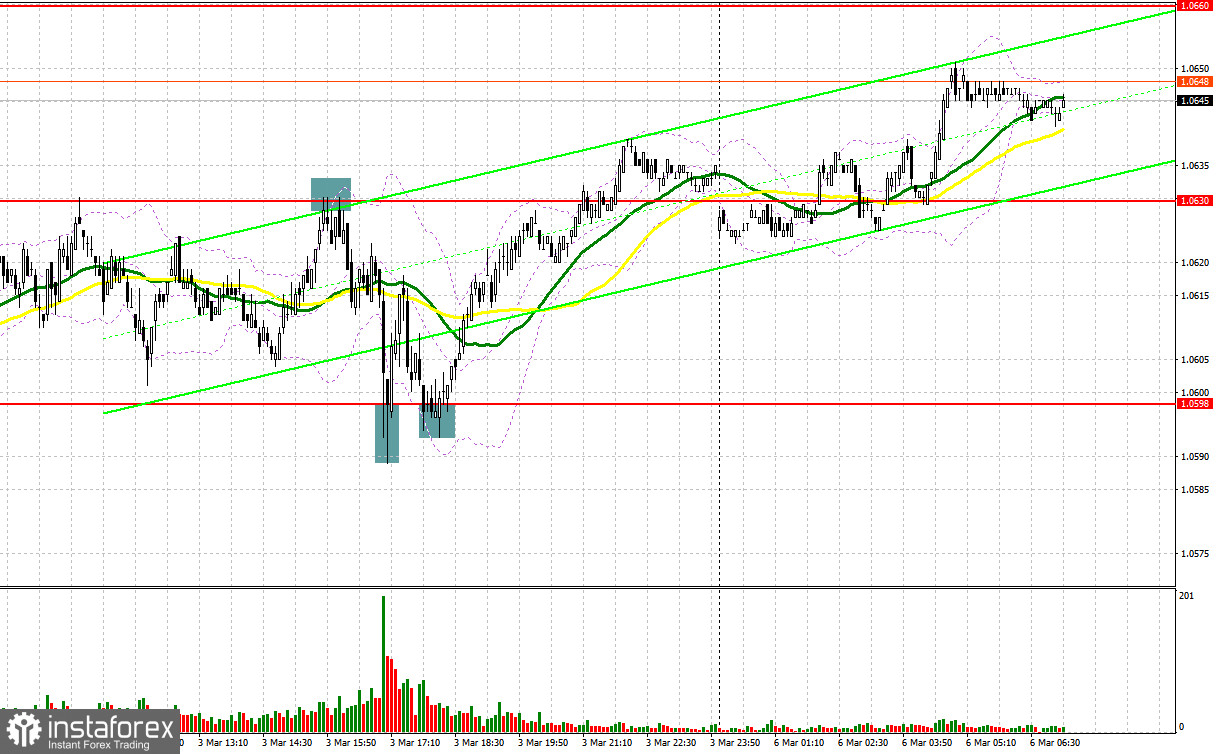

On Friday, traders received several perfect signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 1.0630 to decide when to enter the market. A rise and a false breakout of this level led to a sell signal. As a result, the pair dropped by 30 pips to 1.0598. In the second part of the day, one more false breakout of this level formed a perfect sell signal, which allowed traders to earn another 30 pips.

Conditions for opening long positions on EUR/USD:

