Euro reacted to the mixed data on manufacturing activity in the eurozone, while ignoring a negative labor market report from Germany, where the number of unemployed rose rather than declined as expected.

Pound, on the other hand, struggled to regain its weekly highs in the morning, but a decline in UK manufacturing activity in February proved unpalatable to speculative traders. Market volatility in the afternoon will be contingent on the ISM manufacturing activity report and statements by Fed officials. Expect a repeat of yesterday's situation, in which both euro and pound lost ground despite weak US data.

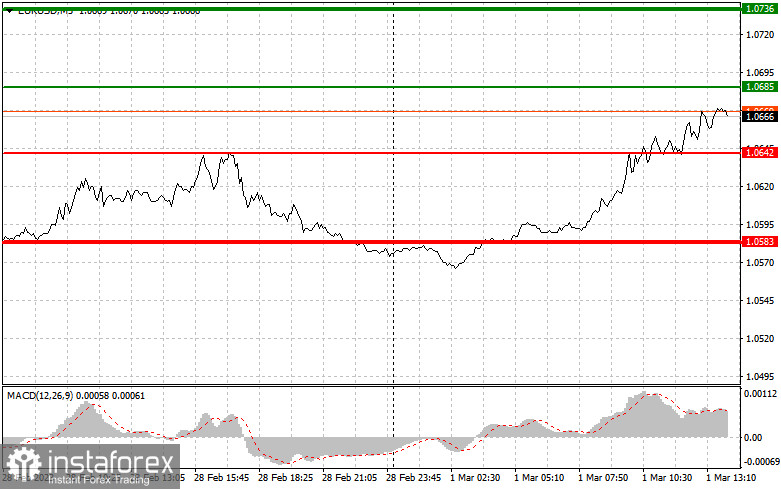

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0685 (green line on the chart) and take profit at the price of 1.0736.

Euro can also be bought at 1.0642, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0685 and 1.0736.

For short positions:

Sell euro when the quote reaches 1.0642 (red line on the chart) and take profit at the price of 1.0583.

Euro can also be sold at 1.0685, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0642 and 1.0583.

GBP/USD

For long positions:

Buy pound when the quote reaches 1.2067 (green line on the chart) and take profit at the price of 1.2127 (thicker green line on the chart).

Pound can also be bought at 1.2024, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2067 and 1.2127.

For short positions:

Sell pound when the quote reaches 1.2024 (red line on the chart) and take profit at the price of 1.1972.

Pound can also be sold at 1.2067, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2024 and 1.1972.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română