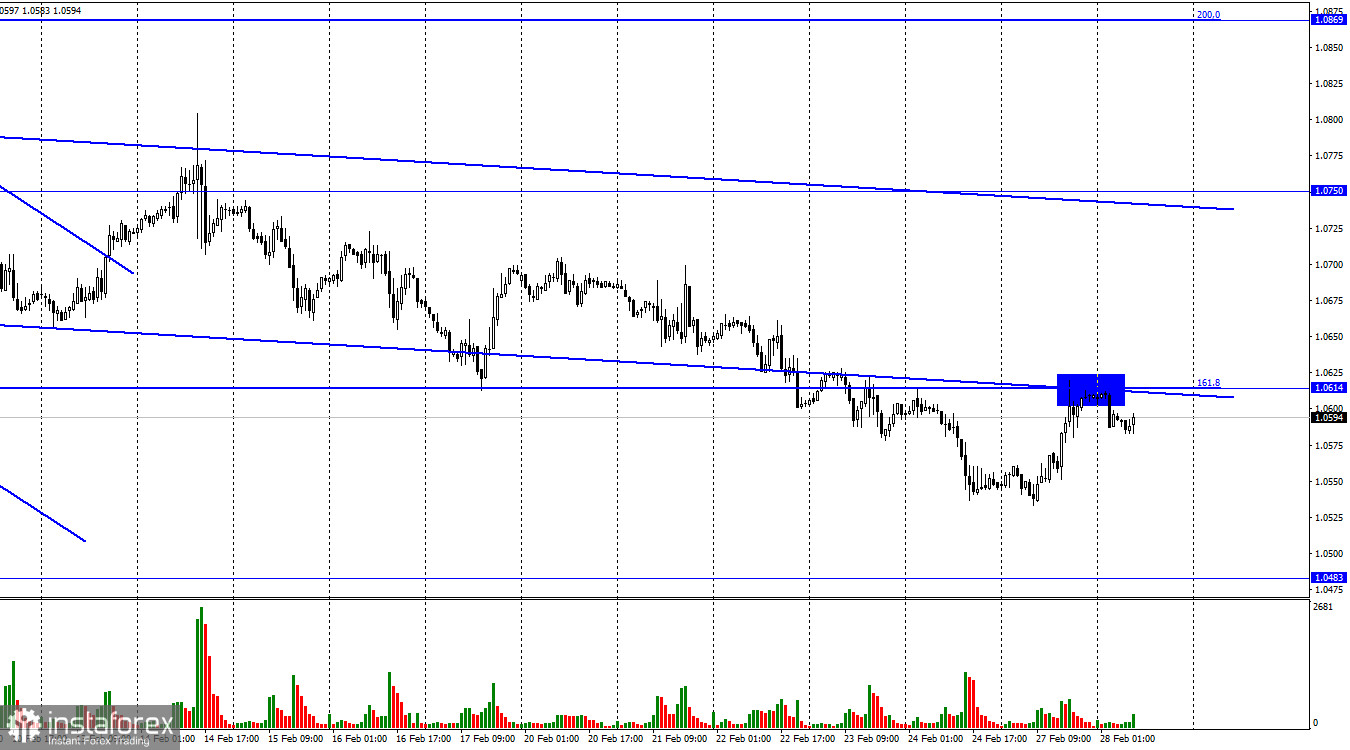

On Monday, the EUR/USD pair reversed in favor of the euro, returning to the corrective level of 161.8% (1.0614). The US dollar benefited from the quotes' rebound from this level and the continuation of the decline toward the level of 1.0483. At the time of writing, the decline cannot be described as strong, and closing above the level of 1.0614 will allow us to anticipate growth to the upper line of the downward trend line, indicating that traders' overall sentiment is "bearish."

Monday was not the most informative day. The only thing that traders could focus on was the report on long-term goods orders, which I already covered yesterday. There was essentially no other news. The dollar's decline during the day is not unexpected because this data came in lower than expected. The next step is to determine whether bullish traders are prepared to increase their positions and push the pair at least as high as the upper line of the channel. Also, it will depend on their ability to close above the level of 1.0614.

The information background won't exist at all on Tuesday. I, therefore, do not anticipate any strong movements today. There won't be many significant events for the Eurozone this week, so I don't anticipate either a major increase or a strong decline. Only an inflation report has the power to leave a lasting impression. The forthcoming ECB and Fed meetings will soon be the focus of traders' attention. And it appears to me that they are more anxiously anticipating the American regulator's conference, which could provide details about the bank's future strategy for combating excessive inflation. Economists' perspectives are currently divided. Some people think the Fed will keep raising interest rates for a very long period, while others think any further tightening will come to an end soon. The fate of the euro and the dollar will be largely based on the decision taken in March.

