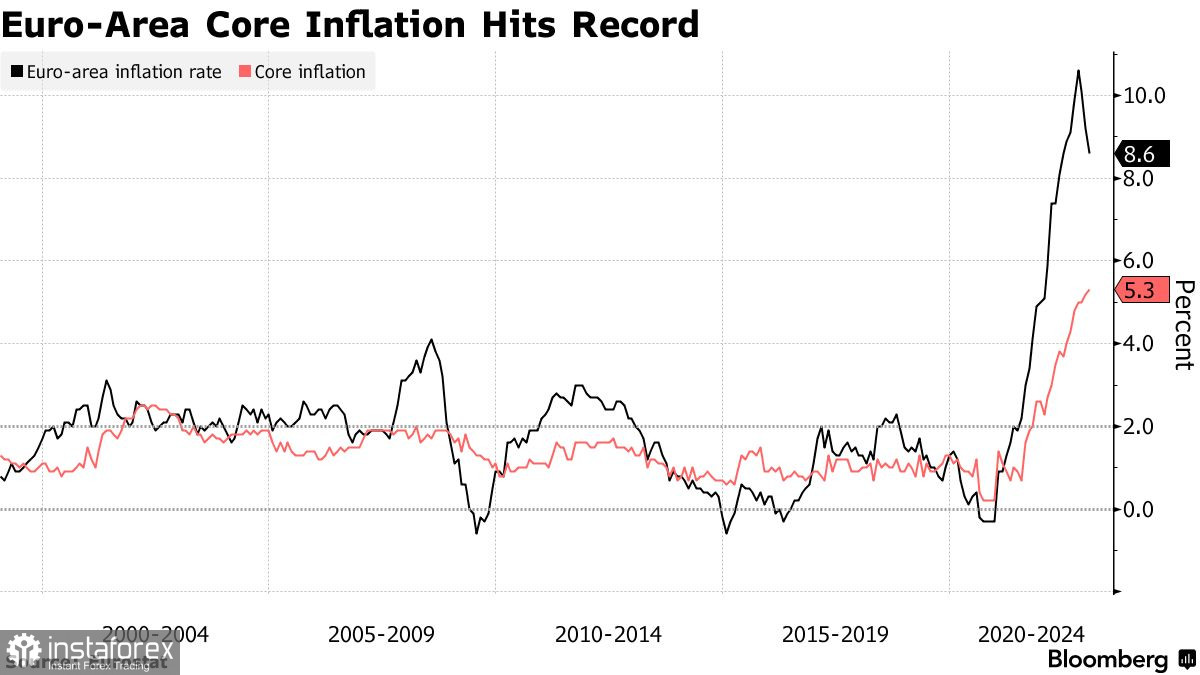

The euro ignored another signal that core inflation in the euro area hit a record high in January this year. Let's look into whether things are really that bad and whether the euro will continue to decline.

As the revised data showed, the likelihood that the European Central Bank will continue its campaign of raising interest rates by another half a point next month has increased significantly. Core price gains reached 5.3% — more than an initial reading of 5.2% — Eurostat said Thursday. General inflation, which includes food and energy, also rose 0.1 percentage point to 8.6% after Germany's figure was higher than the agency's preliminary estimate.

The report highlights the consequences of Europe's worst price shock in a generation since Russia launched a military special operation in Ukraine, which led to a surge in energy prices. Obviously, this will further spur ECB hawks focused on underlying price pressures. Surveys showing the bloc's economic resilience have also been interpreted as grounds for continued price increases.

Most recently, officials led by ECB President Christine Lagarde said at their last meeting that they intend to raise the deposit rate from 2.5% to 3% when they next meet for a monetary policy meeting. Now it appears that the move may be revised more aggressively at the March 16 meeting. Combined with a resilient economy, today's inflation figures may allow the hawks at the ECB to raise interest rates even more before the summer begins.

Most recently, executive board member Isabelle Schnabel raised her expectations for a rate hike and policymakers now see the ECB rate cycle peaking at around 3.75%. Bank of France Governor Francois Villrois de Galleau tried to refute such assumptions, saying that a rate hike at all upcoming meetings is not guaranteed. The latest report should have disproved him.

Meanwhile, the expectation of further interest rate hikes is not providing much support to the euro as the market is betting on an equally aggressive policy from the Federal Reserve. The latest U.S. economic data has turned things upside down again, and central bank officials were just forced to announce that the fight against high inflation, unfortunately for them, is not over yet. Obviously, the rise could continue as early as this spring, as the labor market continues to be resilient and retail sales continue to show good growth due to the serious imbalance in supply and demand.

In the short term, after the next update of the monthly lows on this one, we can count on a bullish correction of risky assets, but it is unlikely to be prolonged.

As for the technical picture of EURUSD, the pair remains under pressure. To stop the bear market, it is necessary for the pair to rise above 1.0615 and 1.0660, as it will push the trading instrument to 1.0720. Above this level, it can easily climb to 1.0760 with the possibility of updating 1.0800. In case the pair falls around 1.0580, I expect big buyers to be active. If there is no one there, it would be a good idea to wait for a renewal of the low at 1.0530 before opening long positions.

As for the technical picture of GBPUSD, the bulls managed to stop the bear market around 1.2035. Bulls need to climb above 1.2100 to restore the situation. A breakdown of this resistance will strengthen the hope for further movement to the area of 1.2140, after which it will be possible to speak about a more sharp upward movement to 1.2170. The trading instrument might be under pressure again after the bears take control over 1.2035. A breakdown of this range will strike a blow to the bulls' positions and will push GBPUSD back to 1.1980 with the prospect of an exit at 1.1920.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română