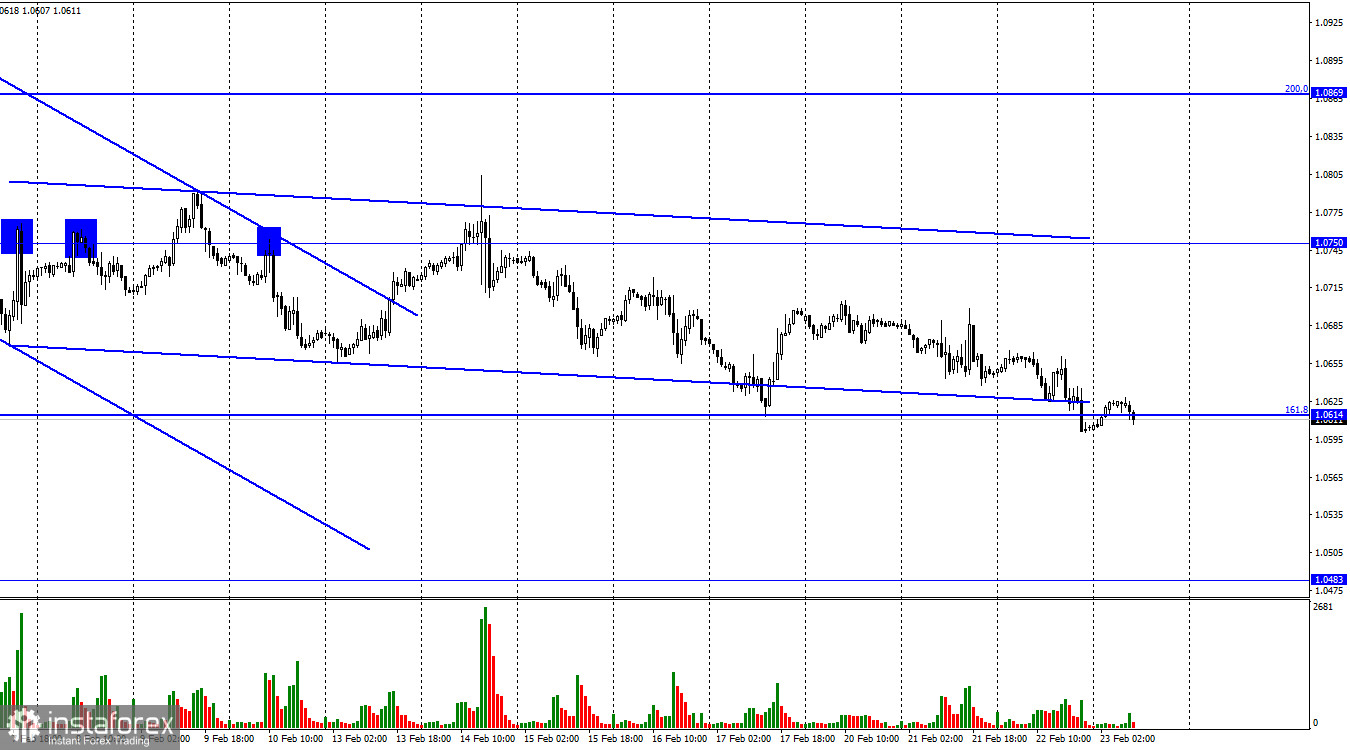

Yesterday, the EUR/USD pair continued to decline. Quotes completed a consolidation under the area of the downward trend as well as under the corrective level of 161.8% (1.0614). As a result, traders' mood may still be described as "bearish," and the decline can still go down to the level of 1.0483. A rebound from the 1.0614 level (unlikely) might help the pair grow slightly.

The Fed minutes, which were released in the evening, were the only thing that happened yesterday. The main points of the protocol were as follows: all committee members agreed that raising interest rates should continue because inflation is still too high, and several managers indicated their willingness to support a 0.50% rate rise at one of the upcoming sessions. Although the protocol may not have identified America, I believe that it had a tone that encouraged bear traders (those who are formally buyers of the dollar in the euro/dollar pair) because it was obviously "hawkish." The pair's decline from yesterday may therefore continue today, which would be pretty consistent with the information background. There won't be many significant events this week. Two significant reports are scheduled for today, but upon closer examination, their significance is completely lost. The data on GDP in the United States is an intermediate value for the fourth quarter, whereas the report on inflation in the European Union is merely the final value for January. While the fourth quarter's GDP was very strong, I do not anticipate a storm of emotion in the market today, but the dollar may continue to rise. As Jerome Powell has already said, there is very little chance of a recession in the United States. The protocol predicts that the rates will keep increasing.

