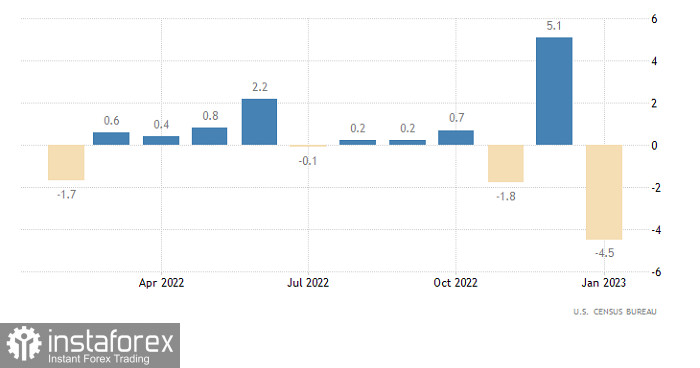

Yesterday, the greenback plunged on the back of disappointing macro statistics in the US. Thus, durable goods orders tumbled by 4.5% after surging by a downwardly revised 5.1% in the previous month. Figures had been expected to show a 3.5% decline. In this light, consumer spending in the US may soon drop, with its growth now slowing.

United States Durable Goods Orders:

Today's macroeconomic calendar is empty. The greenback has recently been bearish only when under the pressure from weak macroeconomic statistics. When the calendar was empty, the dollar either strengthened or traded sideways. The first scenario is unlikely to play out due to the greenback's current overbought status. Therefore, we may see a flat trend in the market today.

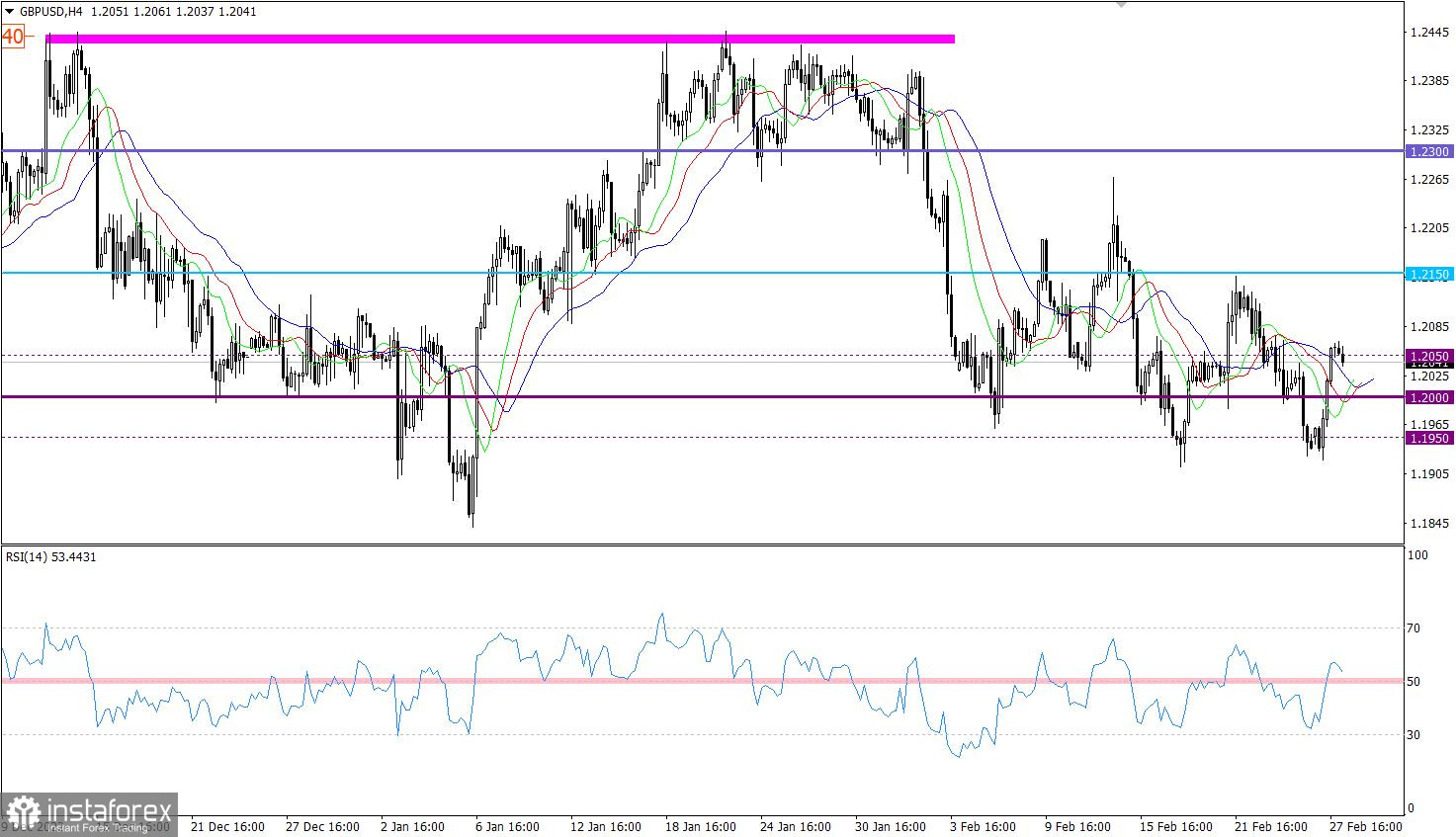

GBP/USD gained about 1% yesterday. Despite such a sharp price change, the quote is still hovering around a psychological level. In other words, the graphical picture on the chart remained almost unchanged.

Moving up, the RSI crossed line 50 on the H4 chart, signaling a bullish bias.

The Alligator's MAs are intertwined on the H4 chart, indicating a slower downward cycle.

Outlook

The pair is hovering in the 1.1950/1.2050 range, with the psychological level seen at 1.2000. It can be assumed that the current fluctuations near this mark will go on for a while. However, consolidation beyond one of the limits of the 1.1950/1.2050 range on the daily chart may reveal the pair's further movement.

Speaking of complex indicator analysis, there is a signal to buy in the short term and intraday in the wake of the recent impulse.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română