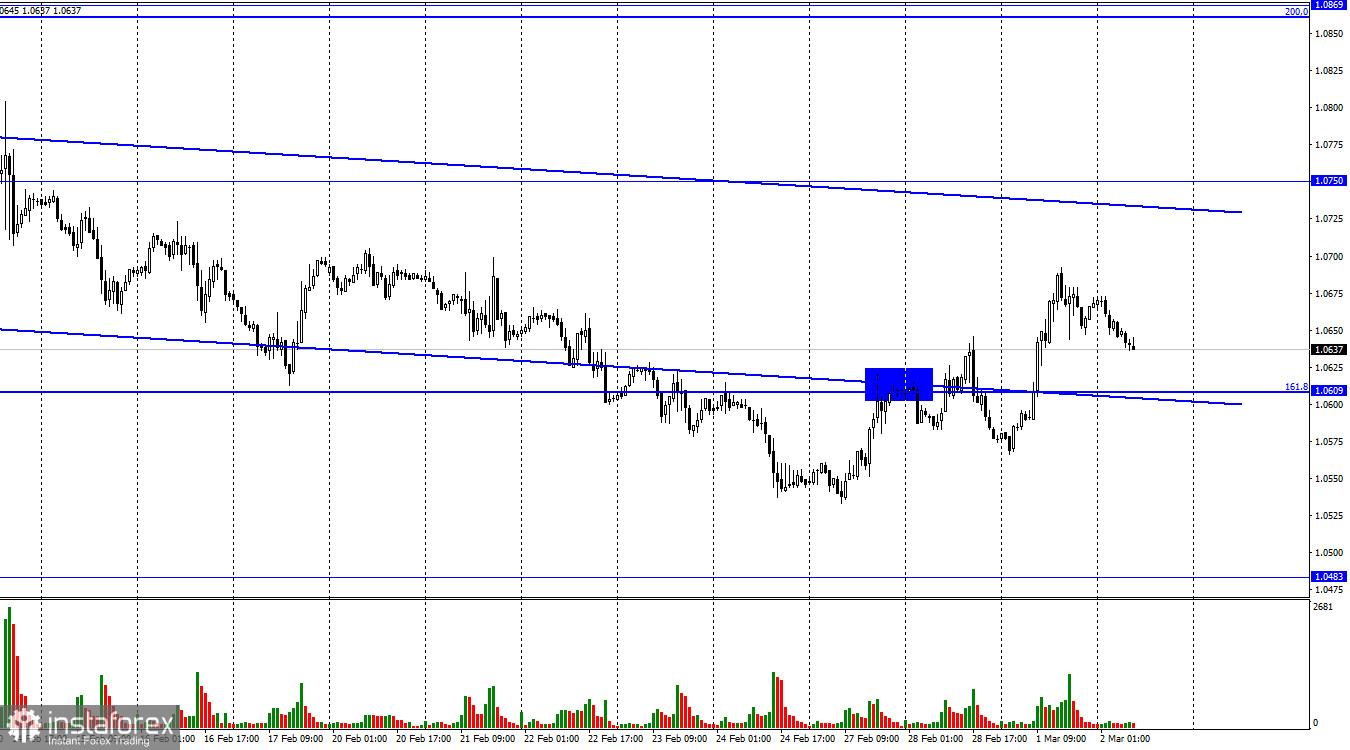

Hi, dear traders! On Wednesday, EUR/USD reversed upwards and continued to rise towards the upper boundary of the descending trading channel. This trading channel indicates that traders are bearish on the pair. If it settles below the retracement level of 161.8% (1.0609), it could then fall towards 1.0483.

Yesterday was a positive day for the euro and quite an interesting one for traders. Germany's inflation data for February disappointed European analysts. The consumer price index remained unchanged compared to January at 8.7%. It suggests the expectations of traders regarding the eurozone inflation are unrealistic. The EU inflation was forecasted to slow down to 8.3-8.4%. In my opinion, however, this forecast will not be fulfilled, and inflation will be higher than estimated. If it does match forecasts, we can still expect the consumer price index to stop falling in the coming months. The European currency has demonstrated some growth on this data, but this trend is unlikely to be long-lasting.

The main question now is how the ECB will react to the latest inflation data. The fact that the decline has slowed down should disappoint the European regulator and will definitely lead to new hawkish rhetoric. However, Christine Lagarde has already declared that the interest rate will rise by 0.50% in March, so we should not expect any other results from the March policy meeting. Meanwhile, inflation reports may surprise traders again before the May meeting. So far, the interest rate is expected to be hiked by 0.25% in May, but I believe it will be raised by 0.50% once again. Inflation in the EU remains objectively high, while its downtrend is also showing signs of slowing down.

