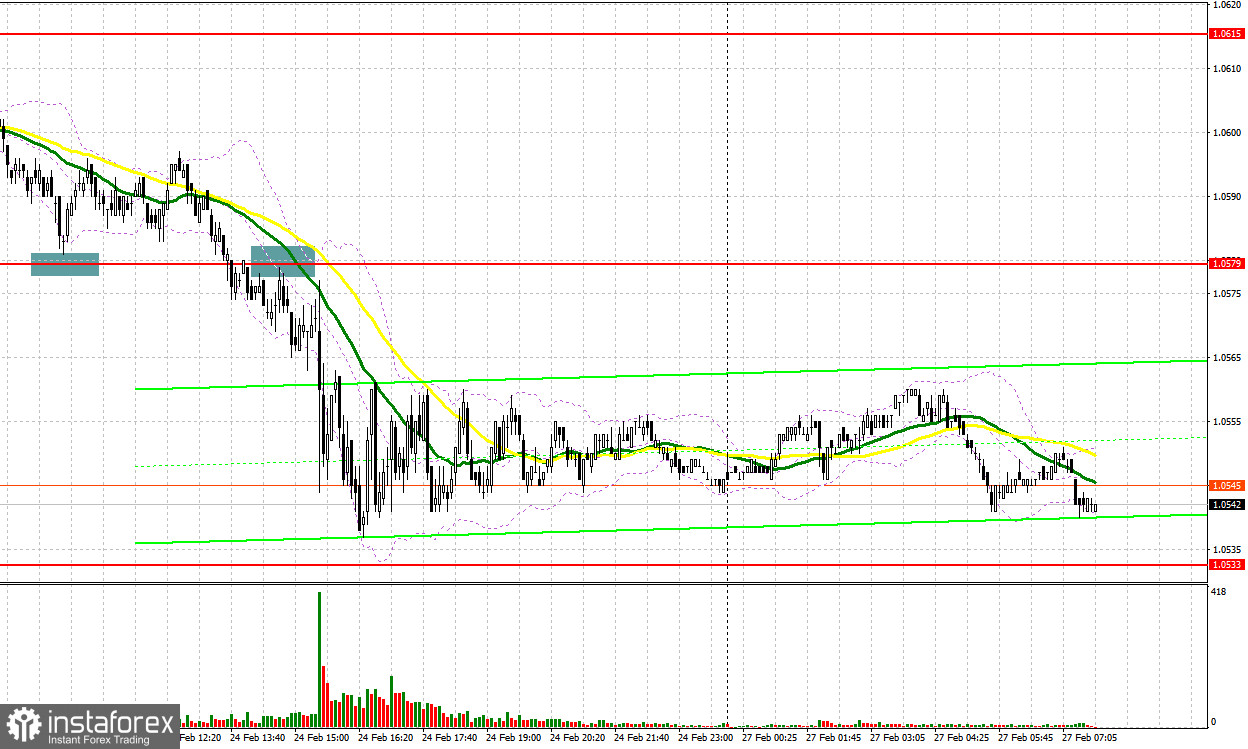

A few entry signals were generated on Friday. Let's take a look at the M5 chart to get a picture of what happened. In my previous review, I focused on the 1.0579 level and considered entering the market there. The worse-than-expected GDP data in Germany did not trigger a fall in price. A false breakout through 1.0579 created a buy entry point, and the quote rose by 15 pips. In the North American session, the price broke through 1.0579, and its retest made a sell signal and a 40-pip drop in price.

When to open long positions on EUR/USD:

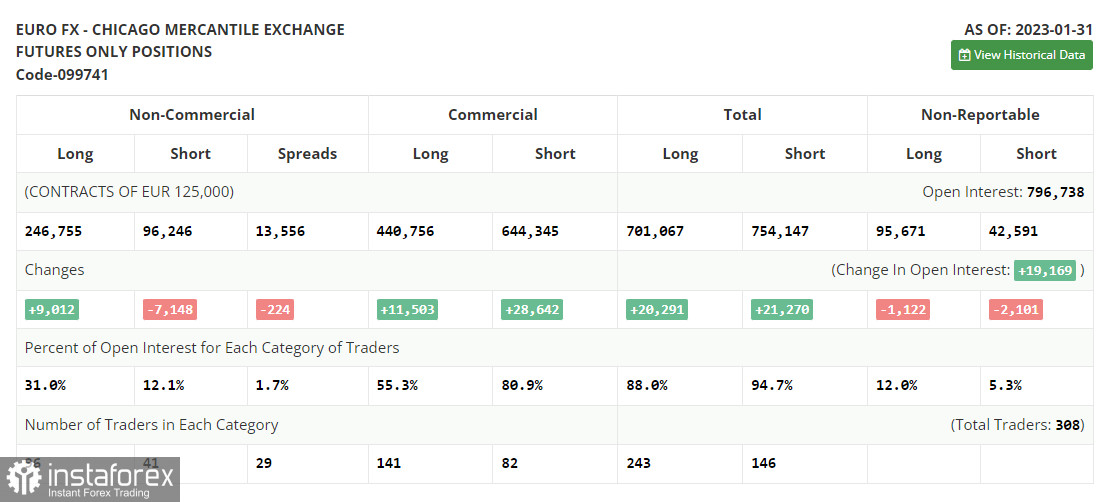

Before giving an outlook for EUR/USD, let's look at the situation in the futures market and see how the Commitments of Traders changed. The COT report for January 31 logged a rise in long positions and a drop in short ones. Apparently, that happened before the decision of the Federal Reserve and the European Central Bank on interest rates. In fact, COT data from a month ago is of little interest at this point as it is not relevant due to the technical glitch the CFTC recently suffered. This week, there will be just a few interesting macro events. Therefore, the pressure on risk assets may ease somewhat. That may trigger a correction in EUR/USD. According to the COT report, long non-commercial positions increased by 9,012 to 246,755. Short non-commercial positions dropped by 7,149 to 96,246. Consequently, the non-commercial net position came in at 150,509 versus 134,349. The weekly closing price fell to 1.0893 from 1.0919.

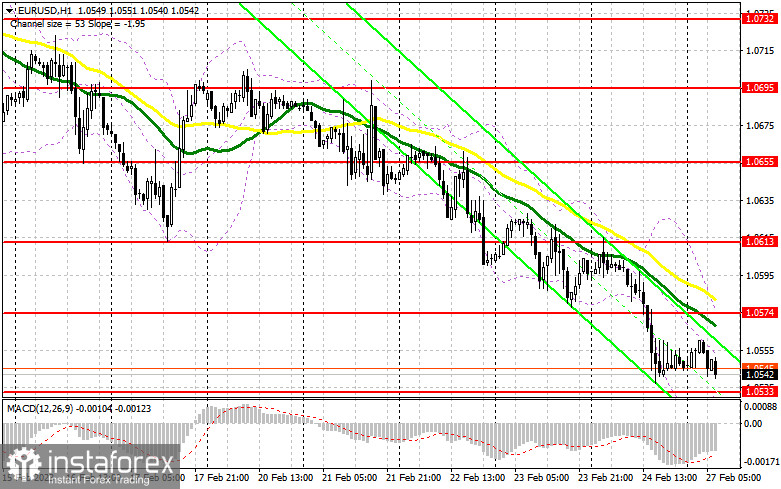

The eurozone will see the release of a series of macro reports today, including consumer confidence for February, loans to households, and M3 money supply. Therefore, the pair may rally at month-end, especially given a strong MACD divergence. Moreover, the ECB's Lane will give a speech today. He may again call on raising interest rates to tame inflation. If the pair extends the fall, the bulls should not give EUR/USD to go below support at 1.0533. In case of a false breakout through the mark, the trading plan will be to buy with the target at the nearest resistance of 1.0574, which is in line with the bearish MAs. After a breakout and a downside retest, the price may hit 1.0613, targeting 1.0655. The most distant target is seen at the 1.0695 high. If the price reaches it, it will mark the beginning of a new bull trend. This is where I am going to lock in profits. If EUR/USD goes down and there is no bullish activity at 1.0533, which is highly likely, the bears will retain their control over the market, and the pressure on the pair will increase. A false breakout through support at 1.0487 will generate a buy signal. The trading plan will also be to buy from the 1.0451 low, or even lower, at 1.0395, allowing a bullish correction of 30 to 35 pips intraday.

When to open short positions on EUR/USD:

On Friday, the bulls failed to trigger a correction to the upside after surprising macro data in the US. We may see a bearish continuation depending on the released statistics today. The bears should protect resistance at 1.0574, formed on Friday. It will be wiser to open short positions after a breakout through the barrier, targeting 1.0533, if macro releases in the eurozone disappoint. In fact, the bears and the bulls will attempt to take this level under their control as there are only yearly lows below it. A breakout, consolidation, and an upside retest of this range will make an additional sell signal with the target at 1.0487. If US macro data comes upbeat, the pair may go to 1.0451 in the North American session. I am going to lock in profits at this level. In case of growth in EUR/USD in the European session and the absence of the bears at 1.0574, the bulls will retain control over the market. The trading plan will be to open short positions after a false breakout at 1.0613. On a rebound, the instrument could be sold at the 1.0655 high, or even at 1.0695, allowing a bearish correction of 30 to 35 pips intraday.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating a bear market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.0574, in line with the upper band. Support stands at 1.0533, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română