The pair was held under the upward trend corridor on the 4-hour chart. Because the pair left the corridor where they had been since October, I believe this moment to be of utmost importance. The current "bearish" trading sentiment offers the US currency with a target of 1.0201 good growth chances. Emerging divergences are currently undetectable in any indication.

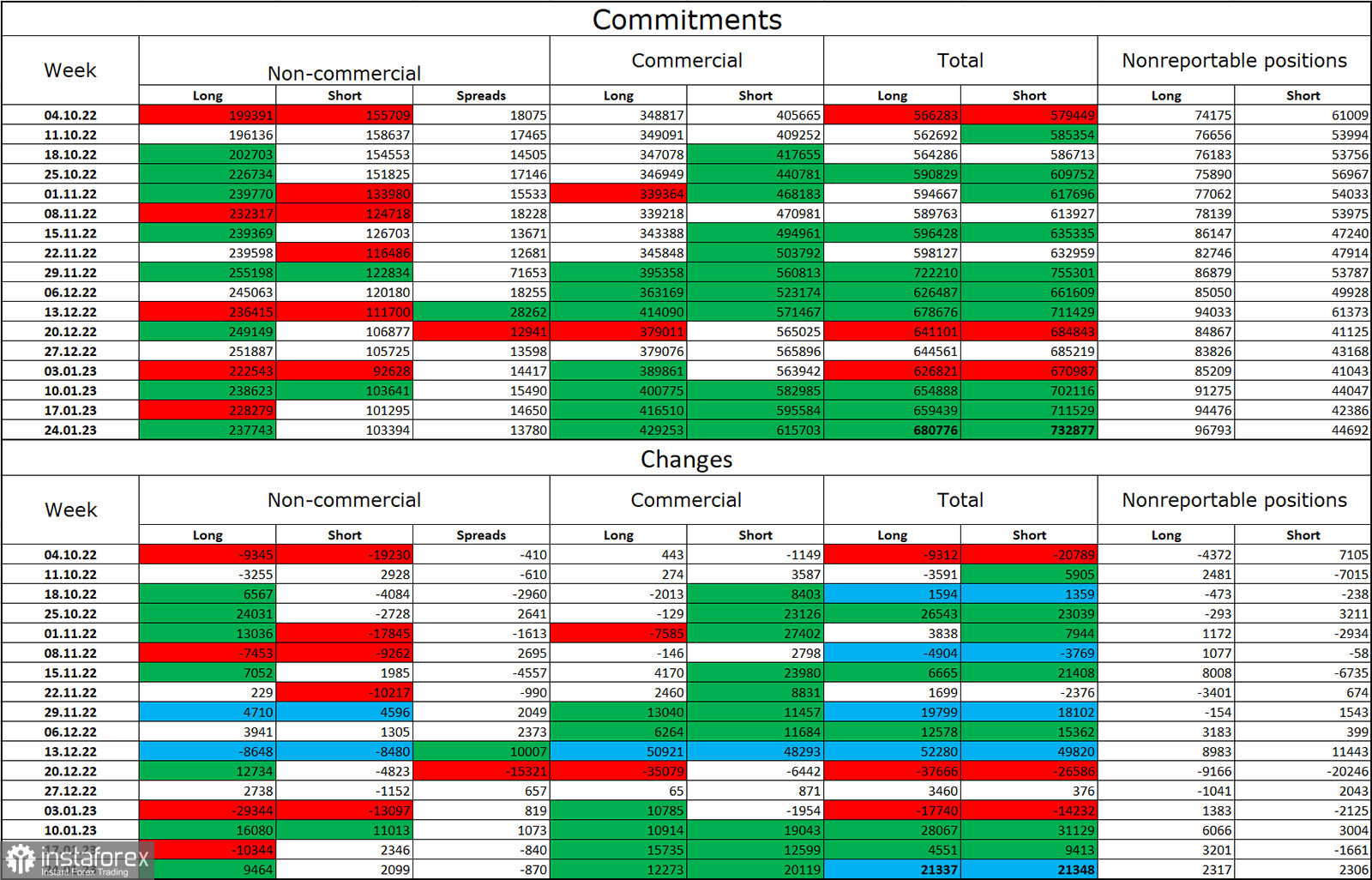

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand of short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now increasing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, therefore its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

Calendar of events for the United States and the European Union:

There is not a single significant event scheduled for February 27 on either the economic calendars of the European Union or the United States. Today's traders won't be affected by the information background's sentiment.

Forecast for EUR/USD and trading advice:

On the 4-hour chart, new sales of the pair with a target price of 1.0483 could be initiated at a close below the level of 1.0610. These trades can now be held until the hourly chart closes above 1.0614. On the hourly chart, buying the euro currency is possible if it closes above the level of 1.0614 with a target of 1.0740.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română