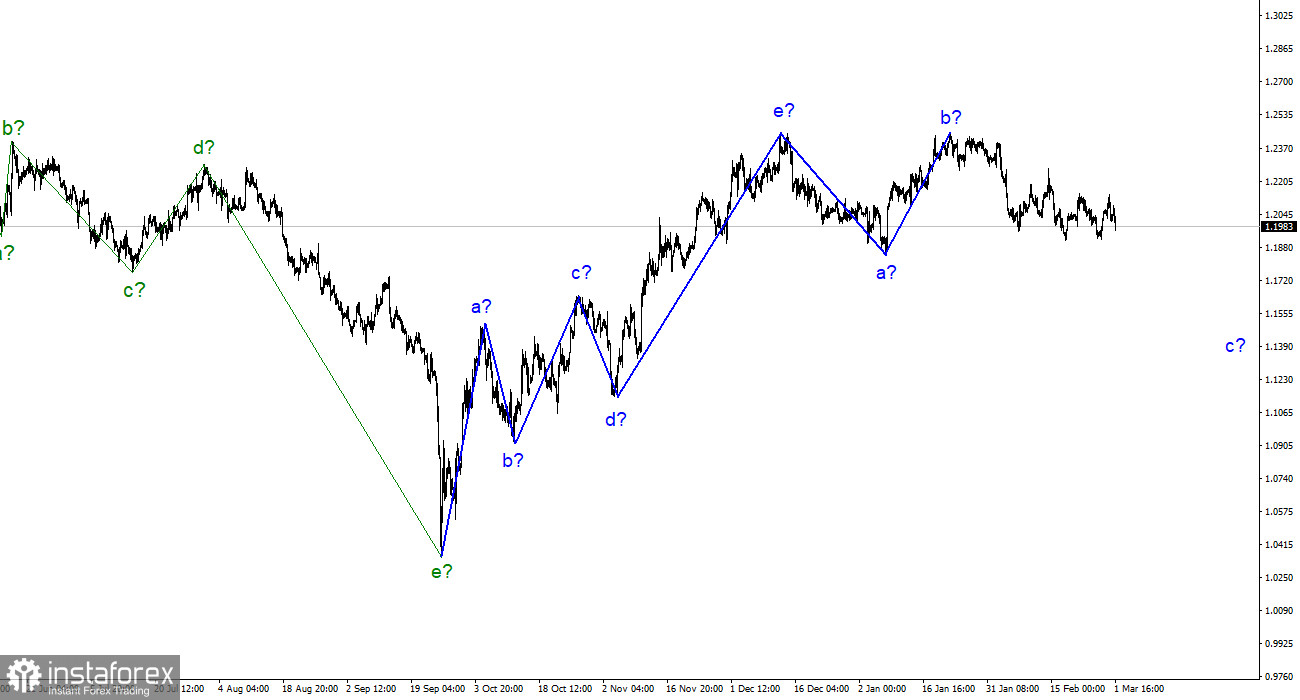

The wave analysis for the pound/dollar pair now appears to be challenging, but it does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the pattern a-b-c-d-e and is most likely already finished. I predict that the downward section of the trend has begun and will continue to develop, taking at least a three-wave form. Wave B appeared to be unnecessarily long, but it did not cancel. So, it is now anticipated that a wave has started to form with a downward trend section, the targets of which are situated below wave a's low. The price would be at least 300–400 points less than it is at the moment. Although it's too soon to speculate, I believe wave c may end up being deeper and that the entire downward section of the trend may potentially adopt a five-wave pattern. The instrument has long been on the verge of starting to build an upward trend segment again, and it wasn't until later that quotes began to move away from the peaks reached. Since wave c has not yet finished, the low of the assumed wave a has not yet been broken.

The US ISM index did not surprise sellers.

