In the European session, EUR/USD was bullish. However, growth halted with the opening of the North American session. The pair turned bearish again and returned to its previous levels. Despite its clear overbought status, EUR/USD needs some strong drivers to push it higher. Thus, macro statistics could be that driving force. Yet, yesterday's macroeconomic calendar was empty. In fact, there will be no macro releases today as well. Of course, both the US and the eurozone will see the release of its final data on business activity in the manufacturing sector. However, these figures are expected to come in line with preliminary estimates and have already been priced by traders. Still, should the reports differ drastically from expectations, EUR/USD would edge lower.

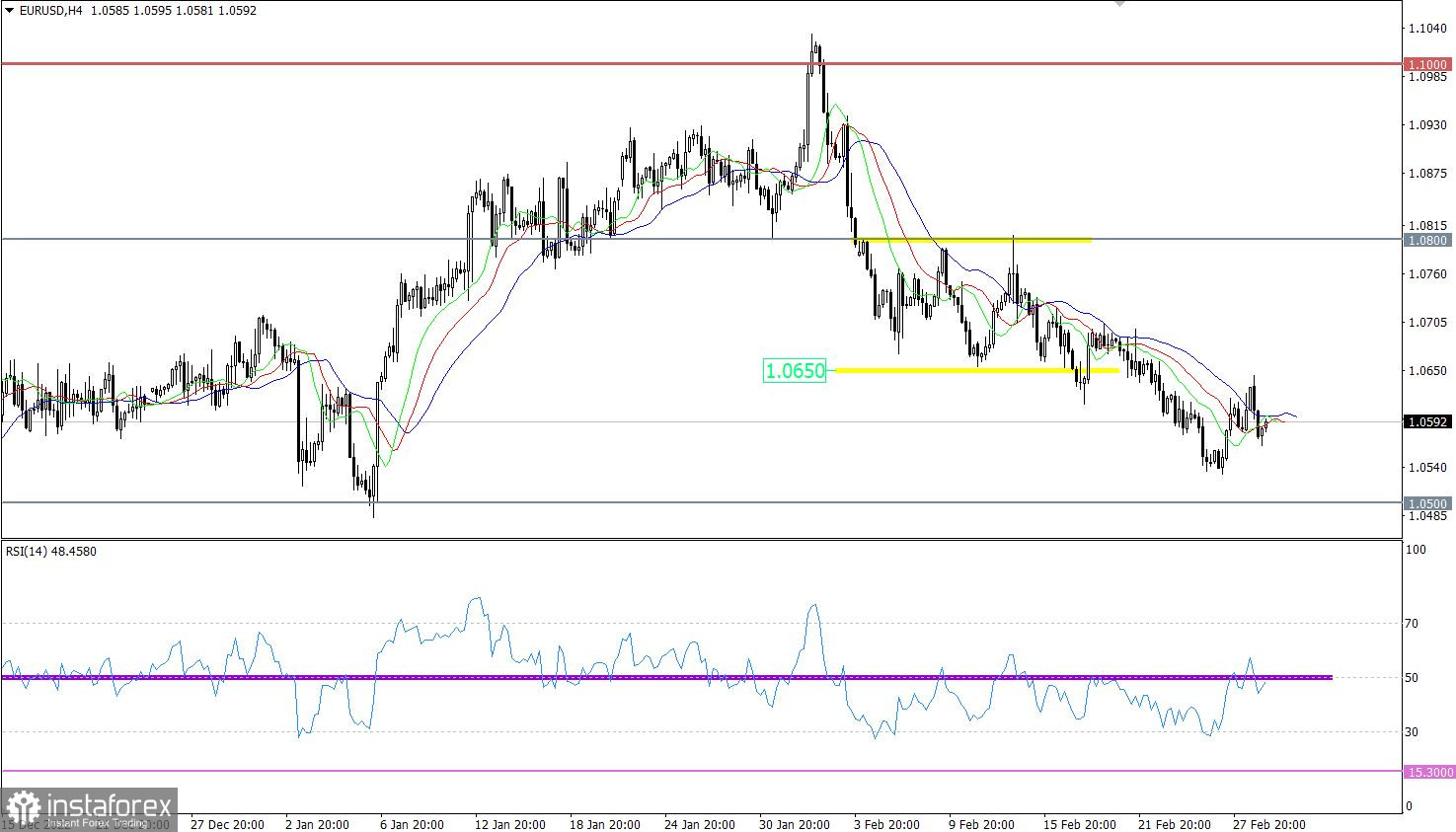

EUR/USD failed to enter a recovery phase. The quote retraced from the 1.0500 mark to the key level of 1.0650, indicating a bearish bias.

The RSI went above line 50 in the 4-hour time frame but then reversed.

The Alligator's MAs are intertwined in the 4-hour time frame, signaling a slowing bear cycle from early February. In the daily time frame, the Alligator's MA's are still heading down, reflecting a bear cycle.

Outlook

Despite its attempts to recover, the quote updated the swing low. Recovery will become possible if the price stays above 1.0530. Meanwhile, a signal to buy will be generated only after consolidation above 1.0650.

As for complex indicator analysis, there is a signal to buy in the short term and intraday due to the recent retracement.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română