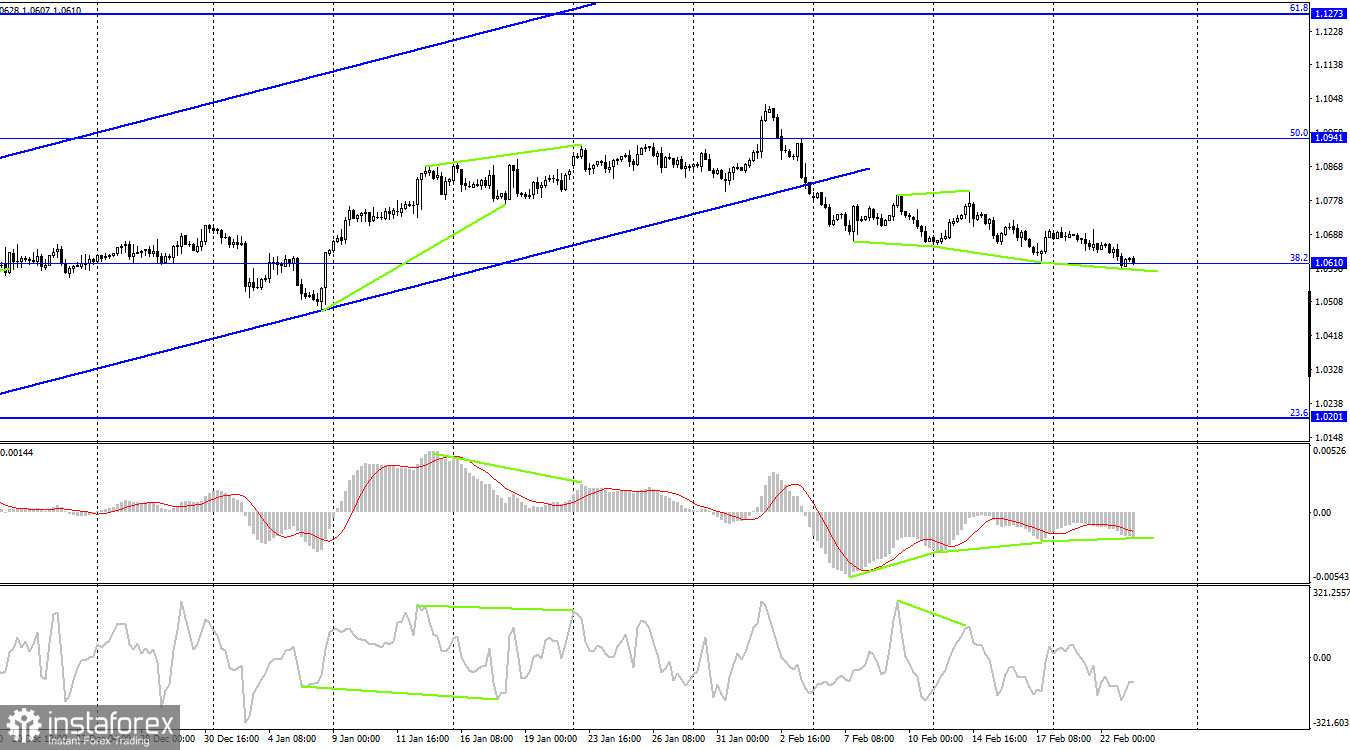

The pair was held under the upward trend area on the 4-hour chart. I believe this is an important moment because the pair have left the area where they have been since October. The current "bearish" trading sentiment offers the US dollar good growth chances with targets of 1.0610 and 1.0201. Yet, we might anticipate some growth thanks to the MACD indicator's "bullish" divergence. Moreover, the increase follows the 1.0610 level. For a while, these two signals can prevent the pair from falling.

