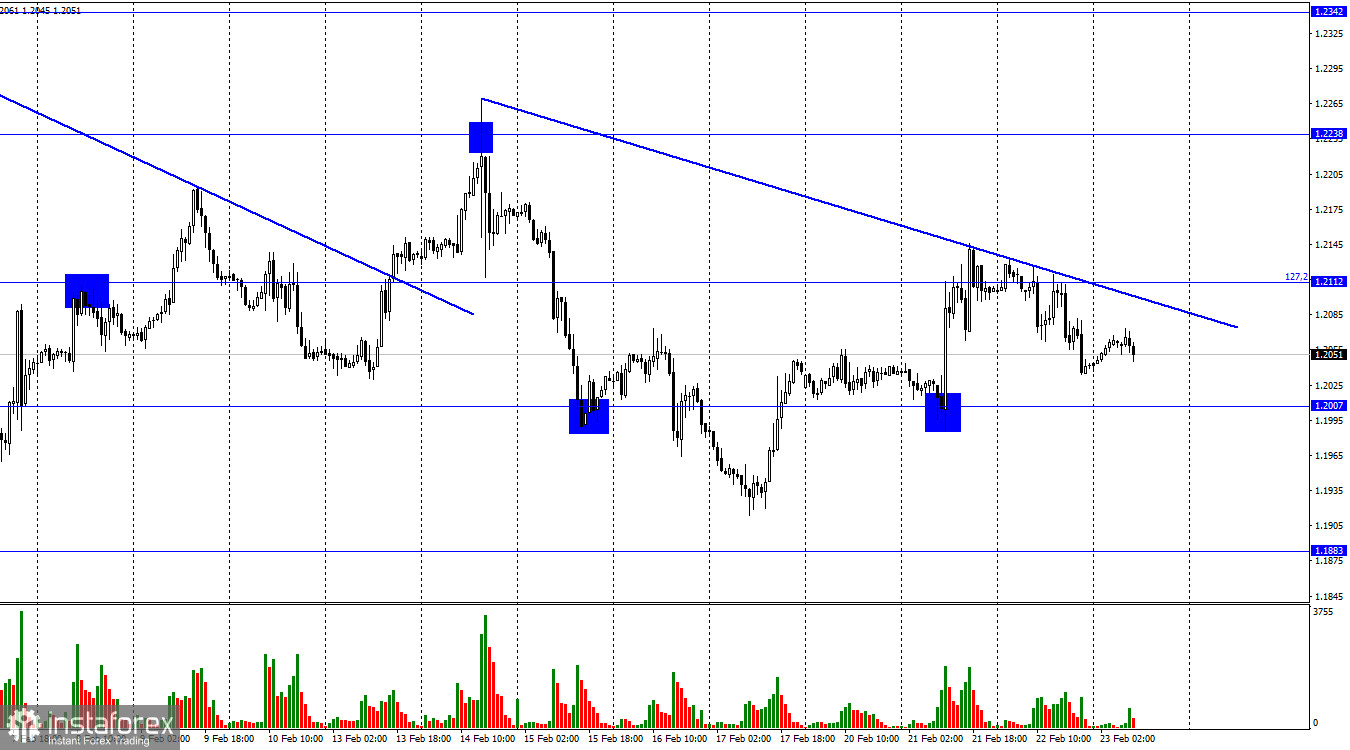

The GBP/USD pair reversed around the corrective level of 127.2% (1.2112) in favor of the US dollar, and started a new process of falling toward the 1.2007 level, according to the hourly chart. The downward trend line describes traders' attitudes as "bearish." The decline in quotes might last for a while, and in the days to come, the information background won't be able to do anything to prevent it.

The February FOMC protocol's "hawkish" tone, as I've already mentioned, makes the dollar's rise entirely understandable. There won't be any significant events taking place in the UK this week. The retail trade data released on Friday is comparable to the business activity indices. We should anticipate a strong response from traders if we observe a sharp rise or fall in volumes. Yet, it is impossible to plan for this. The most crucial thing right now is to comprehend that, despite relatively regular and powerful pullbacks to the top, traders are still prepared for sales. Rate expectations are gradually changing in the Fed's favor because it is still uncertain what to anticipate from the Bank of England until 2023. When Andrew Bailey first buries the British economy, it is uncertain what to expect from him when he later predicts that the recession won't last as long or be as severe. For the current year and the following year, the economic decline might not exceed 1%. Based on this, the Bank of England may raise interest rates for a while, but "some time" will not be long enough. To get inflation down to 2%, more drastic steps are needed because it is still too high.

