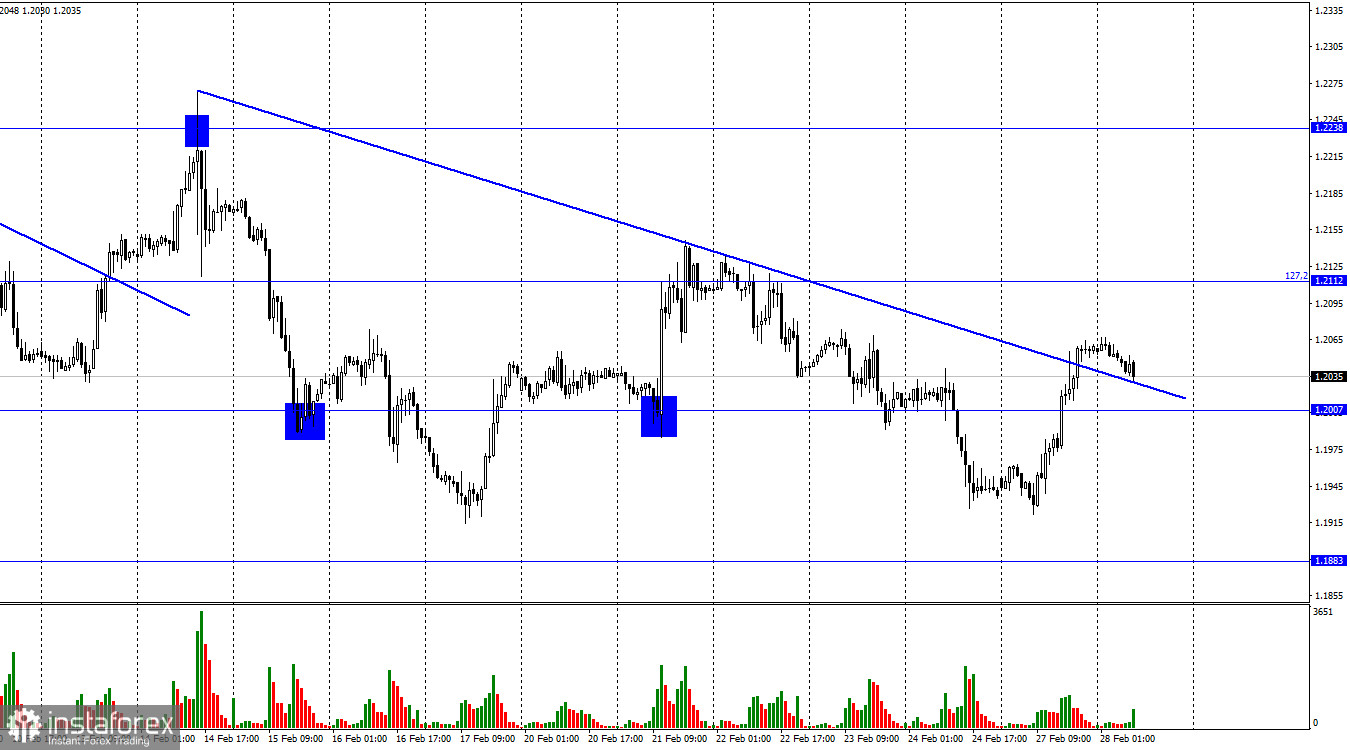

The GBP/USD pair reversed in favor of the British pound and anchored above the downward trend line, according to the hourly chart. Trading participants might anticipate continuous gains today and tomorrow in the direction of the Fibo level of 127.2% (1.2112). The US dollar will benefit from a new consolidation of prices below the 1.2007 level and a decline in the direction of the 1.1883 level.

Yesterday, the British pound had the same background information as the euro. However, another event occurred that cannot be ignored. Catherine Mann, a director at the Bank of England, argued that the regulator should not stop tightening monetary policy since doing so could simultaneously result in a new rise in inflation and a decline in economic activity. She added that the financial situation right now is "softer" than is necessary to lessen the effect of inflation on salaries and prices. "We need to tighten more firmly. The majority of this year and next may see significant inflation rates. The economic data currently does not support ending the rate hike cycle," said Mann. Let me remind you that the UK has an inflation rate of 10% or higher, and the government and central bank are particularly concerned about wage growth.

