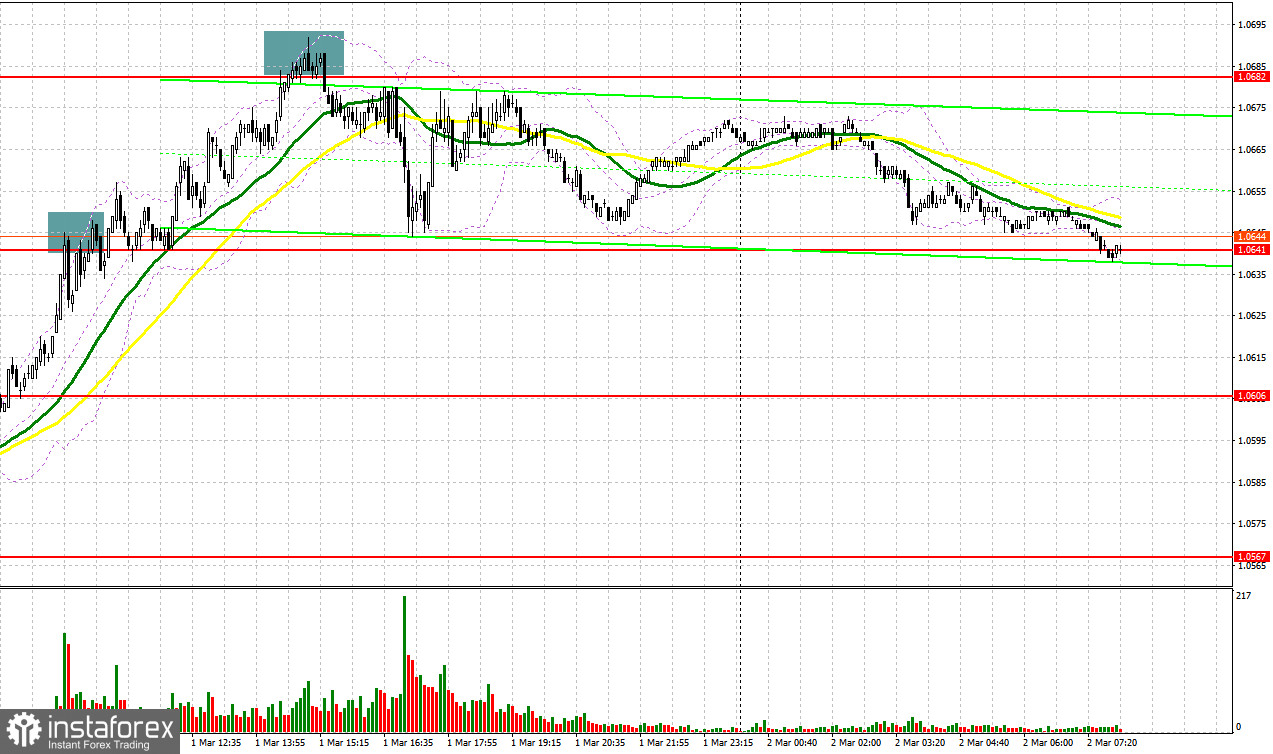

Yesterday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.0644 and recommended making decisions with this level in focus. Although I was betting on a recovery of the euro at the start of the month, I did not expect such a rapid rise. A false breakout of 1.0644 triggered a sell signal. I had to close Stop Loss orders. The pair did not decline lower. After a jump in the afternoon, the bears pushed the pair to 1.0682, which led to a false breakout and a sell signal. The downward movement totaled about 40 points. It helped traders recoup losses and made small gains.

When to open long positions on EUR/USD:

