While bitcoin and ether are correcting before the next big sell-off, which I recommend to pay special attention to and which we will talk about in the technical analysis below, Robert Kiyosaki once again announced the impending collapse of the global economy.

Rich Dad Poor Dad author Robert Kiyosaki published his even more gloomy forecast and pointed to the collapse of the global economy. Rich Dad Poor Dad is a 1997 book co-written by Kiyosaki and Sharon Lechter. It has been on the New York Times bestseller list for over six years. The book has sold over 32 million copies in over 51 languages in over 109 countries.

Kiyosaki said yesterday that the global economy is on the brink of collapse, warning of risks that could hurt investors. He tweeted: "World economy on verge of collapse. Runs on banks next? Savings frozen? Bail-ins next?" He then urged investors to buy silver. "You can buy a real silver coin for about $25," he noted, adding that this is just his recommendation and he does not make money from it.

"I simply want you prepared for what is coming," Kiyosaki stressed.

During a financial crisis, depositors may panic and withdraw all their money at once, which can lead to a raid on banks and freezing of accounts. In addition, if a bank faces insolvency, it may impose a ban on depositor withdrawals to stay afloat. All of this could be financially damaging to investors.

Kiyosaki has spoken frequently about his distrust of the Biden administration, the Federal Reserve, the Treasury, and Wall Street. Earlier, he warned that the Fed's actions could destroy the U.S. economy and the dollar.

He has also repeatedly discouraged investing in stocks, bonds, mutual funds and exchange-traded funds (ETFs), and relies on bitcoin, gold, and silver, which he believes are the best investments in volatile times. He called gold and silver "God's money" and bitcoin "the people's money."

According to Kiyosaki, by 2025, the price of bitcoin will be $500,000, gold will rise to $5,000, and silver will confidently gain a foothold at around $500. This year, he expects gold to reach $3,800 and silver to $75. Kiyosaki has repeatedly noted that holders of gold, silver, and BTC will become richer when the Fed ends its tough policy and once again prints trillions of dollars. In January, he said the global economy was in recession, warning of skyrocketing bankruptcies and unemployment.

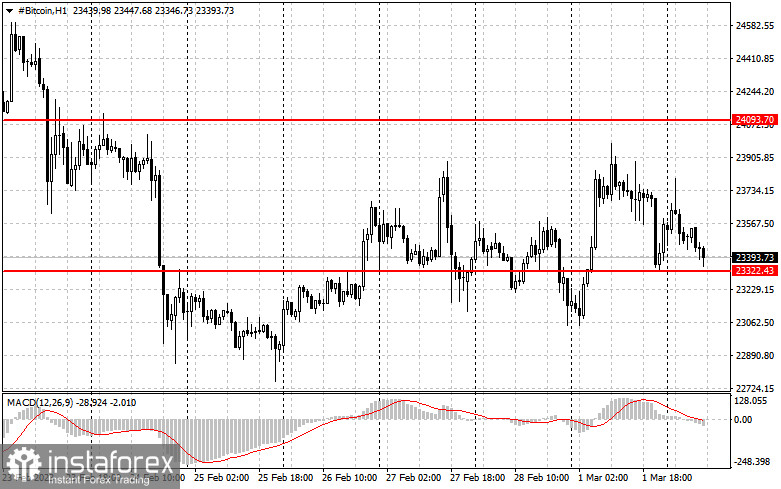

As for today's technical picture of bitcoin, demand for it remains rather sluggish. It will be possible to talk about seizing a new initiative by buyers only after fixing at $24,000. Only this will return the bullish trend with the prospect of updating $25,000 and $25,700. The farthest target will be $26,770, where a rather large profit-taking and a bitcoin pullback may take place. In case the pressure on the trading instrument returns, the focus will be on defending the $23,300 level. Its breakout by the sellers would be a blow to the asset. It will bring back the pressure on bitcoin, opening a direct way to $22,500. A breakdown of that level would "drop" the world's first cryptocurrency to the $21,700 area.

Ethereum buyers' focus is now on the breakdown of the nearest resistances of $1,640 and $1,680. It will be possible to continue the bullish trend only after completing this task, which will lead to a second spurt to the $1,730 area. Going beyond that will open the way to $1,820, which will return the balance on ethereum with an upside potential to $1,885. The more distant target will be the $1,950 area. If the pressure on the trading instrument continues, a drop to the $1,595 level will come into play. Continued decline to $1,554 will push the trading instrument to a low of $1,470.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română