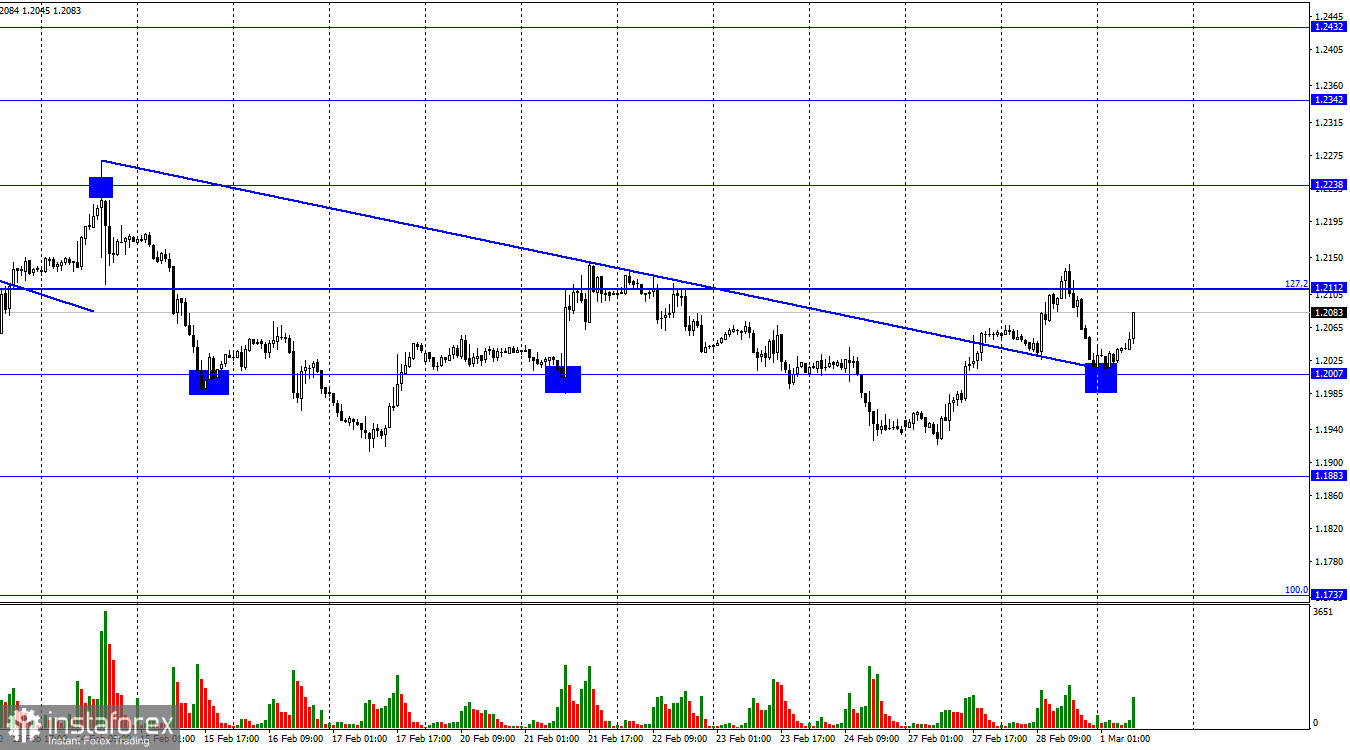

The GBP/USD pair reversed in favor of the US currency on Tuesday, dropping below the 1.2007 level, according to the hourly chart. The British pound benefited from the quotes' rebound from this level and the resumption of growth in the direction of the corrective level of 127.2% (1.2112). If this level rebounds once more, we can expect a drop to 1.2007 once more, and if it consolidates above it, we can advance toward 1.2238. The likelihood of the British pound rising has increased after the bulls were able to cross the downward trend line.

The British pound has already experienced one significant event this week. Catherine Mann, a representative of the Bank of England, stated that the regulator should keep tightening the PEPP because inflation is still high and rapid wage growth causes the consumer price index to gradually decline. Such statements from Bank of England officials indicate, in my judgment, that the regulator will not slow down the pace of tightening policy. I should also point out that ECB officials have consistently hinted at an impending rate increase of 0.50% in March. As a result, I anticipate that this month's rate increases in the European Union and Great Britain will total 0.50%.

