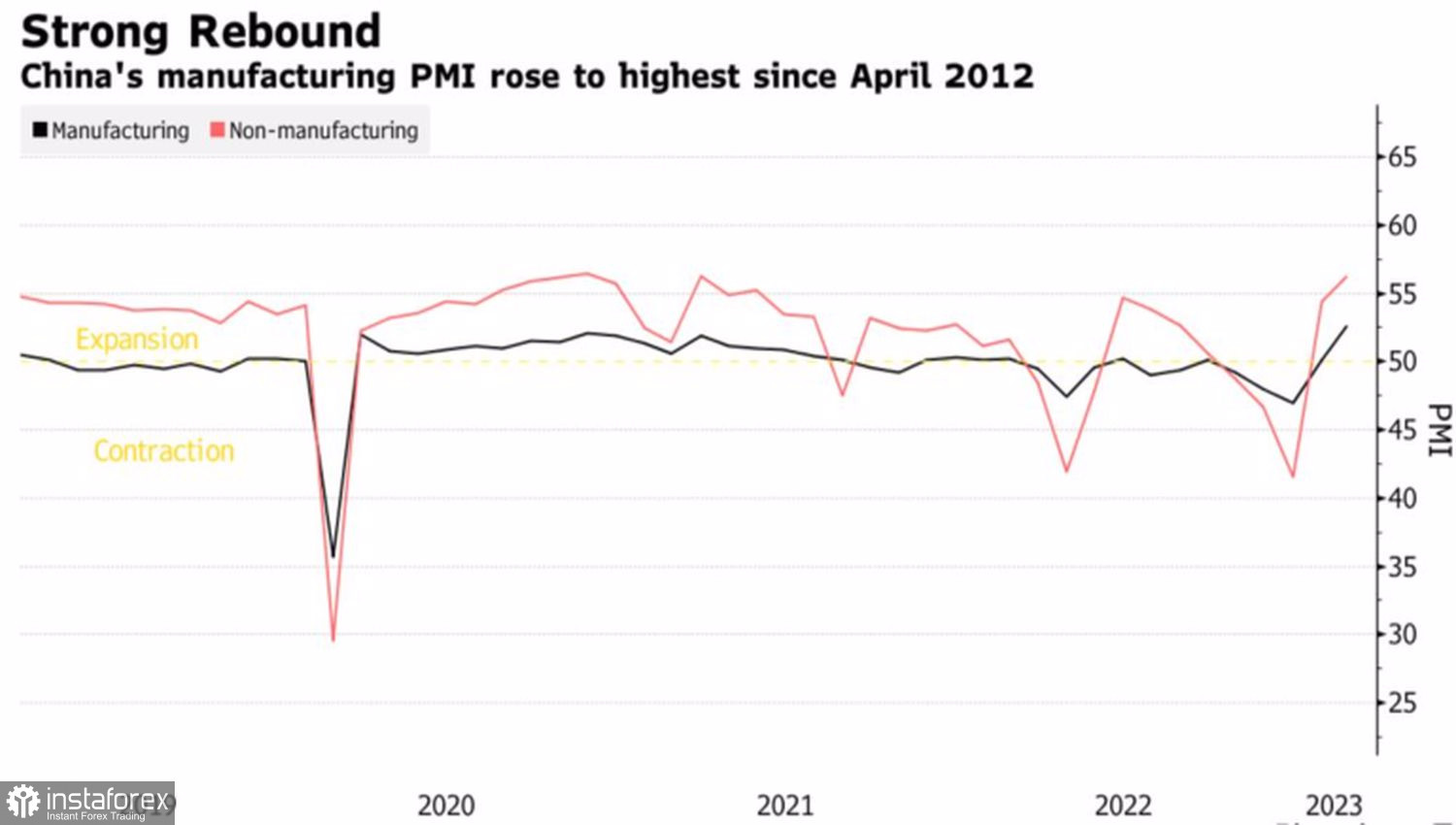

The strong data on Spanish and French inflation for February only temporarily raised the EURUSD quotes, but as soon as China's manufacturing PMI soared to 52.6, the maximum since 2012, the main currency pair again rushed to attack. According to Barclays, the euro may grow by 3%–4% against the U.S. dollar due to the reopening of the Chinese economy and the continuation of the ECB's monetary policy tightening cycle.

Dynamics of business activity in China

According to a Bloomberg insider, Chinese officials are pleasantly surprised at how the economic recovery is going. In their opinion, the peak of the COVID-19 pandemic was supposed to be in February–March, but, in fact, it happened in January, which opens the door for rapid GDP growth. If the economy was rocking at the end of winter, it will surely shoot in the spring, which is good news for the export-oriented eurozone. In addition, the IMF expects China to contribute 50% to global GDP growth. If the global economy expands rapidly, it fuels global risk appetite and promotes the sale of safe-haven assets, including the U.S. dollar.

