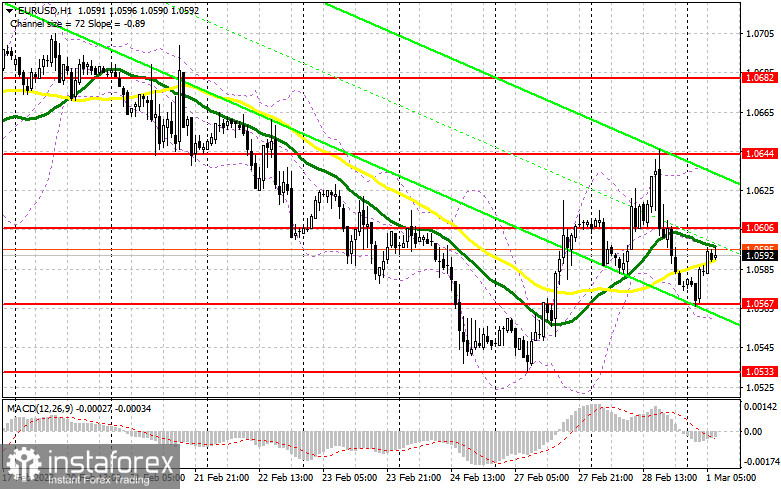

Yesterday, traders received just one signal to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 1.0613 to decide when to enter the market. A breakout and a downward test of this level led to a buy signal. As a result, the pair climbed by more than 30 pips but failed to reach the target of 1.0673.

Conditions for opening long positions on EUR/USD:

The euro quickly dropped from the previous levels. However, today, buyers have a chance to push the price higher once again. At the beginning of the month, bulls may control the market if the eurozone economy proves to be strong. Traders should focus on Germany's manufacturing PMI data for February, which may boost the euro in the first part of the day. If bulls do not show a reaction, it will be wise to bet on a decline near the closest support level of 1.0567. If bulls fail to protect this level, the pair is unlikely to launch an upward correction. A decline and a false breakout of 1.0576 will lead to a buy signal with the target at the resistance level of 1.0606 formed yesterday. There are bearish MAs slightly below this level. A breakout and a downward test of 1.0606 amid strong data from the eurozone will give an additional buy signal with the target at 1.0644, a new resistance level formed during yesterday's US trade. A breakout of 1.0644 will affect bears' stop orders, thus altering the market situation and forming two more signals with the target at 1.0682, where it is better to lock in profits. If the euro/dollar pair declines and buyers fail to protect 1.0567 in the first part of the day, pressure on the pair will return. What is more, a breakout of this level will intensify bearish sentiment. In the event of this, traders will focus on the support level of 1.0533. Only a false breakout of this level will lead to a buy signal. It is possible to open long positions just after a bounce off the low of 1.0478 or even lower – at 1.0451, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on EUR/USD:

Sellers of the euro have become active and may regain control over the market soon. The upward correction will stop when bears gain control over 1.0567. However, to enter the market we should wait for a false breakout of 1.0606. This will be a perfect condition to go short with the target at 1.0567. A breakout and a reverse test of this level will give an additional sell signal with the target at 1.0533, which will intensify bearish sentiment. A settlement below this level will lead to a decline to 1.0487, where it is better to lock in profits. If the euro/dollar pair increases during the European session and bears fail to protect 1.0606 amid positive data on Germany's labor market and the eurozone PMI, it is better to avoid selling until the price touches 1.0644. There, traders may go short only after a false settlement. It is also possible to open short orders just after a rebound from the high of 1.0682, expecting a downward correction of 30-35 pips.

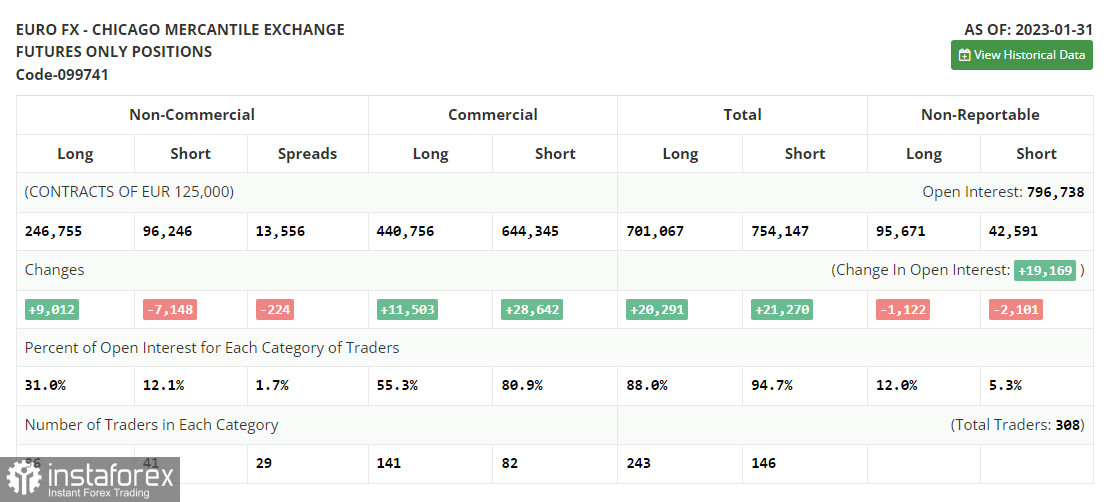

COT report

According to the COT report for January 31, the number of long positions increased, whereas the number of short ones dropped. It is obvious that this happened before the Federal Reserve and the European Central Bank announced their decisions on the key rates. In fact, the COT data from a month ago is of little interest now because of a technical problem in the CFTC that has been recently settled. This week is not rich in macroeconomic events. Therefore, the pressure on risk assets may ease somewhat, thus causing a correction in the euro/dollar pair. According to the COT report, the number of long non-commercial positions climbed by 9,012 to 246,755, whereas the number of short non-commercial positions dropped by 7,149 to 96,246. Consequently, the non-commercial net position came in at 150,509 versus 134,349. The weekly closing price fell to 1.0893 from 1.0919.

Signals of indicators:

Moving Averages

Trading is performed near the 30- and 50-day moving averages, which points to the market uncertainty.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the resistance level will be formed by the upper limit of the indicator located at 1.0630. In case of a decline, the lower limit of the indicator located at 1.0560 will act as support.

Description of indicators

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercia traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română