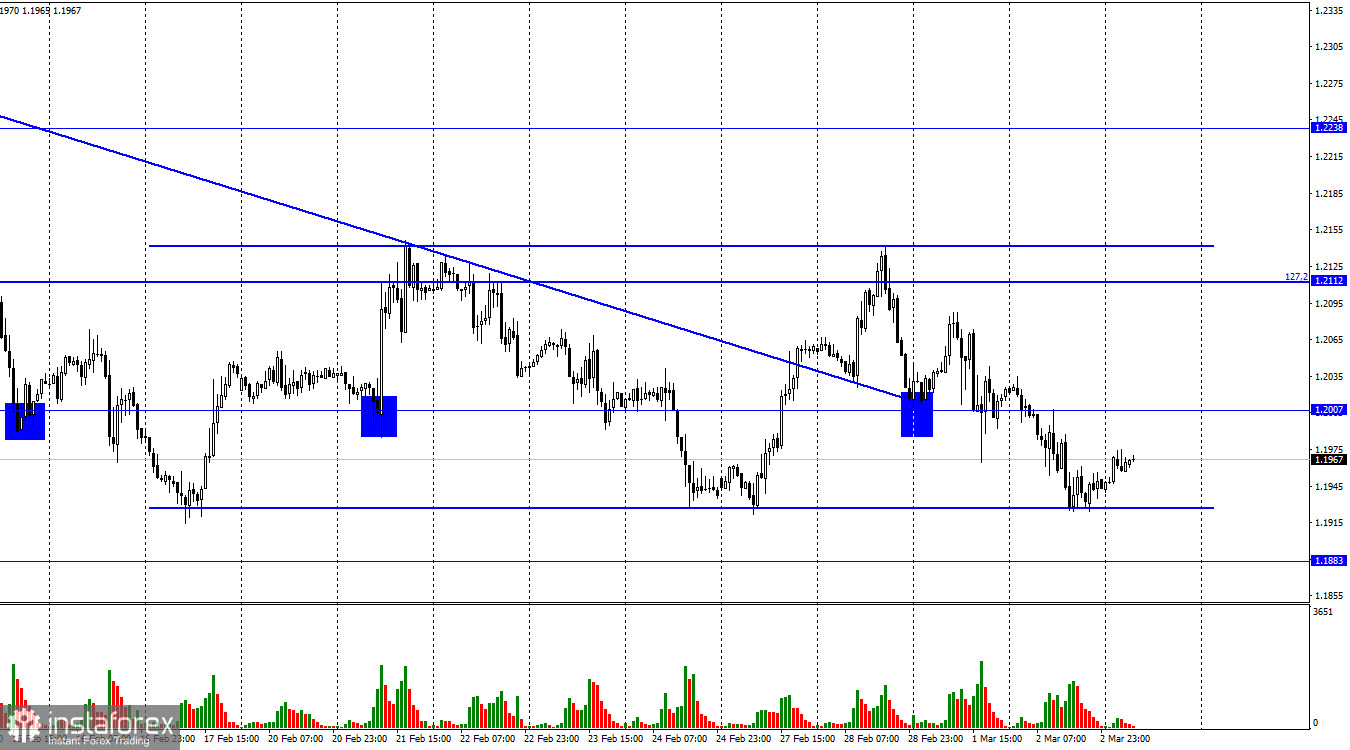

The GBP/USD pair kept falling in the direction of the side channel's lower line, which it had achieved earlier in the day, according to the hourly chart. The rebound from this line favored the British pound and signaled the start of growth, which can now be continued up to the corrective level of 127.2% (1.2112). The likelihood of additional falls will grow if the pair's rate is fixed beneath the side channel.

The British pound had a pretty boring day yesterday, but as we can see, traders were not. The horizontal movement of the pair is currently the main fundamental factor that traders should consider. Although there weren't many significant events this week, the background information is essential, and the British pound moved perfectly within the side channel. As a result, graphical analysis has taken precedence over the information backdrop. Today, on Friday, the UK will announce the index of business activity in the services sector, which may increase significantly (over 50.0), which will help the British pound begin new growth. Also, the rebound from the channel's lower line will properly complement this increase.

Yesterday, Bank of England Chief Economist Hugh Pill gave a speech. He said that economic growth is outpacing predictions and that private-sector wages are rising. Let me remind you that the Bank of England is having a very difficult time right now due to high rates of wage growth in addition to rising inflation. However, the regulator believes that rising wages will lead to more consumer expenditure, a slight shortage of goods and services, and a rise in inflation. But traders were uninterested in news of this magnitude, the pound found no support, and the current week will close with a significant ISM index in the United States. This week's ISM manufacturing data fell short of traders' expectations, but the service sector surprised them because practically every nation now has strong service sector numbers.

