EUR/USD

Higher time frames

The pair closed February's session with a strong bearish candlestick. In February, bears developed a pullback from the resistance area formed by a combination of the monthly medium-term trend and the upper boundary of the weekly Ichimoku Cloud. In March, the main goal for the sellers will be to confirm and develop the previously formed pullback. At the moment, the area of 1.0579 –1.0576 (monthly Fibo Kijun + lower line of the daily Ichimoku Cloud) acts as resistance. A break from the daily Ichimoku Cloud to the selling zone and a firm hold in this area will set a new downward target for the next breakout. The weekly support area at 1.0461 –1.0363 –1.0284 fortified by the monthly short-term trend at 1.0284 will serve as the next downward targets. In case bulls seize the initiative, they will need to cancel the Death Cross with the levels at 1.0619 –1.0724 –1.0783 –1.0842. Next, buyers will have to enter the bullish zone at 1.0777 and form support at the weekly short-term trend of 1.0758. Besides, another goal for the bulls will be to overcome the resistance area at 1.0894 –1.0901 where the levels of the monthly short-term trend and the upper line of the weekly Ichimoku Cloud have converged.

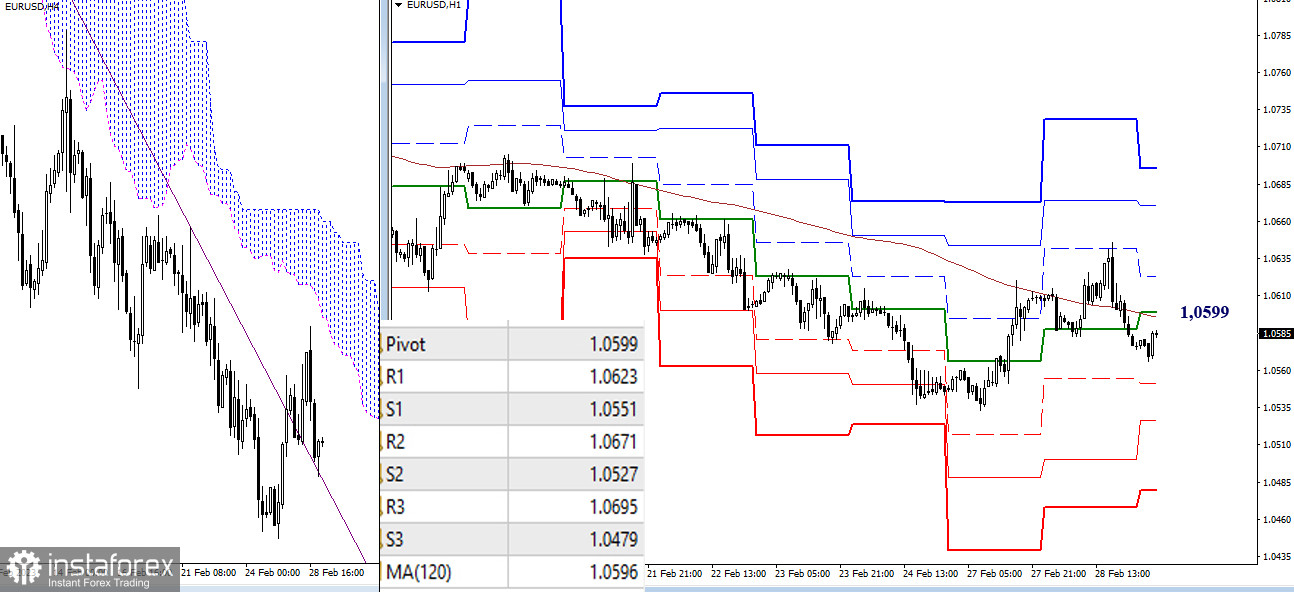

H4 – H1

On lower time frames, the pair is still looking for direction for the long term. That is why the key levels are constantly shifted. Trading above the key levels of 1.0596-99 (daily central pivot level + weekly long-term trend) will mean that bulls are leading the market. Their upward targets are located at the resistance area formed by the standard pivot levels of 1.0623 –1.0671–1.0695. Trading below the key levels of 1.0596-99 will intensify the bearish bias. In this case, the downward targets are found at the key support levels of 1.0551–1.0527–1.0479.