I do not rule out the possibility that Mann's speech yesterday supported the British pound as well, as it lifted a thin layer of mystery off the Bank of England's upcoming plans. The British regulator should, in my opinion, increase the rate to 6% or higher, but this may take some time, and it is unknown how the UK economy will be doing in six or twelve months. Nonetheless, bullish traders can use Mann's statements to increase their long positions. The likelihood of the pound seeing new growth increases with the number of such speeches by British Central Bank members. This week in the UK, there won't be many noteworthy reports, therefore I don't anticipate significant pair growth. As well as a strong fall.

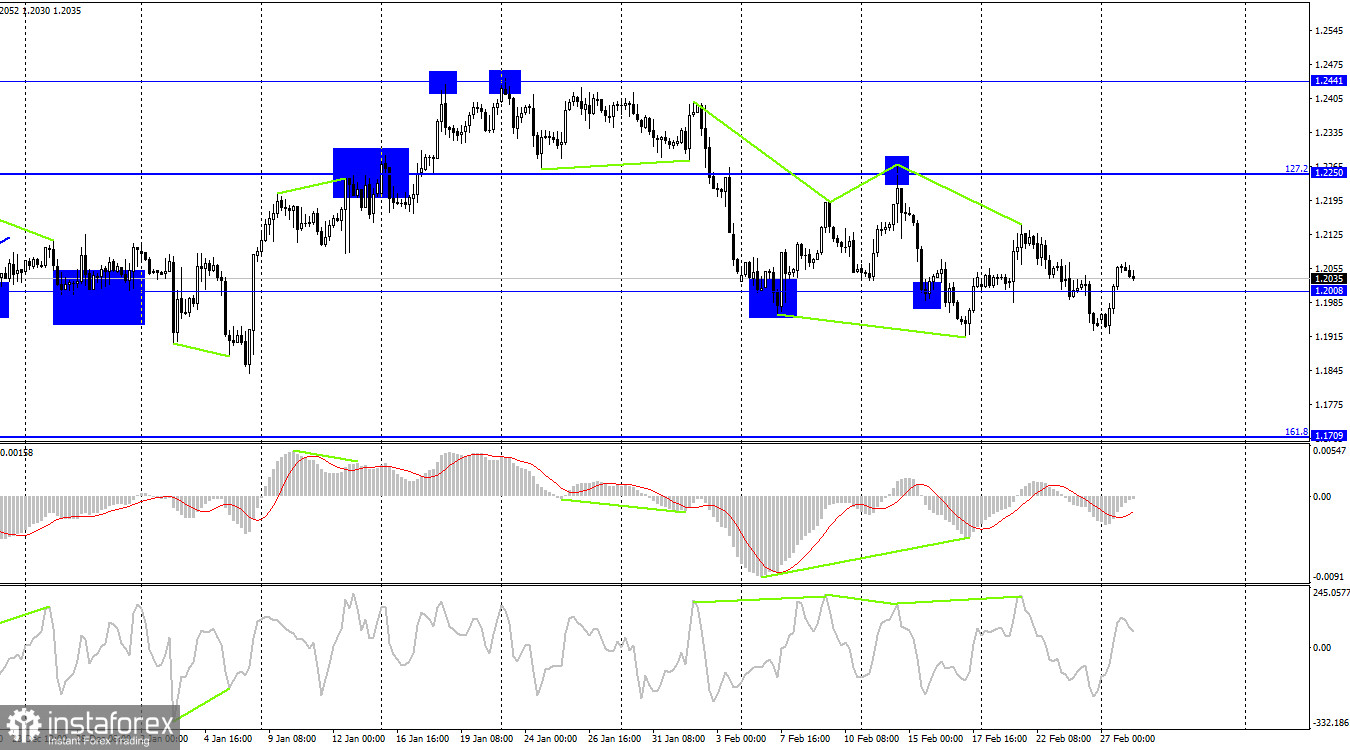

The pair reversed in favor of the pound on the 4-hour chart, although recent reversals have become increasingly common in financial markets. The 1.2008 level is rarely noticed by traders. There are no new divergences in the making. No trend line or corridor exists. Given the complicated nature of the situation, I encourage you to focus more on the hourly chart analysis.