But it is unlikely that traders have already figured out these answers; they may be doing so in the next weeks. The likelihood of continuing monetary policy tightening is increasing, and traders have already begun to factor in the possibility of more Fed rate increases. The euro and the pound can show an increase of 200–300–400 points over the next two weeks, although both currencies are more likely to decrease on the older charts. This week in the UK, there won't be many significant events; the sole one is the service sector business activity index on Friday. At the same time, traders are waiting for this indicator to grow rapidly and break through the 50.0 level. Unless the US business activity indices also show significant growth this week, the British pound has a good chance of growing.

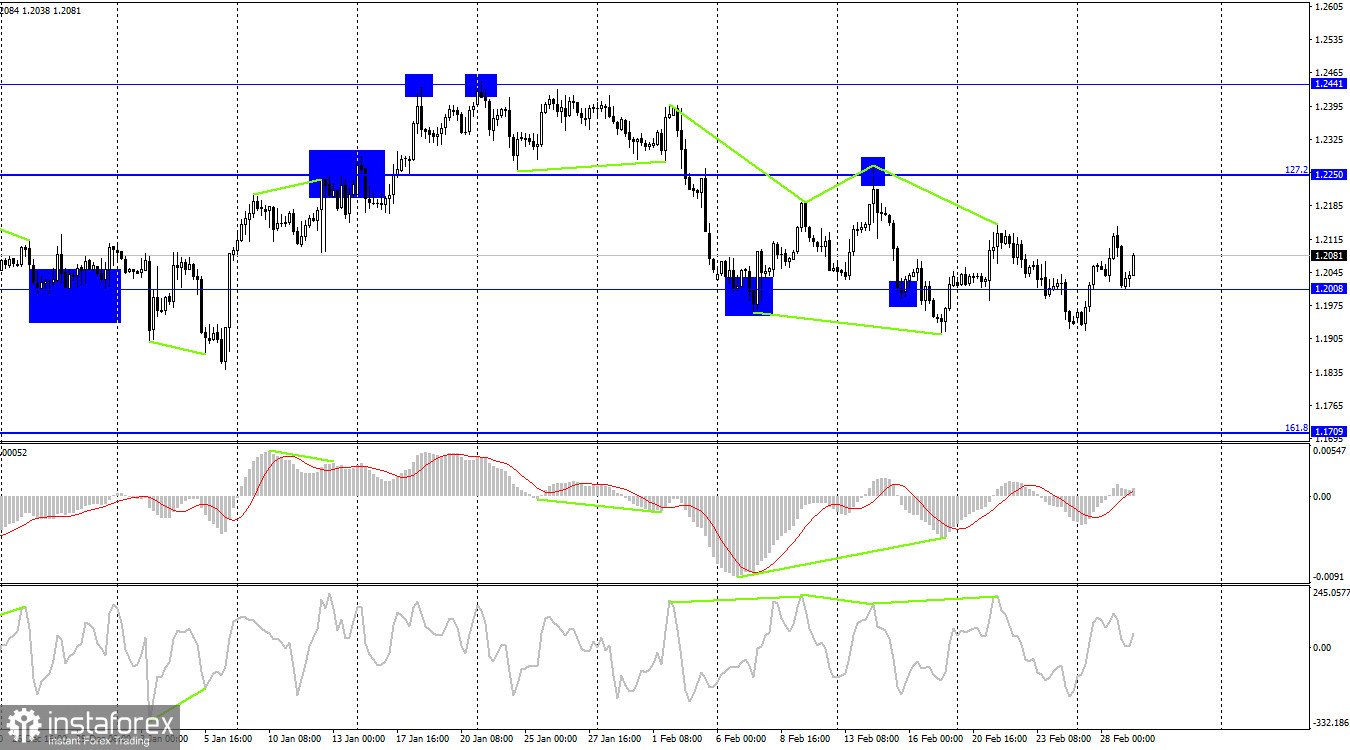

On the 4-hour chart, the pair completed a new reversal in favor of the British pound, though reversals have recently become a relatively common occurrence in the market. The 1.2008 level is rarely noticed by traders. There are no new divergences in the making. No trend line or corridor exists. The issue is fairly confusing, therefore, I encourage you to focus more on the hourly chart analysis. However, not everything is evident.

