Pound fell after Bank of England governor Andrew Bailey said that although further interest rate hikes are being considered, a final decision has not yet been made. He also presented a new inflation forecast, that is, a fall below 4.0% by the end of the year, which can hardly be called optimistic. This seems to hint that the central bank is not only preparing for the end of rate hikes, but also on the possibility of lowering them. The situation also prompted euro to fall in price.

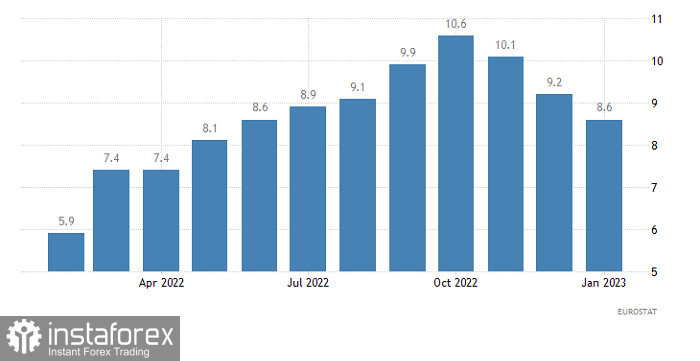

Today, it is likely that euro and pound will continue to decrease, as preliminary inflation data in the eurozone is expected to slow down from 8.6% to 8.4%. There is also the possibility of a more marked decline, that is, down to 8.2%.

Inflation (Europe):

EUR/USD was trading above 1.0650, but failed to hold on to new levels. As a result, there was a pullback, which will continue unless the pair manages to return above 1.0650.

GBP/USD is trading below 1.2000. Sentiment will shift if the pair holds below 1.1950 in the daily period. Until then, variable chattering along the psychological level is possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română