Considering the latest UK final services PMI, there was nothing surprising about the pound's growth on Friday. While earlier estimates showed growth from 48.7 to 53.3 points and the composite index from 48.5 to 53.0 points, the final data showed growth to 53.5 points and 53.1 points, respectively. The situation is somewhat different in the United States, and while according to preliminary estimates the services PMI increased from 46.8 points to 50.5 points, and according to the final data to 50.6 points, the composite index increased from 46.8 points to 50.1 points. The preliminary estimate, however, showed growth to 50.2 points. In other words, the UK indicators turned out to be better than expected, while in the US, one was better and the other one was worse. However, the difference was so small that it couldn't justify the pound's growth by almost a hundred points.

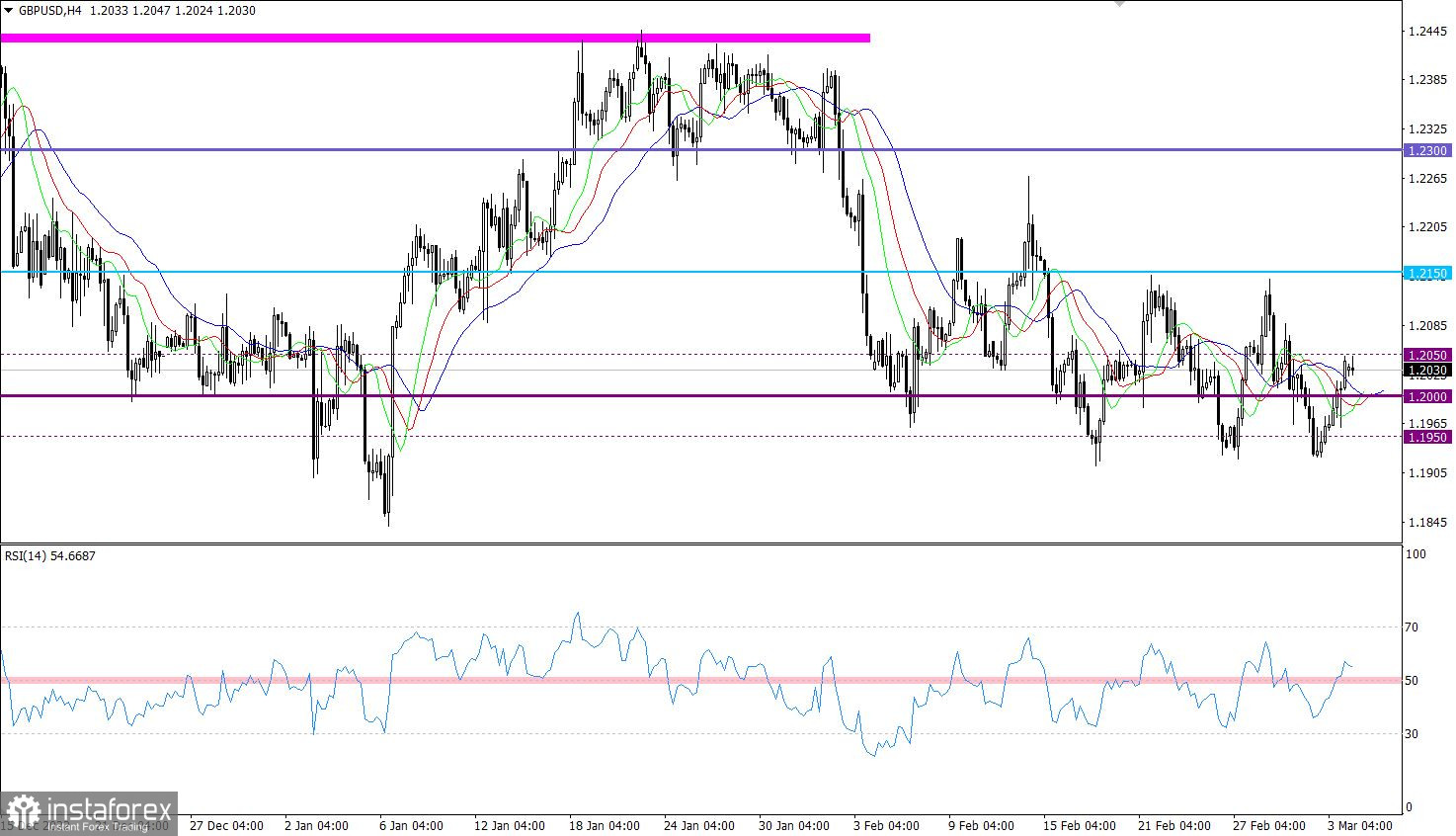

The pound started to rise after it hit 1.1950. In the last two weeks, the pound rose steadily twice more just from these values. It continued to rise until it approached 1.2150. It turns out that this was all due to purely technical factors. Generally, it is reasonable, because fundamentally, the situation in the market remains unchanged. Investors are waiting for the central banks' decisions on interest rates, and an update on their further actions. Macro data has its own adjustments, but are quite insignificant, because changes in interest rates are much more important.

Based on this, the next possible outcome is that the pound will continue to rise until it reaches the 1.2150 mark, after which there should be a reversal.

By the end of last week, the GBP/USD pair rebounded from the lower limit of the 1.1920/1.2150 horizontal channel. As a result, long positions had increased, which caused the price to climb above 1.2000.

On the four-hour chart, the RSI bounced from the lower limit of the flat and crossed the 50 middle line. This confirms bullish sentiment among traders.

On the same time frame, the Alligator's MAs are intersecting each other, which corresponds to a flat.

Outlook

Based on the price fluctuations, we can observe that the flat persists. Keeping the price above 1.2050 may strengthen the bullish sentiment, which will open the way towards the upper limit of 1.2150.

However, in case the upward momentum slows down and the price falls below 1.1950, there is a risk of breakdown of the lower limit of the flat at 1.1920.

The complex indicator analysis unveiled that in the intraday and short-term periods, technical indicators are pointing to bullish sentiment since the asset bounced from the lower limit of the flat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română