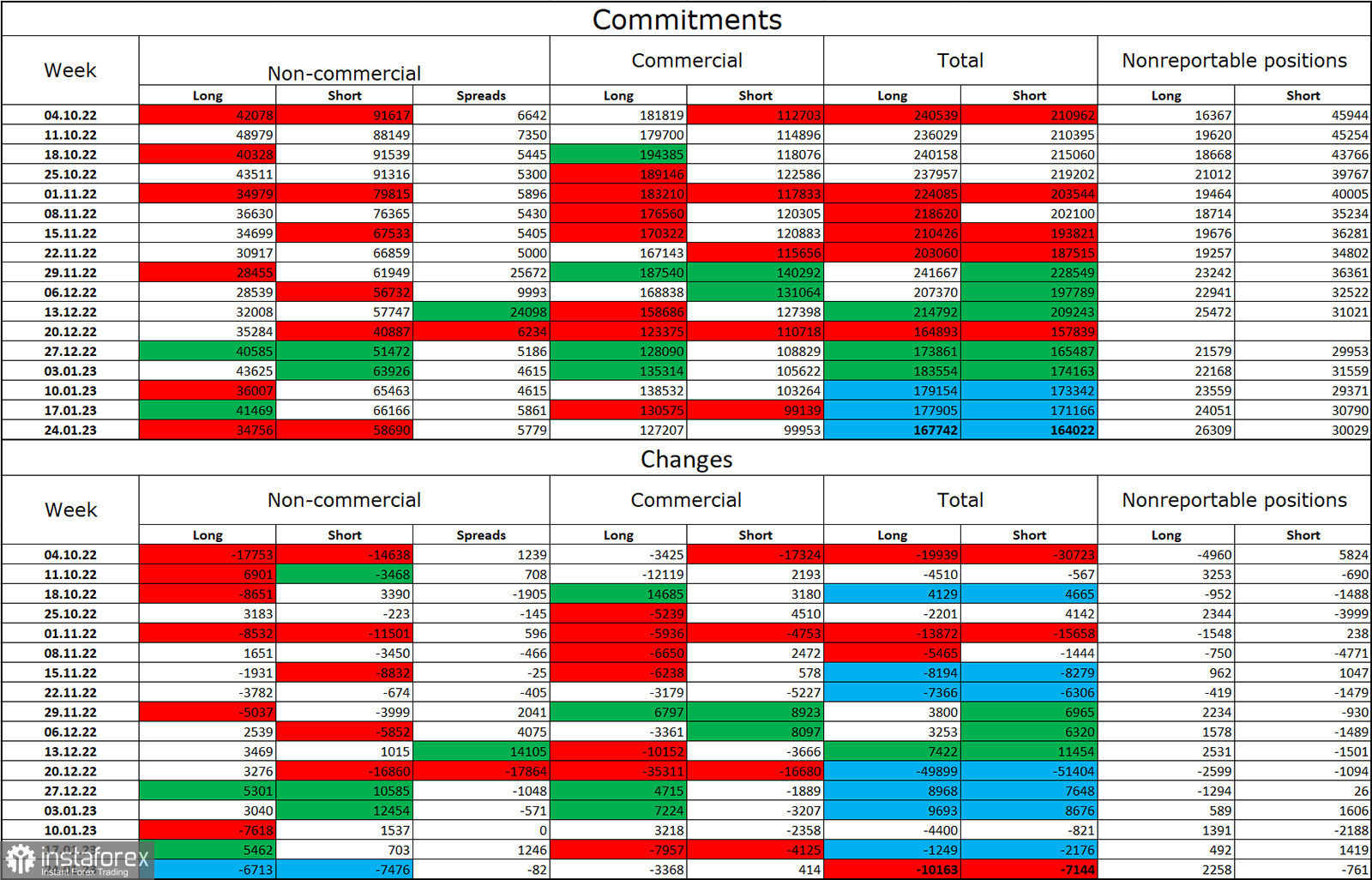

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "Non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short in the hands of speculators is nearly doubled once more. As a result, the forecast for the pound has once again declined, but it is not eager to decline and is instead concentrating on the euro. An exit from the three-month upward channel was visible on the 4-hour chart, and this development may have stopped the pound's growth.

The following is the UK and US news calendar:

The economic calendars in the UK and the US are empty on Tuesday. The rest of the day won't see any impact from the information background on traders' attitudes.

Forecast for GBP/USD and trading advice:

As the hourly chart closes below the 1.2007 level, I suggest new sales of the British currency with a target of 1.1920. With a fix above the 1.2007 level and a target price of 1.2112, buyers of the pair are now able to keep their positions open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română