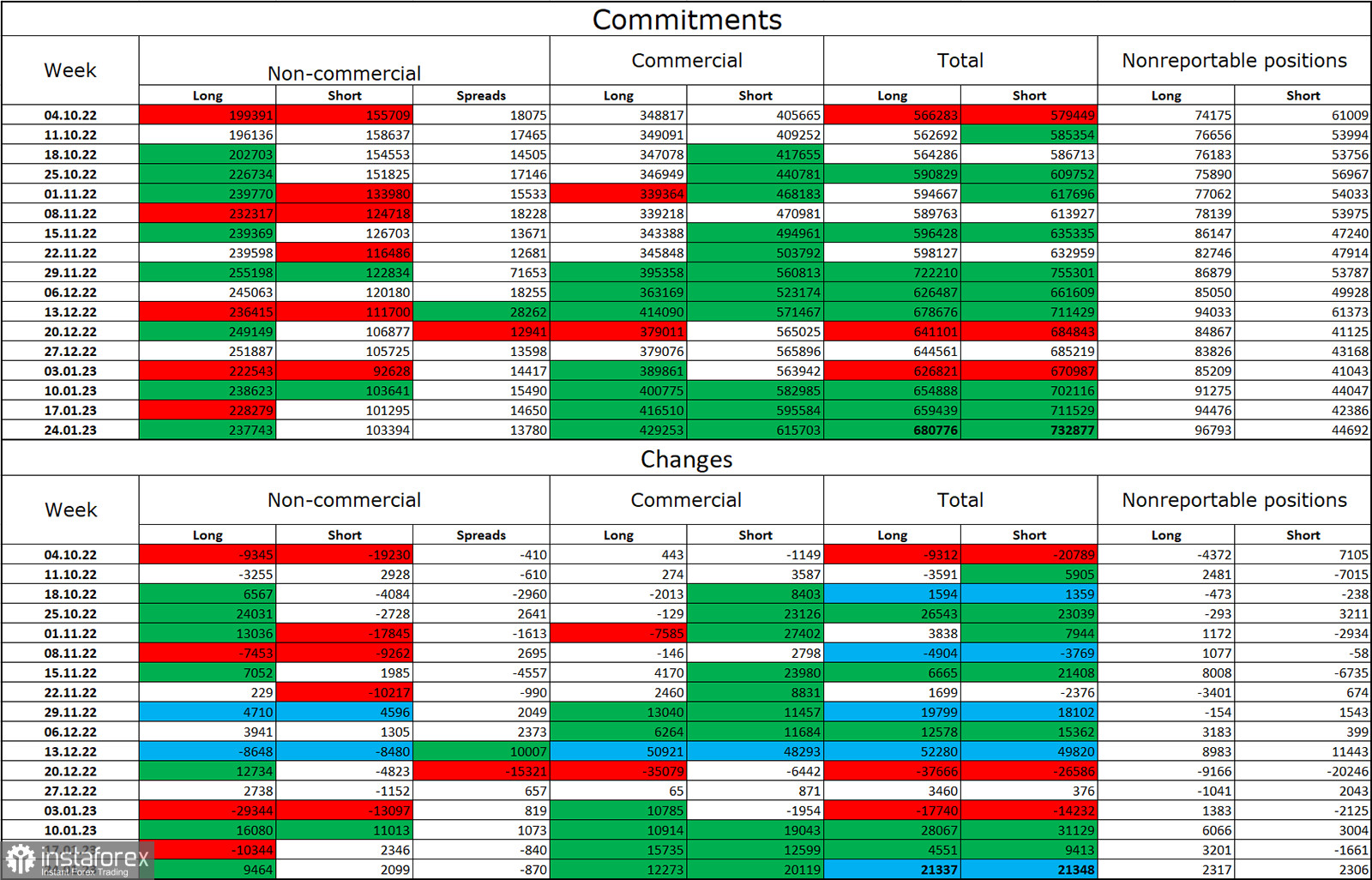

Report on Commitments of Traders (COT):

Speculators opened 9,464 long contracts and 2,099 short contracts during the most recent reporting week. Major traders' attitude is still "bullish" and has somewhat improved. Currently, 238 thousand long futures and 103 thousand short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still favorable for the euro, so its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

EU – consumer price index (CPI) (10:00 UTC).

US – GDP (13:30 UTC).

US – number of initial applications for unemployment benefits (13:30 UTC).

On February 23, there won't be any significant records in the economic calendars of the European Union or the United States, but there will be some interesting reports. The information backdrop may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

When the pair closes below the level of 1.0610 on the 4-hour chart, new sales of the pair with a target price of 1.0483 are probable. In the 4-hour chart, purchases of the euro currency are possible when it recovers from the level of 1.0610 with a target of 1.0750.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română