Traders prefer to work with the US dollar since everything is more or less clear there, but they are ultimately unsure of what to expect from the British regulator and the British currency. The sentiment of traders is unlikely to shift before reports of the quality of nonfarm payrolls or inflation.

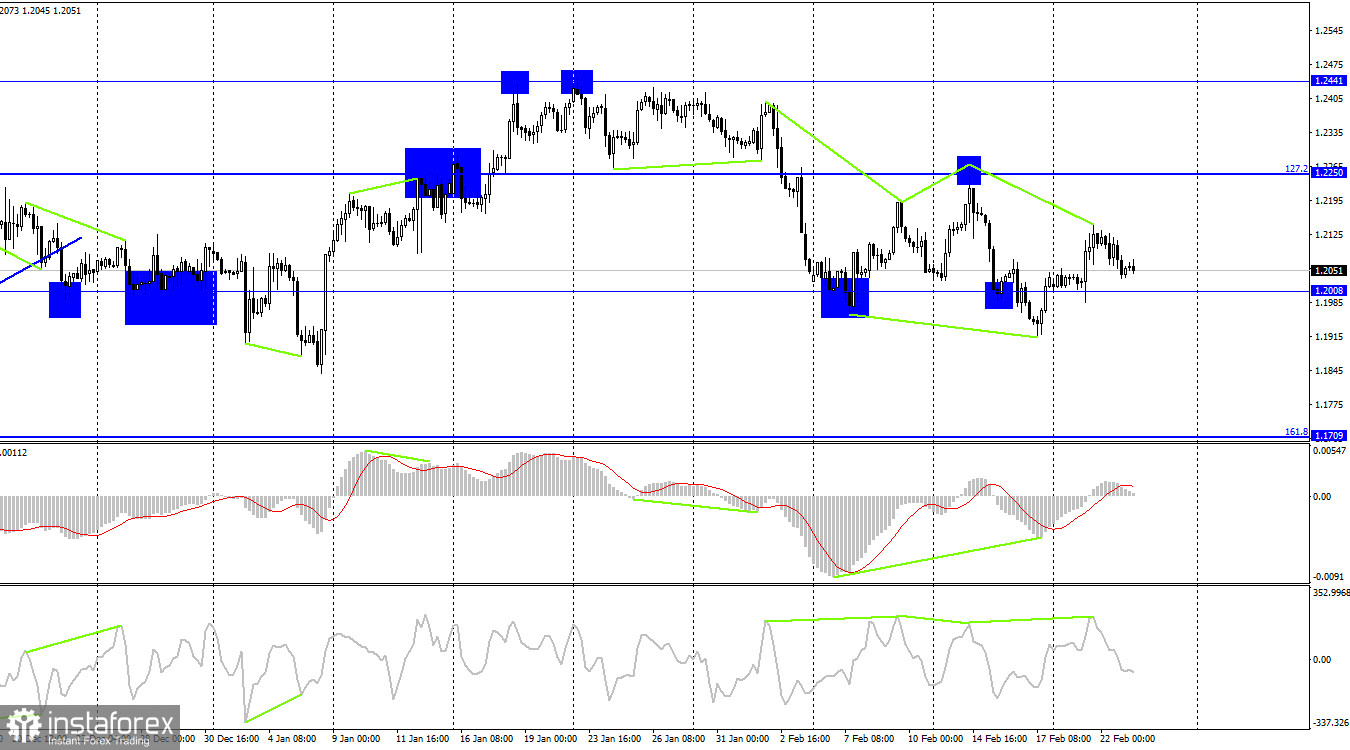

The pair reversed in favor of the US dollar on the 4-hour chart as the CCI indicator showed a "bearish" divergence. The 1.2008 level is where the pair is currently headed, which shouldn't be a challenge to conquer. This success will enable us to anticipate a further decline in the direction of the following corrective level of 161.8% (1.1709). No indication shows any new emerging divergences.

