On this freshly brewed Monday, Wall Street soared to new heights, with 3M and Goldman Sachs stocks rising in anticipation of crucial data on rising inflation and employment trends that will unveil the Federal Reserve's future steps.

All three major stock indexes experienced an upswing as investors absorbed remarks made by Fed Chairman Jerome Powell last Friday regarding the potential need for additional interest rate hikes to control monetary currents and rein in runaway inflation.

Currently, all attention is focused on the upcoming report on the Personal Consumption Expenditures (PCE) price index - a preferred inflation indicator for the Fed - set to be available to the public on Thursday, as well as employment data in the non-farm sector, which are expected to reveal their secrets by Friday.

"Powell demonstrated that the day had turned into a somewhat risky adventure due to his ability to avoid strongly worded assessments that could excite or dismay the market," emphasized Ross Mayfield, engaged in investment strategy analysis at Baird.

Rising Star Among Stars: Nvidia (NVDA.O) shares confidently gained 1.78%, becoming growth leaders in the S&P 500 index. Shares of this chip giant collectively surged by $31 billion.

Political Arena Update: Analyzing the report on wages in the non-farm sector of the US for August will be a high-priority task. Economist forecasts suggest the creation of 170 thousand new jobs in the US this month, slightly lower than the July figure of 187 thousand, and the unemployment rate is planned to remain at 3.5%. These numbers could indicate that the Federal Reserve's interest rate hikes are negatively impacting employers' demand for labor resources, even amid ongoing labor market tensions.

Giant mega-capitalization stocks didn't stay behind: Apple (AAPL.O) and Alphabet (GOOGL.O) stocks added 0.9% to their value.

The remarkable ascent of 3M (MMM.N) stocks: a sharp 5.2% rise followed the announcement of the conglomerate's preliminary agreement to pay over $5.5 billion to settle more than 300,000 lawsuits related to accusations of supplying subpar combat helmets to US military personnel.

A surge in Goldman Sachs (GS.N) stocks by 1.8% occurred after the successful completion of the sale of the investment advisory business to asset management firm Creative Planning LLC.

Radiance of the S&P 500 index: A 0.63% surge, reaching a height of 4433.31 points.

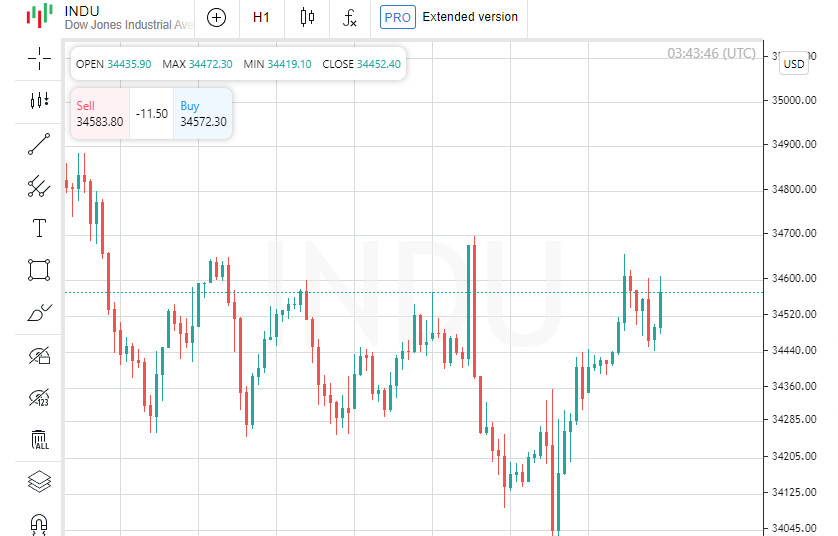

Skillful symphony of the Nasdaq: A 0.84% rise, reaching magical 13,705.13 points, while the Dow Jones Industrial Average added 0.62% to reach a magical 34,559.98 points.

Chinese stars in the American sky: US-listed Chinese companies, including JD.com, Baidu, and Alibaba, gained over 2% following China's decision to cut its stamp duty on stock trading in half starting Monday, in an effort to support its weakening market.

Harmonious conversation between Gina Raimondo and Wang Wentao: US Commerce Secretary Gina Raimondo expressed concerns about restrictions on American companies, including Intel and Micron, in a dialogue with Chinese Commerce Minister Wang Wentao. This conversation pushed Micron stocks up by 2.5%, and Intel stocks gained 1.1%.

Pause in a consequential clash: The US Federal Trade Commission temporarily suspended its review of Amgen's acquisition of Horizon Therapeutics for $27.8 billion. In response, Horizon stocks surged by 5.2%.

A wave of growth in the S&P 500 stock ocean: The ratio of advancing to declining stocks was an impressive 5.5 to 1.

Index evolution: The S&P 500 index set 10 new sparkling highs and 2 new lows; Nasdaq recorded 54 fresh peaks and 162 low points in its record.

Dance of volumes on US exchanges: Trading volumes were relatively moderate, with 8.1 billion shares traded compared to the 10.8 billion average over the previous 20 trading sessions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română