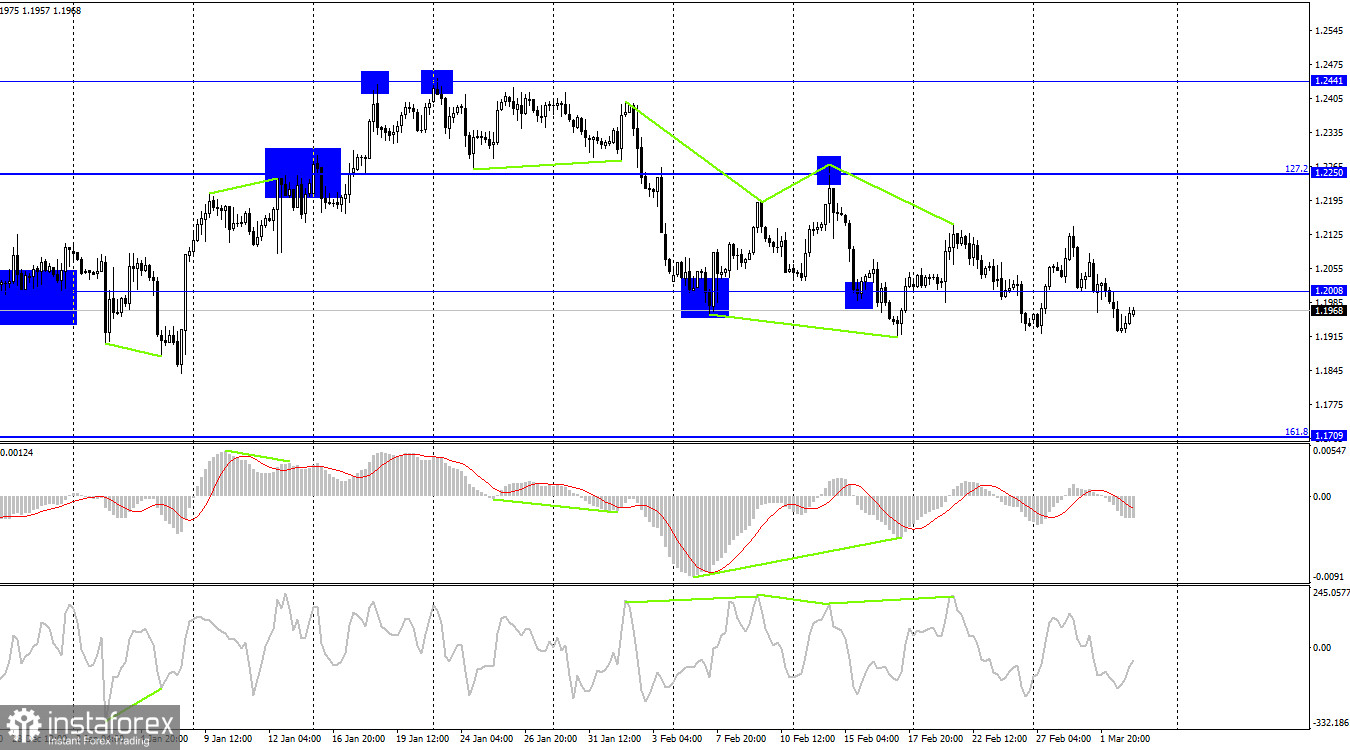

On the 4-hour chart, the pair displayed a new reversal in favor of the US dollar, but lately, market reversals have become a relatively common occurrence. The 1.2008 level is rarely noticed by traders. There are no new divergences in the making. No trend line or channel exists. The scenario is rather intricate, so I encourage you to focus more on the hourly chart analysis, even though not everything is yet evident.