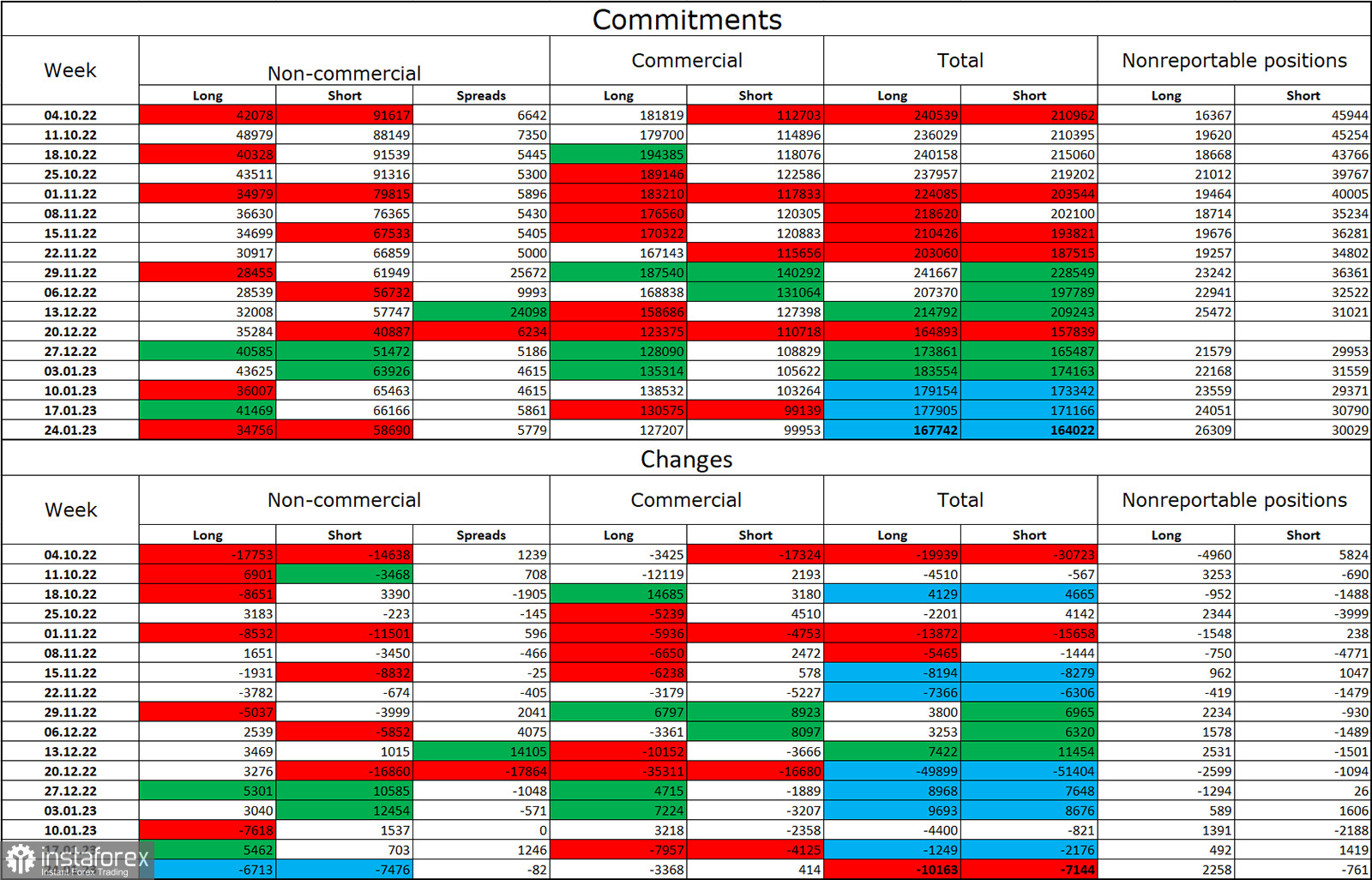

Report on Commitments of Traders (COT):

Over the most recent reporting week, the sentiment among traders in the "Non-commercial" category was less "bearish" than it had been the previous week. The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short in the hands of speculators has nearly doubled once more. As a result, the outlook for the pound has once again declined, but the pound is not eager to decline and is instead concentrating on the euro. An exit from the three-month ascending corridor was visible on the 4-hour chart, and this development may have stopped the pound's growth.

News calendar for the USA and the UK:

US – GDP (13:30 UTC).

US – number of initial applications for unemployment benefits (13:30 UTC).

There are no significant reports scheduled for the US on Thursday, while there are no scheduled economic events in the UK. The information background may not have much of an impact on traders' attitudes for the remainder of the day.

Forecast for GBP/USD and trading advice:

On the hourly chart, sales of the British pound could be initiated when it recovers from the level of 1.2112 with targets of 1.2007 and 1.1883. The deals can now remain open. When the pair recovers from the 1.2007 level, purchases are possible with a target of 1.2112.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română