The EUR/USD pair rallied on Wednesday, rising more than a hundred pips in just a few hours. Such price dynamics were due to several fundamental factors.

Firstly, risk appetite increased on the back of strong PMI data published in China. Second, the euro strengthened its position due to hawkish comments from European Central Bank representatives. Thirdly, EUR/USD bulls took advantage of the situational weakness of the greenback: the US dollar index was actively declining during the day. The pair rose due to inflation growth in Germany. The release came out in the green zone, which seems to have baffled many market participants.

The Chinese miracle

The Purchasing Manager Index (PMI) of China's manufacturing industry rose 52.6, the strongest reading since April 2012. The index has been rising at a great pace for the second straight month, after months of consecutive declines.

China's service sector PMI rose to 56.3 points in February from 54.4 in January. The indicator has similarly risen strongly for the second straight month, reaching its highest level since March 2021.

Markets reacted accordingly: the MSCI AC Asia Index ex. Japan Index, Nikkei, Kospi, STI, Shanghai Composite and Hang Seng traded higher, while the greenback came under pressure (US dollar index did not stay within the 105th figure and already renewed its weekly low).

Inflation in Germany accelerated again

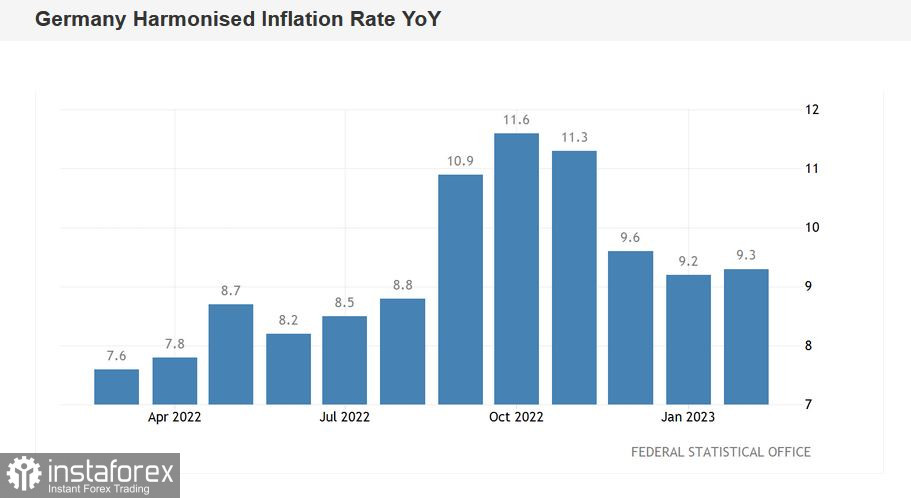

German inflation also supported the pair. All components of the report came out in the green zone. Take note that the previous release - the January one - was in the red. On an annualized basis, the overall consumer price index came out at 8.7% in January. The harmonized CPI (HICP) also fell short of expectations, both on a monthly basis (0.5% vs. the forecast of 1.2%) and on a yearly basis (9.2% vs. the forecast of 10.0%).

The February numbers, on the other hand, painted a slightly different picture. For example, the overall Consumer Price Index came in at 8.7% y/y, compared to the forecast of an 8.3% decline. On a monthly basis, the indicator also exceeded forecasts and stood at 0.8% in February, compared to a forecast of a 0.4% decline. The HICP, which the ECB prefers to use to measure inflation, rose to 9.3%, after climbing 9.2% in January. Most analysts had expected to see this indicator at 9.0%.

It is worth noting that German data quite often correlates with European data, so we can assume that the February inflation growth in the eurozone (release is scheduled for Thursday, March 2) may also surprise traders if it increases. Germany accounts for about a quarter of all price data used to calculate inflation in the eurozone. That's why traders are betting on the pan-European inflation report, opening long positions on the pair.

Here it is worth recalling the words of ECB President Christine Lagarde, who announced another rate hike in March (by 50 points) after the February ECB meeting, but questioned the further steps in this direction. According to some analysts, after March's 50-point hike, the ECB will lower rates to 25 points in May. Some experts also suggest that a 25-point hike at the May meeting could be the "final chord".

But if European inflation "rears its head" again, hawkish expectations for further ECB action will rise. Joachim Nagel, head of the Bundesbank, said that the ECB "may need to raise rates further significantly after March". He also reiterated the thesis that all talk of a rate cut as part of this year does not make sense until there is sufficient evidence that core inflation has fallen to the target level. Obviously, if inflation in the eurozone shows upward values (after months of downward movement), the representatives of the hawkish wing of the ECB will strengthen their positions considerably.

Conclusions

The pair's growth has a correctional nature and is caused not only by the inflation report, which was published in Germany. Other fundamental factors also supported the pair's bulls: the strong PMIs in China, hawkish comments of the ECB, increased risk appetite in the markets and the general weakening of the greenback. Therefore, if Thursday's eurozone inflation report disappoints, the bullish momentum will "deflate" - the initiative will be taken over by the EUR/USD bears. Therefore, it would be better to make trading decisions regarding the pair only after the report is published, which might "redraw" the current fundamental picture.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română