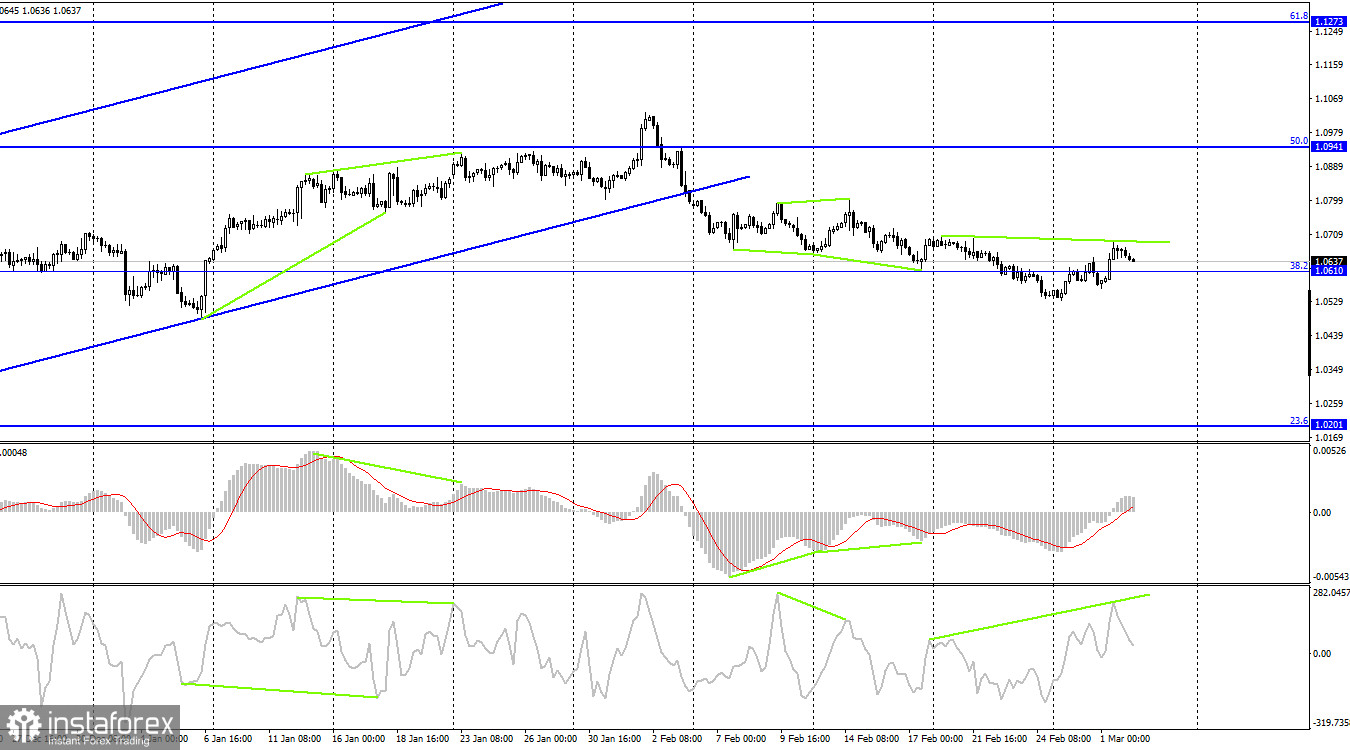

According to the H4 chart, the pair has settled below the ascending trend channel. It is very important for the pair, as it is now below the trade channel it has been in since October. Traders are now bearish on the euro, providing excellent upside opportunities for the US dollar with 1.0201 being the target. There is a bearish CCI divergence, which signals the pair could continue to decline soon.