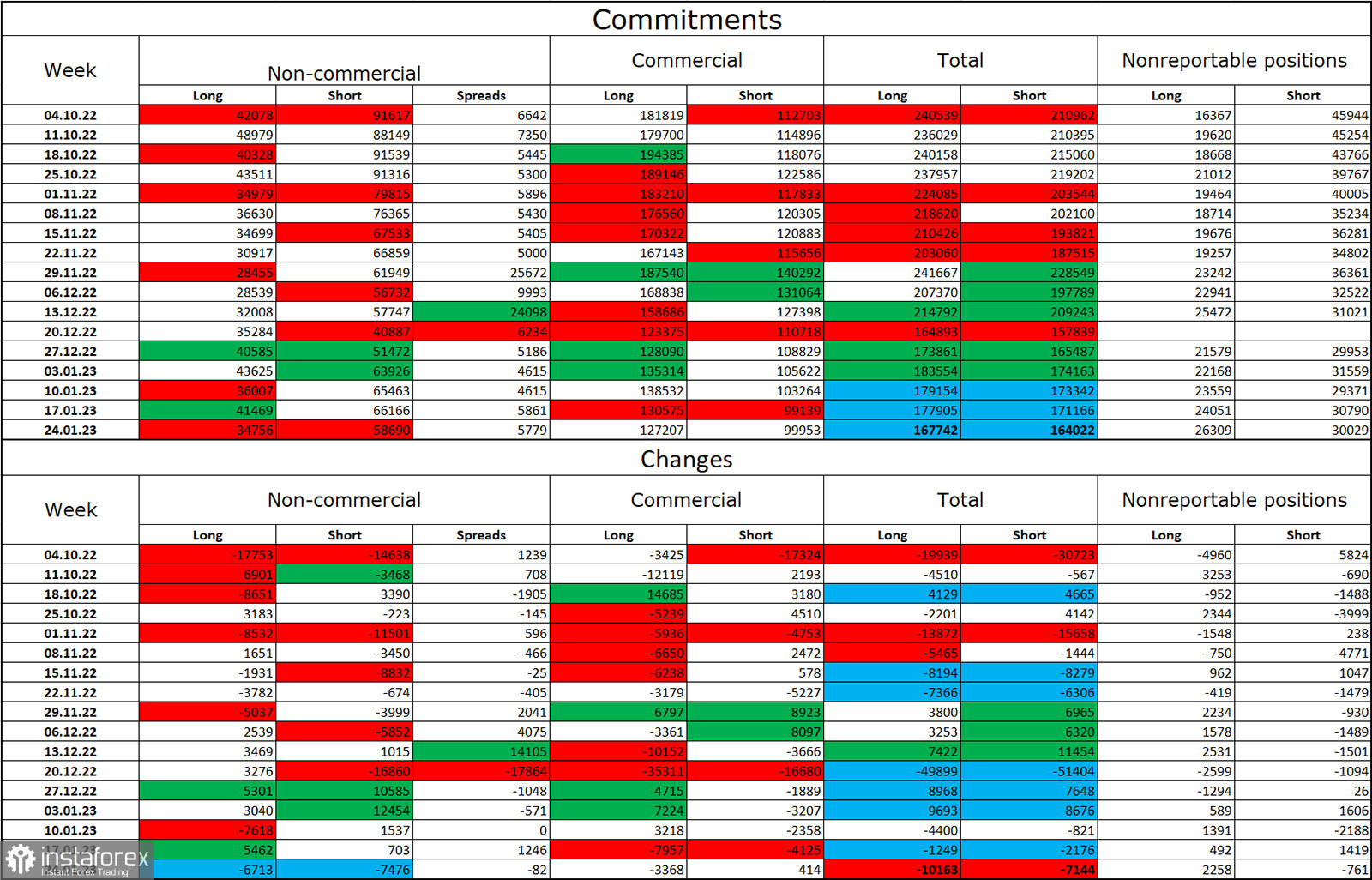

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "Non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short in the hands of speculators has nearly doubled once more. As a result, the outlook for the pound has once again declined, but the British pound is not eager to decline and is instead concentrating on the euro. An exit from the three-month ascending corridor was visible on the 4-hour chart, and this development may have stopped the pound's growth.

The following is the UK and US news calendar:

US – index of business activity in the manufacturing sector (PMI) from ISM (15:00 UTC).

The calendars of economic events in the UK and the US have one entry each for Wednesday. Given the importance of the ISM index, the information background may have a weak to moderate impact on traders' attitudes for the remainder of the day.

Forecast for GBP/USD and trading advice:

On the hourly chart, I suggest new sales of the pound when it recovers from the level of 1.2112 with a target of 1.2007. With a target price of 1.2112, purchases of the pair were possible when it rebounded from the 1.2007 level, and they can now be held open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română