***

GBP/USD

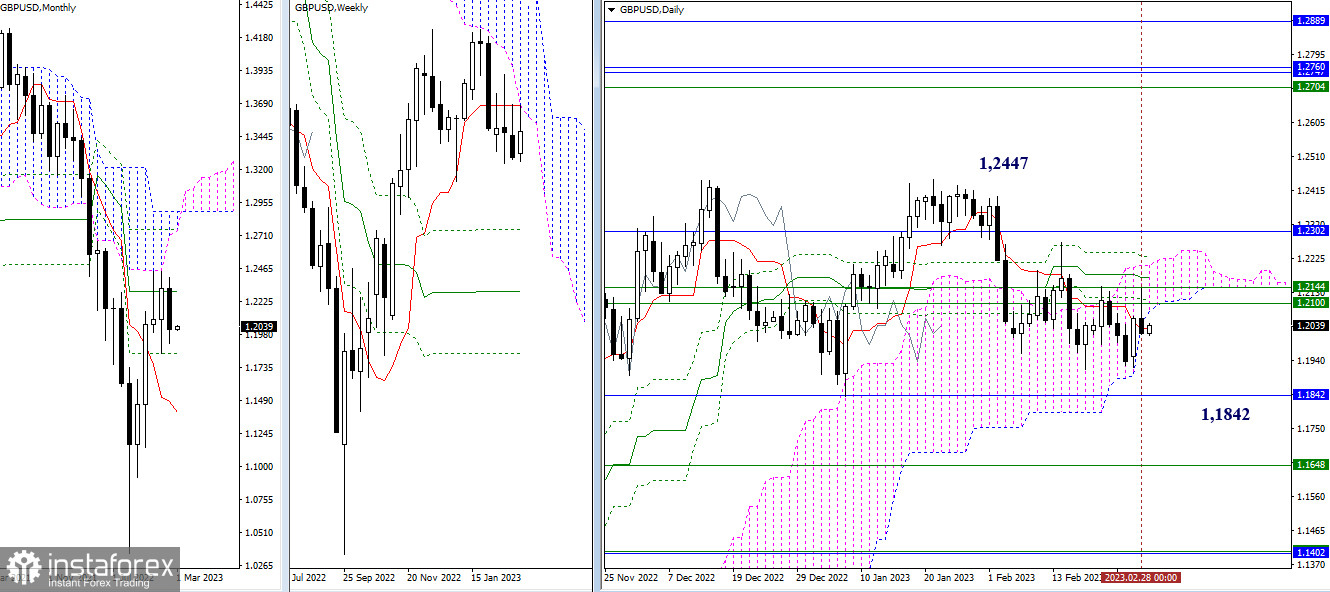

Higher time frames

The pound/dollar pair stayed within the range of the candlestick formed in January. This led to uncertainty on the monthly time frame which resulted in consolidation. Bears will need to move beyond the monthly Fibo Kijun level of 1.1842 and test the next support level represented, for example, by the levels of the weekly Ichimoku Cross (1.1648 –1.1401) and the monthly short-term trend (1.1401). The main goal for the bulls today is to pass the accumulation of resistance levels of 1.2100 –1.2144 –1.2232 –1.2302 found on different time frames and break above the monthly candlestick of 1.2447 that was formed in January.

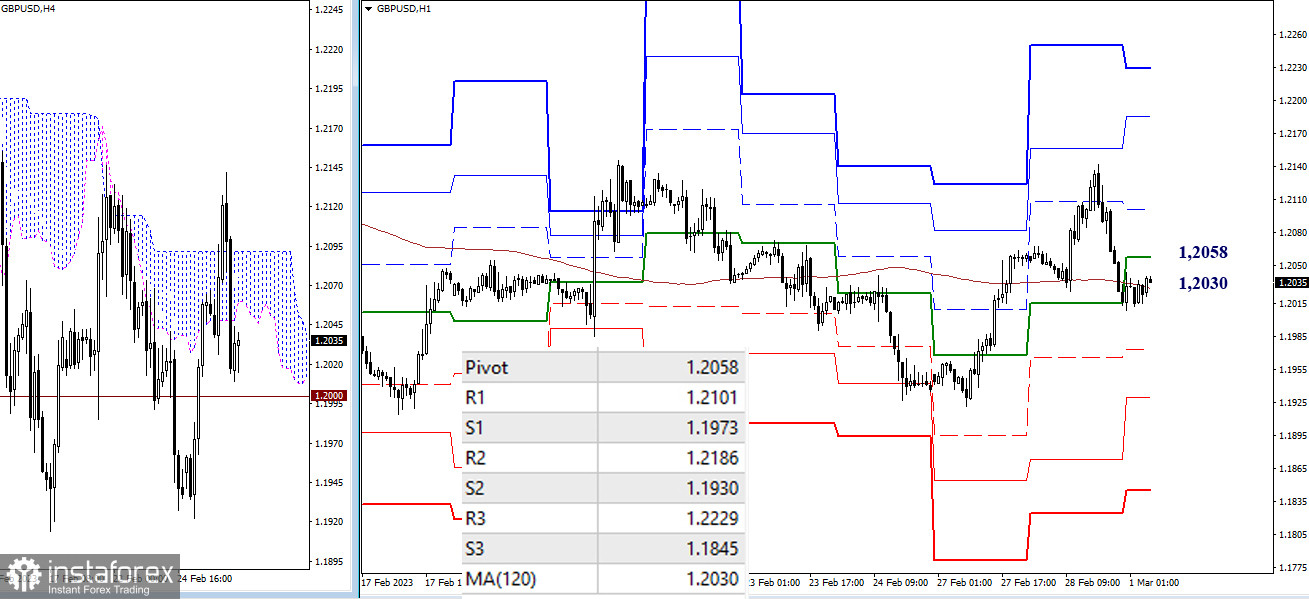

H4 – H1

At the moment, the pair is trading near the key levels of 1.2030 –1.2058 (daily central pivot level + weekly long-term trend). Consolidation near these key levels shows that none of the forces is in control of the market. Gaining control of the key levels and trading below them will intensify the bearish bias. If so, the main downward targets for the day are located at the support area formed by the standard pivot levels of 1.1973 –1.1930 –1.1845. Consolidation and trading above the key levels of 1.2030–1.2058 will mark the prevalence of the bulls. In this case, the upward targets are seen at the standard pivot levels of 1.2101–1.2186–1.2229.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower time frames – H1: Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română