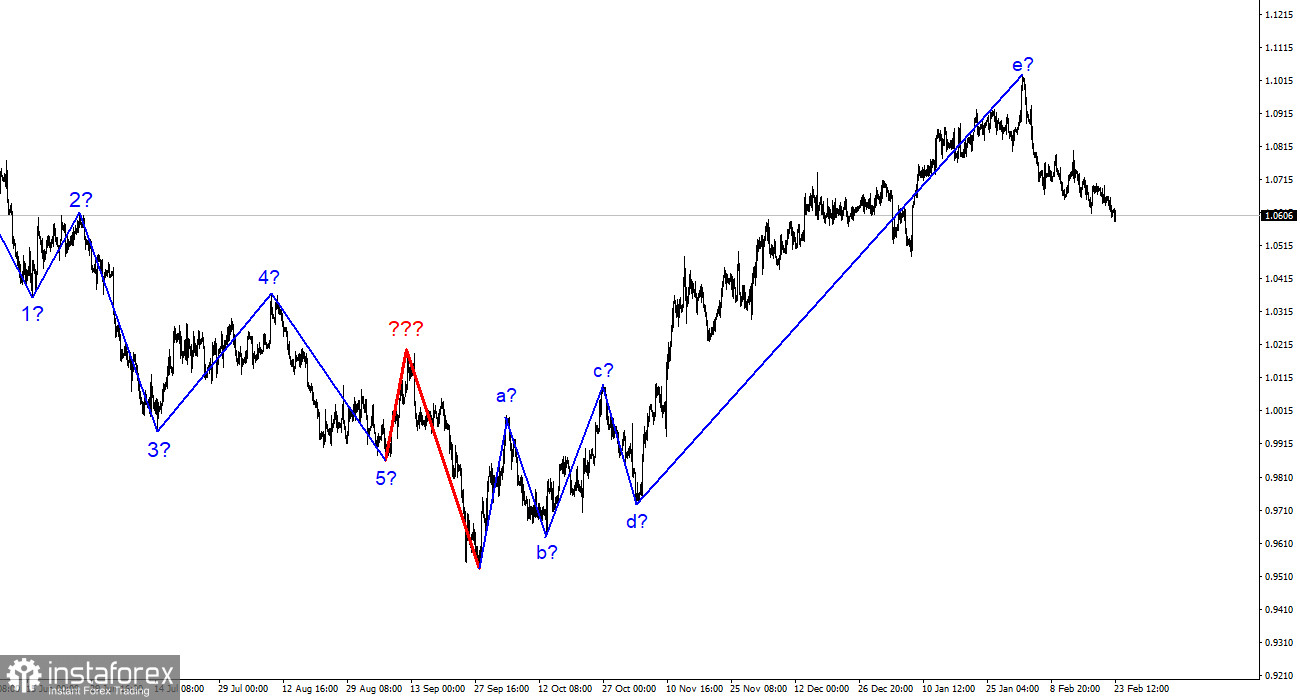

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. Although its amplitude would be more appropriate for the impulsive section, the upward section of the trend has been corrected. The wave pattern a-b-c-d-e that we were able to obtain features a wave e that is far more complex than the other waves. If the wave analysis is accurate, then this pattern's development is complete, and wave e was far longer than any other wave. I still anticipate a significant decrease in the pair because we are expected to develop at least three waves downward. The demand for the euro currency was persistently high throughout the first few weeks of 2023, and during this time the pair was only able to move slightly from previously reached peaks. The US currency did, however, overcome market pressure at the beginning of February, and the present detachment of quotes from the peaks reached can be viewed as the start of a new downward trend section, which I was simply hoping for. I hope that the current news context and market sentiment will not impede the formation of a downward series of waves this time.

On Wednesday and Thursday, the euro/dollar pair kept losing a few hundred points every day. Consequently, there is no question that the initial downward wave's development is still going on. If this is the case, the third wave of the euro currency's decline will likely include at least one more significant decline. The first wave can finish its development at any time. The final European Union inflation data for January were made public today. It was revealed that the rate of inflation fell from 9.2% to 8.6% over this time, which is a bad sign for the euro. Let me remind you that the ECB's "hawkish" tone is less likely to persist the faster inflation declines. Maintaining such rhetoric and raising the interest rate (which is considerably lower than those of the Bank of England or the Fed) is very advantageous for the euro currency.