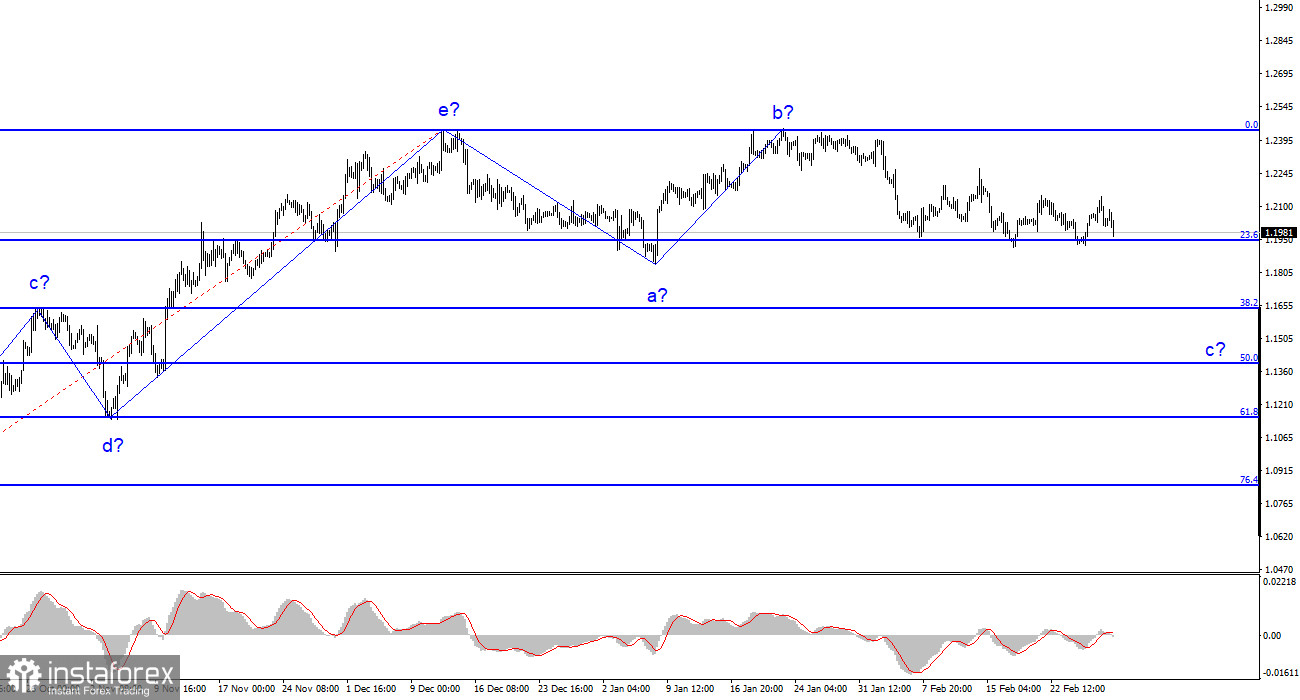

On Wednesday, the pound/dollar pair's exchange rate fell by only 15 basis points, but the day's amplitude was quite high. The difference between the movement of the euro and the pound today immediately attracts your attention. The pound fell for the majority of the day as the euro increased. This phenomenon is easily explained: the euro currency received market support in the form of a report on German inflation, which did not show a slowdown for the second month in a row, increasing the chance of an increase in ECB interest rates. Since the British pound had no such support, we saw the movement that we ought to have observed. From a wave perspective, the presumed wave c is created inside of a complicated structure that incorporates numerous small waves that are pointless to detect. The demand for the British pound should fall so that wave c can stop, and I can assume that the market is ready for new purchases. I believe the pair will decline as long as wave c doesn't update the low of wave a.

A key indicator of business activity in the ISM manufacturing sector was just made public in the US. The market had anticipated a rise to 48 points, but the actual increase over February was only 0.3 points. The market was unconcerned that the index was still below the critical level of 50.0. The demand for the dollar continued to rise in the afternoon. The report's main points haven't changed, and there wasn't much of a difference between expectations and reality (any value below 50 is considered bad). And to continue developing the wave c, the British pound requires data of a stronger nature. The pound's demand has hardly declined in recent weeks, threatening the present wave pattern's integrity.

Conclusions in general.

The development of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave c might be shorter in duration, but for the time being, I anticipate a minimum 300–400 point decline (from current levels).

The picture resembles that of the euro/dollar pair at higher wave scales, but there are still minor differences. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of Figure 15.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română