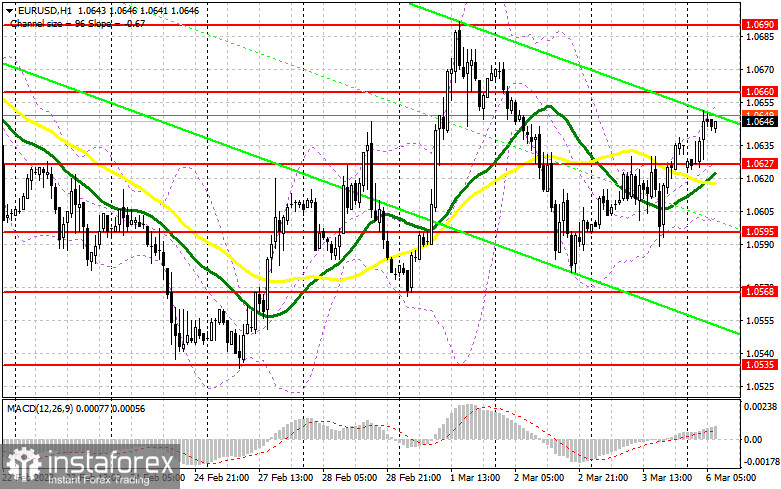

At the beginning of the week, the euro may jump. In the first part of the day, the currency will hardly face pressure. The fact is that today, Germany will disclose its construction PMI figures and the eurozone will publish the retail sales data for January. These reports are unlikely to affect the euro. Apart from that, Member of the Executive Board of the ECB Philip Lane is going to deliver a speech that will hardly cause a sell-off of the euro. That is why in the first part of the day, bulls should protect the nearest support level of 1.0627 formed on Friday. The key target of the recovery process is located at 1.0660, a new resistance level. A breakout and an upward test of this level amid strong data from the eurozone will give a long signal with the target at 1.0690 where bulls may face obstacles. A breakout of this level will affect sellers' stop orders, thus giving a new long signal with the target at 1.0731, where it is better to lock in profits. If the pair tests this level, a new bullish trend could be formed. If the euro/dollar pair declines and buyers fail to protect 1.0627, where there are bullish MAs, pressure on the pair will return. A breakout of this level will lead to a decline to the next support level of 1.0595. Only a false breakout of this level will give a buy signal. Traders may go long just after a bounce off the low of 1.0568 or even lower – at 1.0535, expecting a rise of 30-35 within the day.

Conditions for opening short positions on EUR/USD:

On Friday, sellers made several attempts to support the bearish sentiment but all in vain. Today, traders should avoid selling the asset until they see a test and a false breakout of the new resistance level of 1.0660. In the event of this, the euro may drop to the intermediate support level of 1.0627. A breakout and a reverse test of this level will give an additional sell signal with the target at 1.0595, which will revive the bearish sentiment. A settlement below this range may spur a more considerable drop to 1.0568, where it is better to lock in profits. If the euro/dollar pair increases during the European session and bears fail to protect 1.0660, traders are better to avoid selling until the price touches 1.0690. There, it will be possible to go short after an unsuccessful settlement. Traders may also open short orders just after a rebound from the high of 1.0731, expecting a decrease of 30-35 pips.

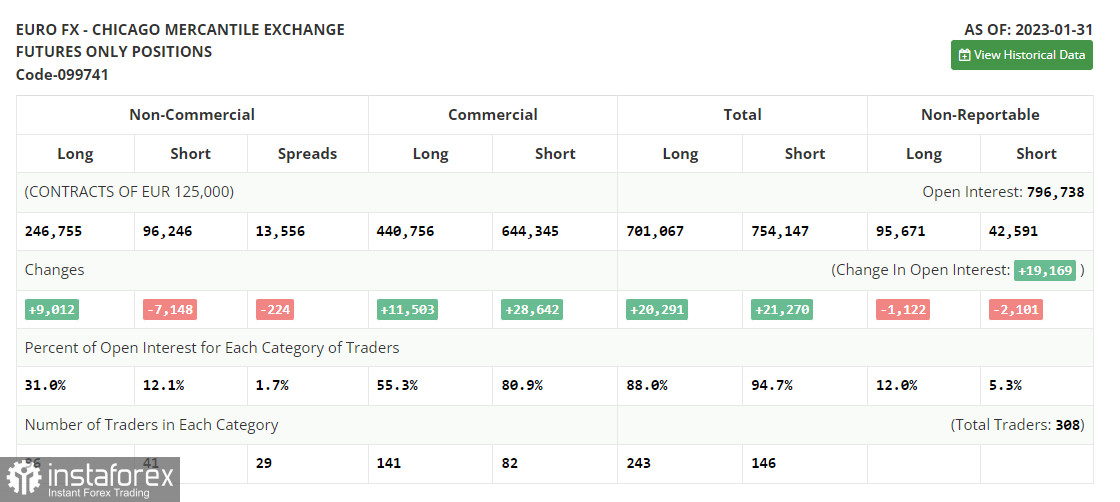

COT report

According to the COT report for January 31, the number of long positions increased, whereas the number of short ones dropped. It is obvious that this happened before the Federal Reserve and the European Central Bank announced their decisions on the key rates. In fact, the COT data from a month ago is of little interest now because of a technical problem in the CFTC that has been recently settled. This week is not rich in macroeconomic events. Therefore, the pressure on risk assets may ease somewhat, thus causing a correction in the euro/dollar pair. According to the COT report, the number of long non-commercial positions climbed by 9,012 to 246,755, whereas the number of short non-commercial positions dropped by 7,149 to 96,246. Consequently, the non-commercial net position came in at 150,509 versus 134,349. The weekly closing price fell to 1.0893 from 1.0919.

Signals of indicators:

Moving Averages

Trading is performed slightly above the 30- and 50-day moving averages, which points to bulls' attempts to regain control over the market.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.0595 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercia traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română