Core inflation increased from 5.2% to 5.3% in the same period, which is already good for the euro but bad for the EU economy. Oil, gas, and food price movements are not taken into consideration when calculating core inflation. It is regarded as being the most crucial for the central bank. If it keeps increasing, the ECB won't modify its stance on rates anytime soon. Yet there is still another crucial factor in play. The market had multiple opportunities to account for the rate changes because the ECB, in a sense, revealed them in advance for the three upcoming meetings (one of which has already occurred). And the market is still optimistic that the rate will increase by another 50 basis points in March and by 25 basis points in May, regardless of how the inflation rate changes. And these changes have already been made. Hence, the market's perception of today's inflation reports has not changed, as evidenced by the continued decline in demand for the euro against the backdrop of a potential new tightening of the Fed's monetary policy.

Conclusions in general

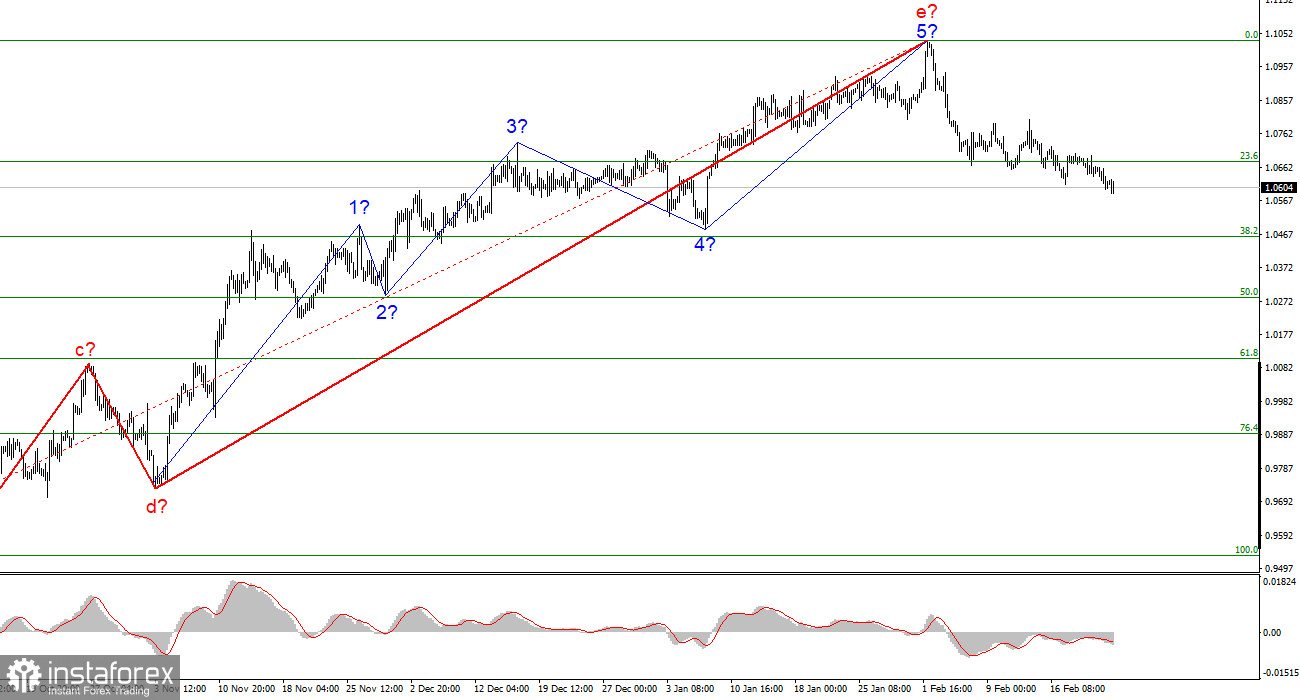

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. Although there is still a chance that the upward trend section will become even more complicated, the chart currently shows what might be the start of a new downward trend segment.

On the older wave scale, the ascending trend section's wave pattern has grown longer but is likely finished. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română