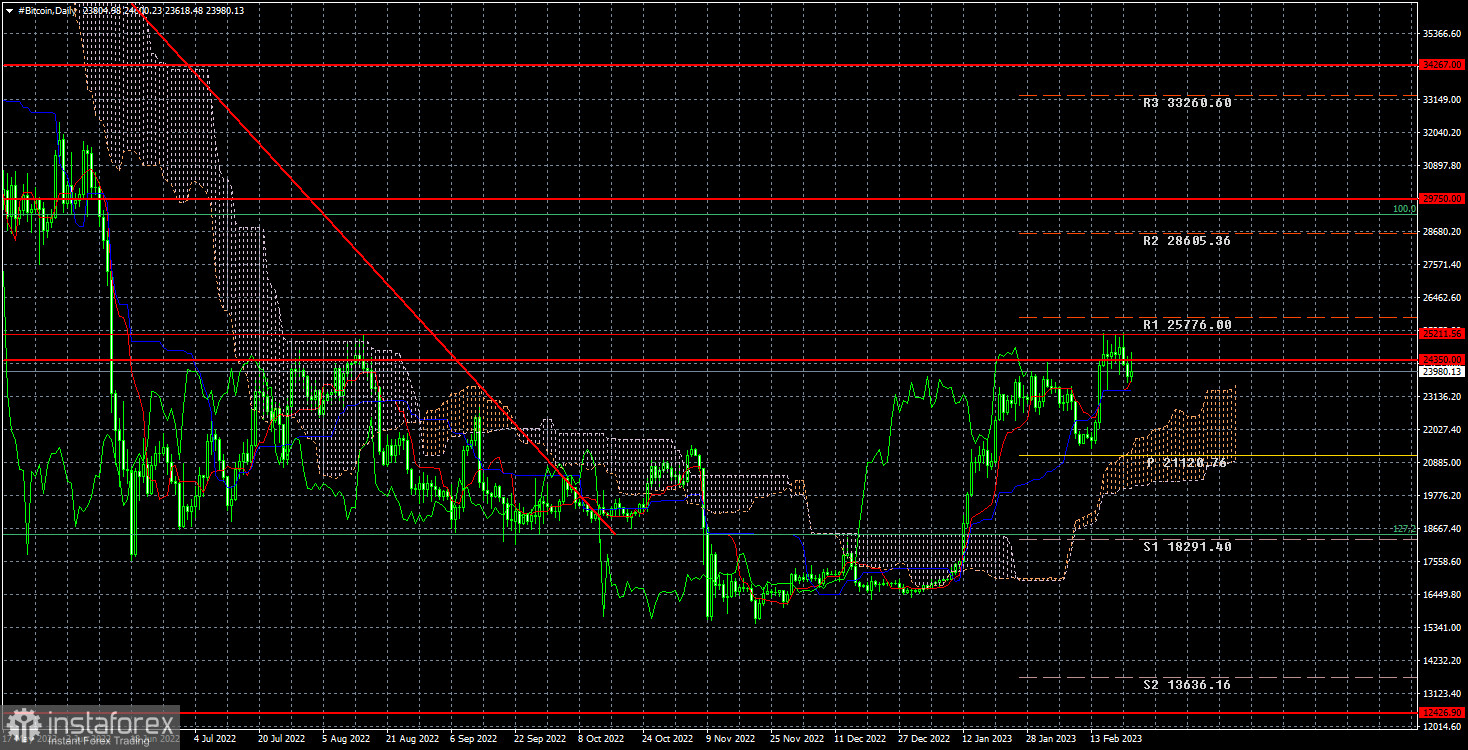

Bitcoin rose to the reserve level of $25,211 and failed to overcome it with four attempts. The price retreated from that level, but it wasn't much. It could just be a run-up before a new attempt to overcome the level, or it could be the beginning of a powerful correction. Let's not disregard the alternative in which the last turn of the upward movement is a turn inside the sideways channel. Below you can clearly see that the current local high is the local peak of the middle of August 2022. Thus, $25,211 may be the upper limit of the horizontal channel. So far, it bounced from this limit, so we can expect Bitcoin to fall, but in this case we should protect ourselves with the Stop Loss.

The minutes of the last Federal Reserve meeting was released in the US. As it often happens, it did not provide any fundamentally new information. In principle, 11 out of 12 minutes did not provide any important information. And if that's the case then the market seldom reacts to them. The key message of the minutes was that some members of the Monetary Committee support the new acceleration of monetary policy tightening. In other words, some officials believe the rate is rising too slowly. The latest inflation report was not yet available at the time of the Fed's February meeting, so the hawkish mood can only harden over time, since inflation is what the Fed is banking on when making monetary policy decisions. So what do we have? Inflation has already slowed to 0.1% a month, and "some members" of the Fed were already thinking in early February that the pace of rate hikes should be increased. As I have already mentioned, 1-2 rate hikes in 2023 will clearly not end the matter. Accordingly, there could be 3 or 4 more rate hikes, and one of them could be half a point higher at once. Such news is not just a disappointment for Bitcoin, in fact, it is bad news. The tighter monetary policy is going forward, the worse it is for all risky assets. So we still see no reason for strong growth. But let me remind you that the cryptocurrency market is quite thin and it does not always need clear reasons to move in one direction or another.

On the 24-hour chart, Bitcoin quotes failed to overcome the support level of $25,211. If it does not resist (and so far everything is going that way), the bullish trend may begin, and the first target will be $29,750. If we look at the current situation dispassionately, I still think that the fall to $15,500 is more probable. But we have to face the truth: the market shows that it is ready to buy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română