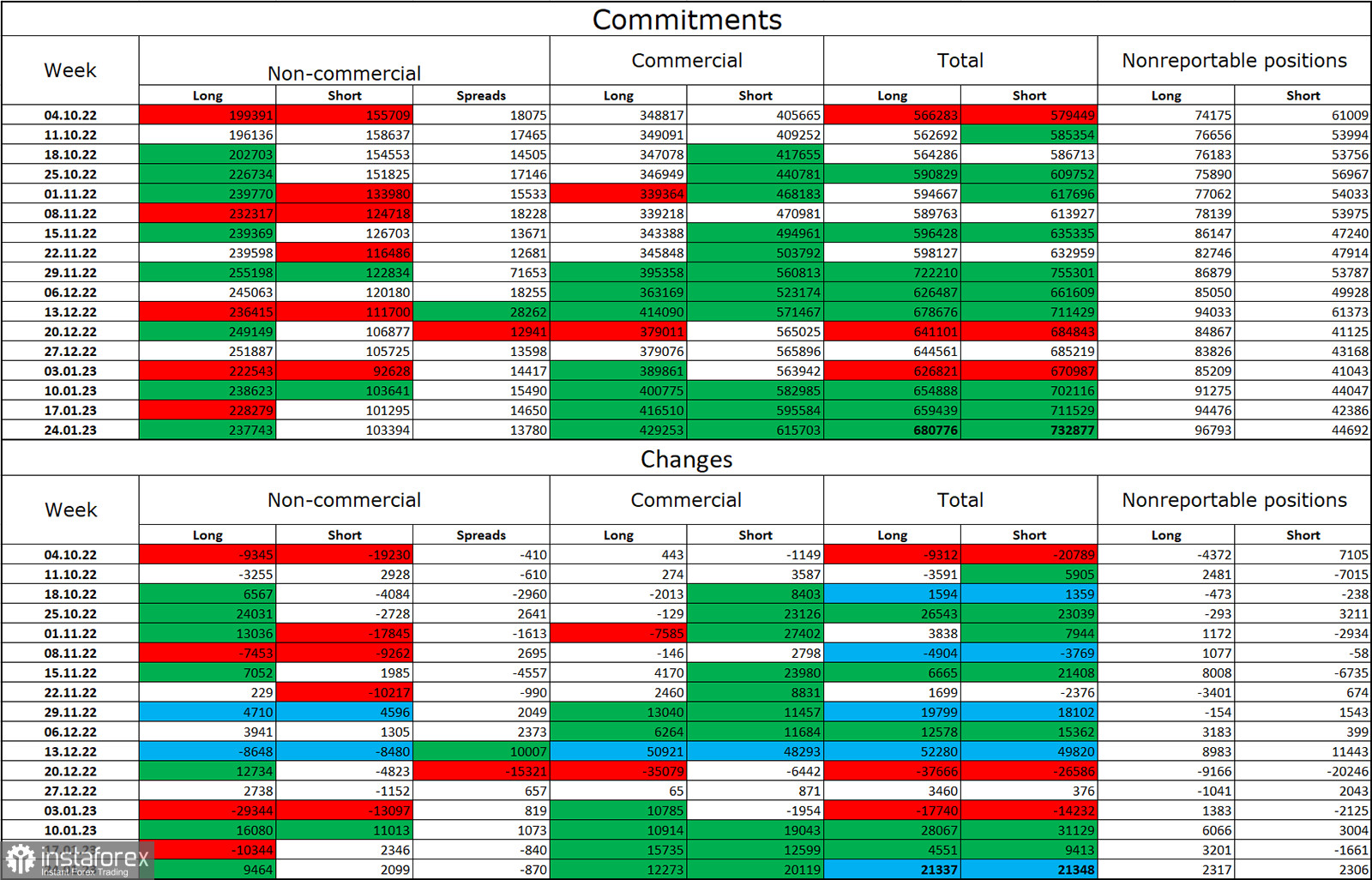

Commitments of Traders (COT) report:

Last week, traders opened 9,464 Long positions and 2,099 Short positions. The mood of large traders remains bullish and has slightly intensified. The total number of open Long positions is now at 238,000, while the number of open Short positions is at 103,000. At this time, the European currency continues to rise in line with the COT reports. However, the number of Long positions is almost two and a half times higher than the number of Short ones. Over the last few months the euro's upside potential has been constantly growing along with the euro itself, but the recent events have not always supported it. The situation remains favorable for the euro after a long period of losses, so its prospects remain positive, provided that the ECB keeps raising interest rates by 0.50%.

US and EU economic calendar:

EU – CPI report (12-00 UTC).

EU – ECB meeting minutes (12-30 UTC).

US – Initial jobless claims (13-30 UTC).

The key event of March 2 is the EU inflation data, which could moderately influence the sentiment of traders.

Outlook for EUR/USD:

New short positions can be opened if the pair closes below 1.0609 on the H1 chart targeting 1.0483, or bounces off the upper boundary of the descending channel targeting 1.0609. Earlier, long positions could be opened if EUR/USD closed above 1.0614 on the H1 chart targeting 1.0725. They can be held until EUR/USD closes below 1.0609, or closed immediately if the trade is profitable.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română