quantitative easing policy. As of March 6, the rate of QT liquidity withdrawals was equivalent to a 0.5%–0.75% key rate hike.

As a result, the investment opportunities of large players are significantly reduced, and savings are preferred. In this regard, there is growing interest in the U.S. dollar and Treasury bonds, which show high yields.

Clouds continue to gather over the S&P 500 index, which showed a 28% drop in fourth-quarter GAAP earnings. As of March 6, there is no mass sell-off in the stock market, but a situation similar to the fall of 2022, when DXY stifled gains in BTC and SPX, could be on the horizon.

The S&P 500 index ended the previous week with the formation of the second confident bullish candle in a row. Technical indicators of the asset also confirm the preservation of bullish dynamics, but there is little room for growth in the SPX.

BTC/USD Analysis

A bullish end for the SPX last week could give BTC the momentum it needs to re-consolidate above $23k. Over the weekend, trading activity around the first cryptocurrency decreased significantly, and the asset moved near the $22.4k level.

Technical indicators do not show clear signals for a possible resumption of the upward movement. The situation may change with the opening of the American markets, and until then, the asset continues to move in a flat without prerequisites for impulsive price changes.

The BTC hash rate for the last two days increased by 12% to the level of 400 EH/s, which in most cases, is a prerequisite for the upward movement of the cryptocurrency. There has also been a decline in BTC supply on exchanges to 2017 levels, which reduces pressure on the price.

Results

Considering the current situation on the market, we should expect an increase in BTC trading activity and the development of an upward movement by analogy with the SPX index. Among the nearest targets, it is worth highlighting the $23k level, which is a psychological frontier for investors.

Further, the asset will continue to approach the $23.8k–$24.4k area, the breakdown of which is the main condition for the resumption of movement at $25k. If we consider the situation over a longer period, then there are no visible reasons for the development of an upward trend in BTC as of March 6.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română