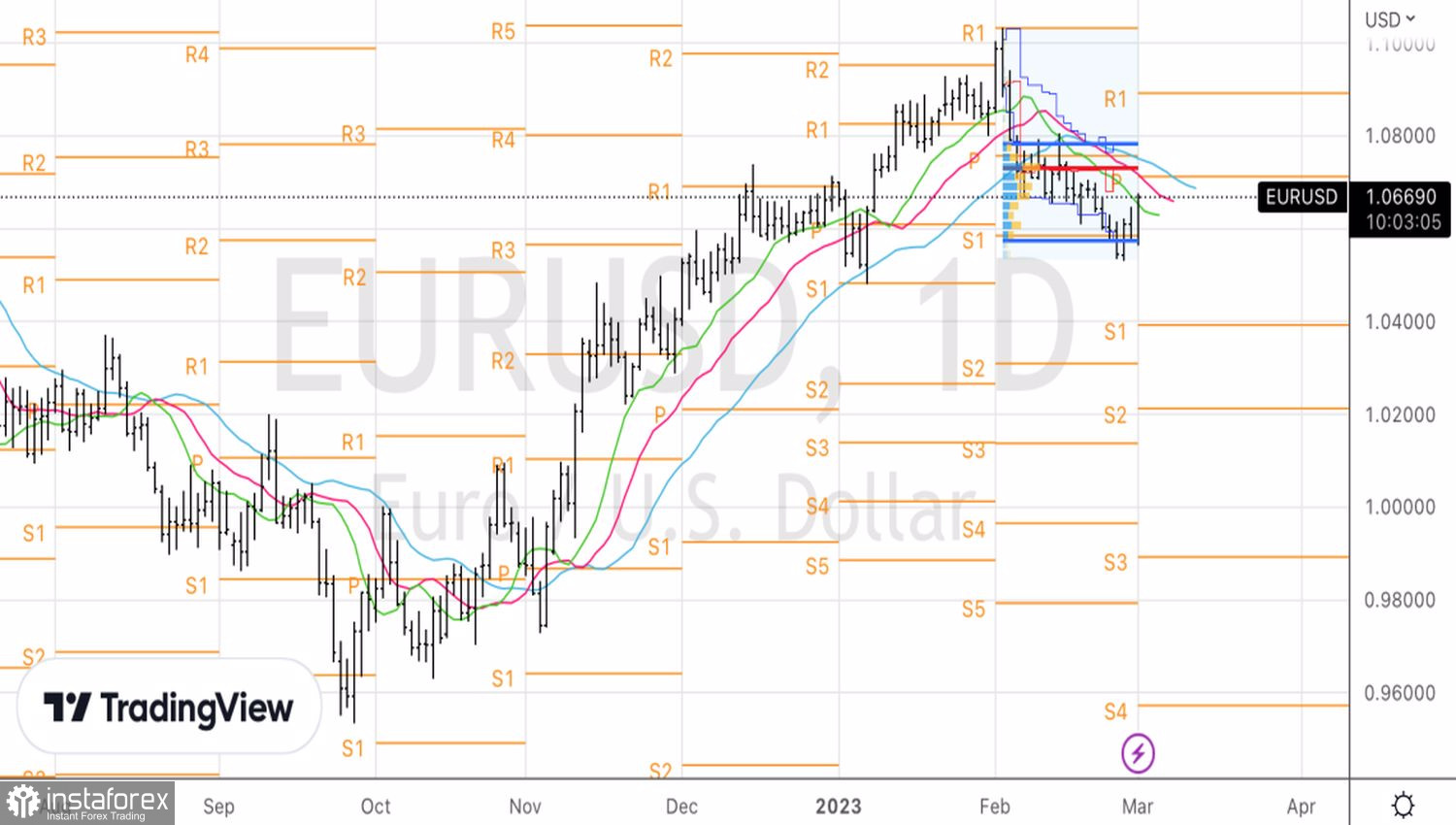

Although the euro could not cope in February with the Fed's intention to raise rates to almost 6% and with U.S. stock indices falling into the abyss, China came to the aid of the EURUSD bulls in March. The regional currency has a reliable ally. Will it wait for the release of data on the labor market and U.S. inflation to crack down on the dollar?

The ECB deposit rate has more upside potential than the federal funds rate. The European Central Bank has already raised it by 300 bps, to 2.5%, and derivatives forecast a ceiling of 4%. This implies 3–5 acts of monetary restriction at 25–50 bps each. Bank of France Governor Francois Villeroy de Galhau believes that the cost of borrowing should reach its peak by summer, September at most, and ECB Chief Economist Philip Lane argues that its presence at a plateau will last a very long time.

ECB deposit rate forecasts

Along with positive news from China and hawkish rhetoric from Governing Council members, the EURUSD rally is fueled by expectations of a run-up in German and European inflation. Bloomberg experts' forecasts assume their slowdown in February from 8.7% to 8.5% and from 8.6% to 8.2%, respectively, but if events develop like those in Spain and France, the euro risks getting even stronger. Although, I wouldn't discount the roller-coaster scenario, as the ISM manufacturing activity statistics from the U.S. will be released a little later. Positive will drop the stock indices and put a leverage on the dollar.

Technically, the EURUSD rebound from the low end of the fair value range 1.0575–1.0785 is a good sign for the bulls, but the resistances at 1.0695, 1.0715 and 1.073 look strong. Their unsuccessful assaults will become the basis for the formation of short positions on the main currency pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română