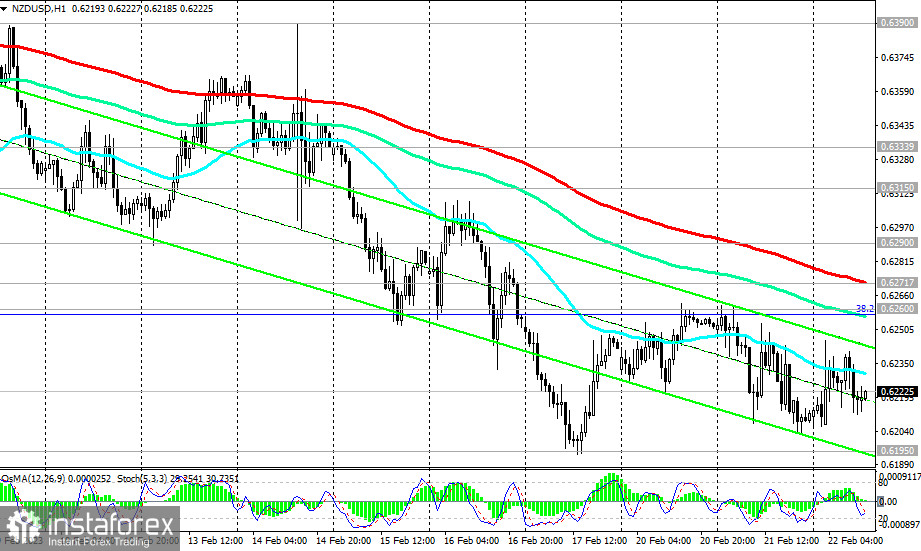

Following the RBNZ's announcement of its decision to raise interest rates yet again, the New Zealand dollar strengthened today, while the NZD/USD pair jumped to an intraday high of 0.6245, then moved back down again.

As of writing, it is trading near 0.6225, remaining in the bear market zone, which makes short positions preferable. Probably, the breakdown of the local support level 0.6195 will be a signal for growth, and NZD/USD will head towards the local (since March 2020) low of 0.5512.

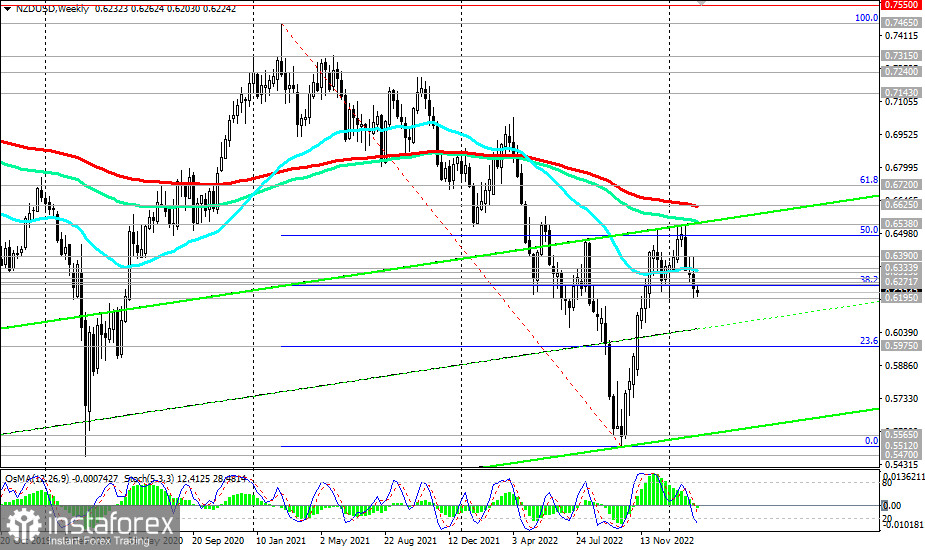

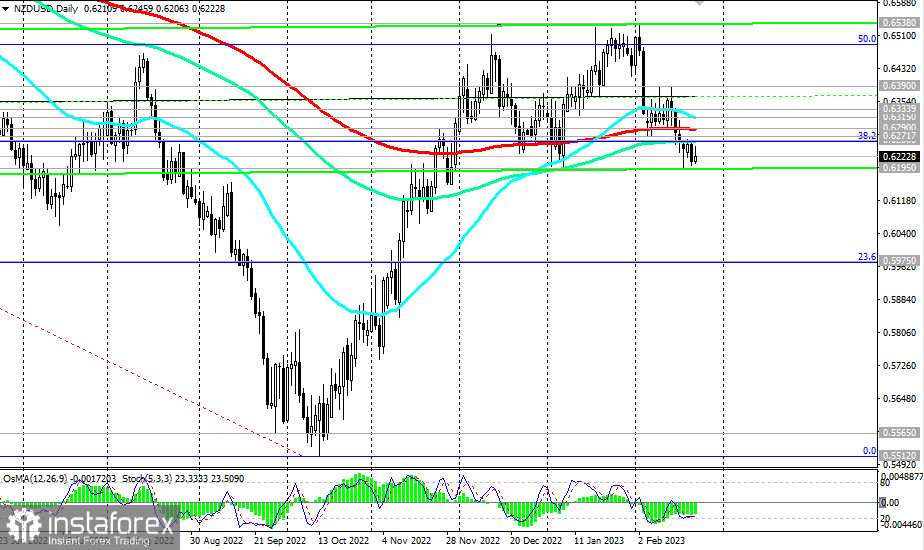

Technical indicators OsMA and Stochastic on the daily and weekly charts are also on the sellers' side.

In an alternative scenario, the signal for the resumption of long positions will be an increase in the area above the key resistance level 0.6290 (200 EMA on the daily chart).

The first signal for this movement may be a breakdown of the important resistance level 0.6260 (144 EMA on the daily chart and the 38.2% Fibonacci level in the recent wave of decline of the pair from 0.7465 in February 2012 to 0.5512, reached in October 2022) and the short-term resistance level 0.6272 (200 EMA on the 1-hour chart).

Support levels: 0.6200, 0.6195, 0.6100, 0.6000, 0.5975, 0.5900.

Resistance levels: 0.6260, 0.6272, 0.6290, 0.6315, 0.6334, 0.6390, 0.6400, 0.6500, 0.6538, 0.6600, 0.6625.

Trading scenarios

Sell Stop: 0.6190. Stop-Loss: 0.6270. Take-Profit: 0.6100, 0.6000, 0.5975, 0.5900.

Buy Stop: 0.6270. Stop-Loss: 0.6190. Take-Profit: 0.6290, 0.6315, 0.6334, 0.6390, 0.6400, 0.6500, 0.6538, 0.6600, 0.6625.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română