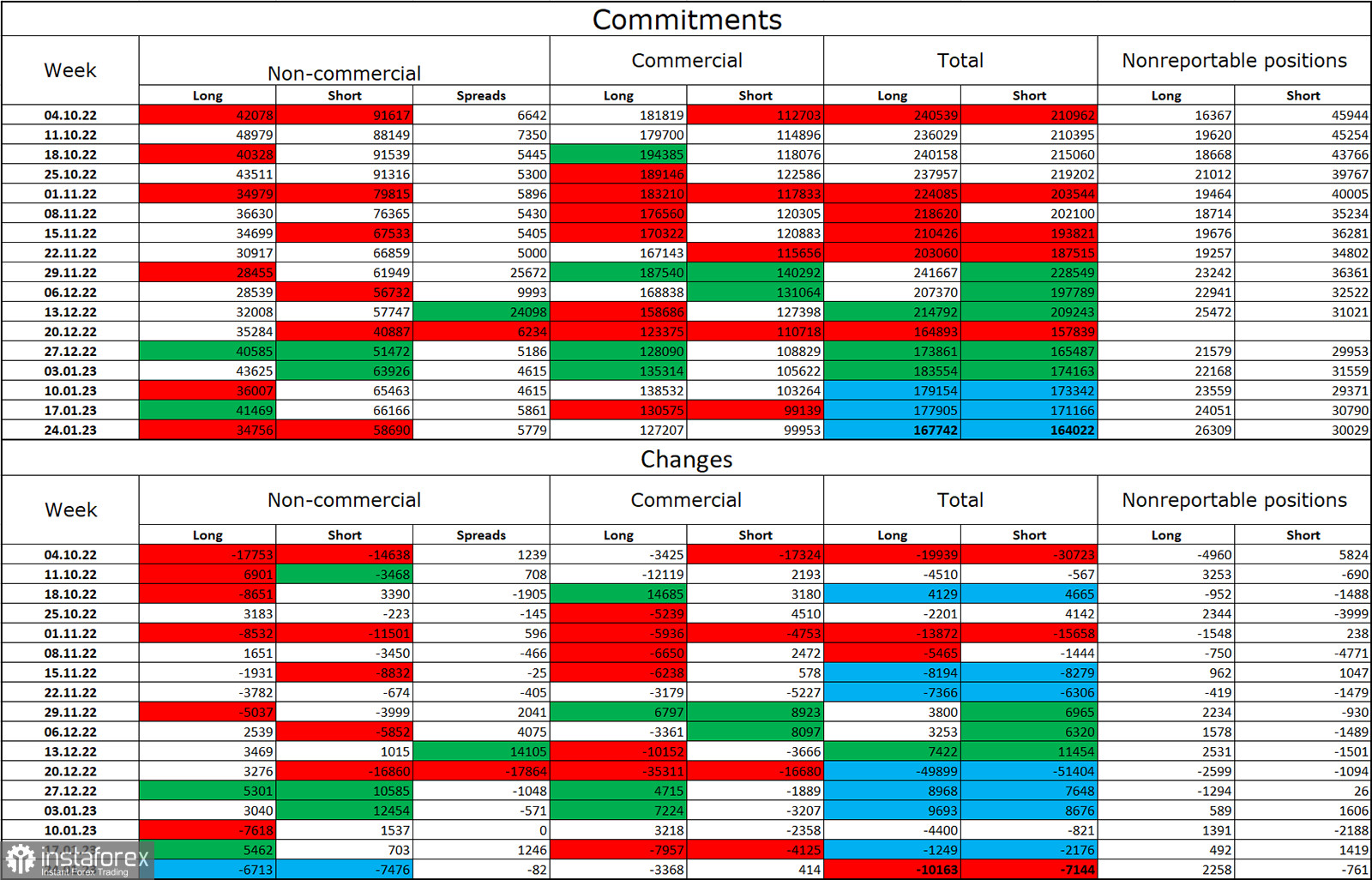

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short positions in the hands of speculators has nearly doubled once again. As a result, the forecast for the pound has once again declined, but the British pound is not eager to decline and is instead concentrating on the euro. An exit from the three-month ascending channel was visible on the 4-hour chart, and this development may have stopped the pound's growth.

News calendar for the US and the UK:

UK – index of business activity in the service sector (09:30 UTC).

US – business activity index (PMI) in the service sector (14:45 UTC).

US – ISM purchasing managers' index for the non-manufacturing sector of the USA (15:00 UTC).

The ISM index is a significant entry on Friday's calendar of economic events in both the UK and the US. Yet the British report could potentially have an impact on the pound. In the remaining portion, the information backdrop may have a weak to moderate impact on traders' attitudes.

Forecast for GBP/USD and trading advice:

On the hourly chart, I suggest new sales of the pound when it closes below the level of 1.1920 (the lower line of the channel), with targets of 1.1883 and 1.1737. With a target price of 1.2112, the pair may be bought when it recovers from the level of 1.1920.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română