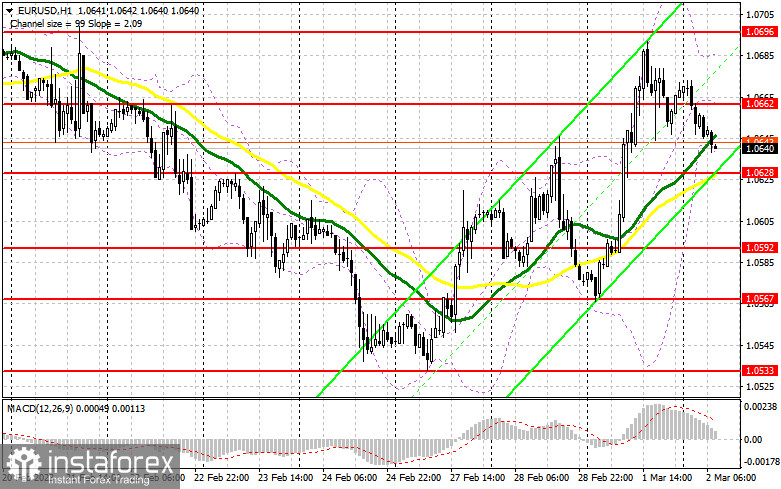

EUR bulls are now anticipating the Euro Area Consumer Price Index for February. They are largely focused on the Core CPI. If it rises, it will confirm the market's expectations that the ECB will raise key rates throughout the year. The eurozone unemployment rate data and the ECB meeting minutes will be of less importance to investors. They are now waiting for the speech of ECB Executive Board Member Isabelle Schnabel. If inflation in the eurozone does not decrease, we will see another attempt by bulls to push the euro to weekly highs. If the figure is in line with forecasts, a larger downward correction may take place. For this reason, it is better to buy after a decline near the support level of 1.0628 where the moving averages are benefiting the bulls. The target will be the resistance level of 1.0662, formed yesterday. A breakout and a downward retest of 1.0662 amid strong inflation data and a decrease in the unemployment rate will provide an additional entry point into long positions with a jump to a weekly high of 1.0696. It will be rather hard for the bulls to push the pair above this level. A breakout of 1.0696 will force bears to close Stop Loss orders. It will cause a shift in market sentiment. The pair may rise to 1.0731 where I recommend locking in profits. If EUR/USD declines and buyers show no activity at 1.0628 in the morning, the pressure on the pair will increase. A breakout of this level will trigger a drop to the support level of 1.0592. Only a false breakout of this level will give a buy signal. You could buy EUR/USD at a bounce from the low of 1.0567 or 1.0533, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

The sellers made an attempt to regain control. However, they are unable to undermine a bull market. Demand for the euro remains high amid expectations of a rise in inflation. Notably, consumer prices climbed in Germany. For this reason, bears are now weak. In the case of an increase, only a false breakout of the resistance level of 1.0662 will lead to a sell signal with the prospect of a decline to 1.0628. At this level, the moving averages are benefiting the bulls. A breakout and downward retest of this level will create a sell signal with a decrease to 1.0592, boosting the bearish sentiment. It may trigger a more significant drop to 1.0567 where I recommend locking in profits. If EUR/USD rises during the European session and bears show no energy at 1.0662, which will happen only amid inflation and labor market data, I would advise you to postpone short positions until a breakout of 1.0696. You could sell EUR/USD at a bounce from 1.0731, keeping in mind a downward intraday correction of 30-35 pips.

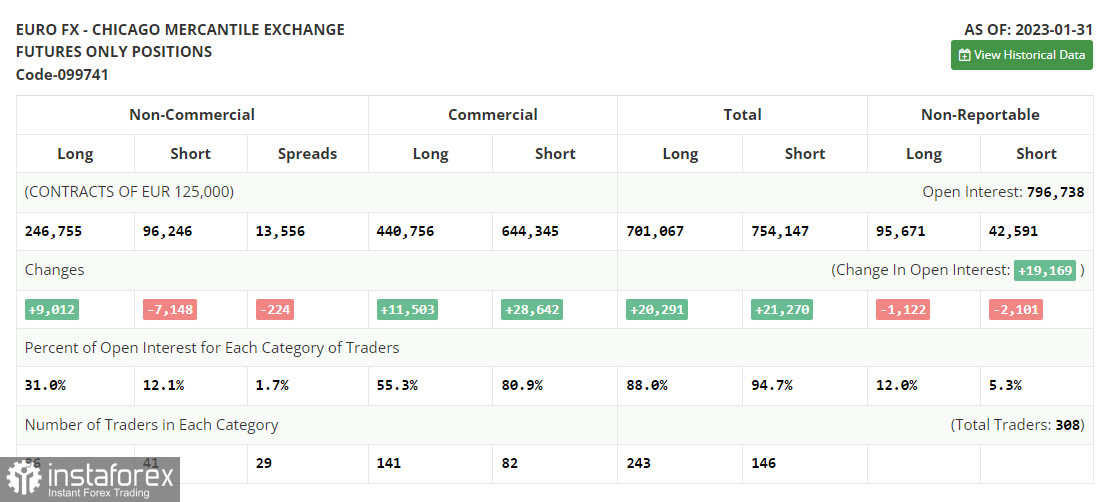

COT report

According to the COT report for January 31, the number of long positions increased, whereas the number of short ones dropped. It is obvious that this happened before the Federal Reserve and the European Central Bank announced their decisions on the key rates. In fact, the COT data from a month ago is of little interest now because of a technical problem in the CFTC that has been recently settled. This week is not rich in macroeconomic events. Therefore, the pressure on risk assets may ease somewhat, thus causing a correction in the euro/dollar pair. According to the COT report, the number of long non-commercial positions climbed by 9,012 to 246,755, whereas the number of short non-commercial positions dropped by 7,149 to 96,246. Consequently, the non-commercial net position came in at 150,509 versus 134,349. The weekly closing price fell to 1.0893 from 1.0919.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which indicates market uncertainty.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.0685 will serve as resistance. In case of a decline, the indicator's lower border at 1.0640 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română